Car Insurance Premium Increase Malaysia – If you are the first time, the purchase of a car can look complicated. But don’t feel a little because some experienced car owners still need help in car insurance. You can put your anxiety for a break because we will share a comprehensive car guide in Malaysia. At the end of this guide, you should understand how cars insurance cars and how best car insurance on the car in the best price.

After the 1987 Land Transport Law. Years, all vehicle owners must have a valid vehicle (road tax) and car insurance to use their cars on the road. Therefore, if you do not have valid road insurance and road tax, it is illegal to drive a car in any public path in Malaysia.

Car Insurance Premium Increase Malaysia

For your information, you must first renew your insurance (least third insurance) before continuing to renew your path tax.

How Much Does Windscreen Insurance Coverage Cost In M’sia?

To enjoy protection through your insurance, you will need to pay the amount called “Premium” to the insurance company you decided annually.

Rate and other documents pays will go to the means of insurance company. Your insurance company will manage and use money to cover financial losses involved in documents owners.

There are three types of car insurance policy that you can choose (1) comprehensive insurance, (2) third party insurance, third party and (3) third-party insurance.

First, comprehensive insurance, also known as the first insurance face. This policy offers more comprehensive coverage for documentary film owners.

Insurance For Car

Comprehensive insurance protects car owners in case of a traffic accident, fire or theft. This policy also provides third party coverage.

Comprehensive insurance is usually mandatory in 10-year -ow new cars. For cars longer than 15 years, most insurance companies recommend covering third-floor insurance, fire and insurance (TPFT).

Third fourth insurance, fire, theft, damage and loss of a third party, are protected. It also provides coverage of documentary owners in case of fire and theft. This policy does not cover documents owners in other circumstances such as automotive accident.

The type of insurance is usually cheaper than comprehensive insurance and is more suitable for the old (usually 10 years old) and is rarely used.

The Future Of Car Insurance: The Rise Of Evs (2025)

Third party insurance only will cover the third party. It covers the damage or loss of a third party and their property caused by car. If your car is exposed to any damage, you will need to bear the costs of repairing yourself.

For a simple reference, the following summary is the difference between three types of auto insurance policies:

After BNM (BNM), from 1. July 2017 years, installments for third parties for cars and cars, fire and stealing products are detected individual insurance companies and takaful operators.

This release leads to the war insurance war, which gives consumers more opportunities. To perceive, some factors affecting car insurance premiums include market value of your car, a year manufacture, non-request, car type, on the car, driving records and occupation.

Best Car Insurance In Malaysia 2025

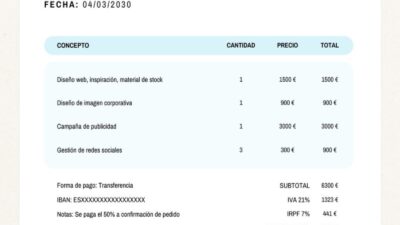

Car insurance = total war (after NCD, if any) + additional coverage (if any) + service tax (6%) + conclusion (RM10)

No deduction requirements (NCD) is a reward plan for you if there is no request for your insurance policy per year. For a private car, the NCD size ranges from 25% to 55%. You can earn NCD without entering insurance claims per year. However, if the third party causes an accident and not right, you don’t have to worry because you will keep NCD.

When you buy or restore your car insurance, you will have to make a decision on the amount of car insured.

When you decide on the secured amount of your car, you can select a market value or agreed value.

Multiply Guide: Personal Income Tax Relief Updates From Belanjawan 2025 For You

Market value indicates the current calculated value of your car. If you select market value, your car is covered with what is

It is worth the market. Suppose you choose market value as a car insurance group, an insurance company will give you the payment of your car market value at times or loss (not market value at the time of renewing your insurance).

The agreed value is the value approved by the insurance company and the document holder at the time of insurance renovation. Insurance companies determine the agreed value based on some subscription factors and risk assessment. Suppose you choose the agreed value as a group of insureds for your car, your insurance company will give you a payment just like an agreed value.

Even the overall coverage may not cover you enough. To provide reinforced protection, you may need accessories for car insurance or optional coverage. Some of the recommended accessories of car insurance are as follows:

Global Insurance Market Trends 2024

To cover the windshield, you only need to pay 15% of the insured amount on your windshield. For example, if the windshield of the RM800 car is, you should only pay 15% IT or RM120 to enjoy covering.

Standard comprehensive insurance does not cover damage caused by natural disasters. Therefore, you may want to include special risk coverage in your insurance policy, especially if you live in the low area, for example.

To enjoy this extra coverage, you will usually pay 0.5% of your car insured. The percentage of this additional installment may differ from insurance companies.

Your insurance provides coverage when a secured car starts a document holder or other driver named. If you allow anyone else who is not appointed in your policy, it runs your policy, you will need to pay the mandatory excess RM400, if your car is exposed to accident.

Cheap Car Insurance And Average Costs For 16-year-olds

To expand your insurance insurance to anyone else, it allows you to drive a car, you can turn on the driver’s extra name. For your information, unlike yourself, you can name another driver in politics for free. For the third driver or more, you will usually pay RM10 for each additional driver.

Like additional driver coverage, all drivers cover your insurance insurance for anyone authorized to drive your car. The difference between additional driver’s coverage and all coverage of the driver is intended for the latter, you should not name anyone in the insurance policy, anyone allowing it to make your car automatically become coverage.

You will cover your insurance to repair or replace standard equipment and factory. So, if you plan to get additional accessories, such as custom sports edges, you should get the car equipment cover.

For car cover, you will need to pay 15% of the insured amount for your additional accessories.

Road Tax Price In Malaysia (2023 Updated List)

This additional coverage will protect your car from damage or loss caused by riots or civil destruction. The rate of the installment of this additional cover is usually about 0.3% of your car insured.

This coverage provides the protection of a document owners or other specific risk management program that your passengers require you in case of accident for your negligence. “Legal responsibility of passengers” is required for cars entering Singapore.

This coverage provides policy owners or other drivers that is called any legal proceedings for neglecting your travelers.

When your damaged car points in an accident at the workshop repair, you can request a cart if you are not a mistake

Insurance Industry In Thailand: Key Trends & Data 2022

You can request a loss of use on the error if you buy “carts)

Your insurance company determines the collection for a trolley based on the evaluation by the officer. Note that the amount of compensation is subject to the estimated number of working days to repair your car. The amount is

Waiver of improvement is determined by part of the cost you should pay when using new original spare parts

“The best” part of the costs you need to submit when the damaged part of the vehicle is replaced with a completely new original part. Since your car will be in a better state with new parts, your insurance company will ask you to submit a difference in costs.

Msig Malaysia Car…

You can buy additional coverage to better give up not to pay additional fees for new spare parts. Note that this coverage is qualified only for vehicles between 5 and 9 years.

Standard car insurance will not cover your fatal or physical injury due to the car accident as you are wrong.

However, if you buy personal coverage of accident at the top of your car, you or the user will get compensation in case of total permanent disability or death as a result of a traffic accident. This cover also stretches on travelers traveling in a safe car.

Do you use your own car for electronic experience services? If you do, you should buy this additional coverage because the standard car insurance does not allow coverage for electronic delivery services.

Factors Driving The Increase In Medical Costs

For your information, the Ministry of Transport has enabled for all private vehicles used