Insurance Rates Nc – On January 3, North Carolina rates Bireurecequested later. third. The Department of Insurance Insurance Homes with 42.2 percent on average.

If the NCDOI agrees with the tumor, the proposed rate will take effect on August 1.

Insurance Rates Nc

Despite the proposed walks in some of the districts 4.3 percent, the beaches of Broonswick, Carter, Pender, Unslov and the new accounts will be subject to an increase of up to 99.4 percent. The Orange and Chiham’s insurance rates will increase 25.1 percent, and the Duram District will increase by almost 40 percent.

North Carolina Home Insurance Premium Base Rates Increasing About 15% By Mid-2026

Stephanie Watkins-Cruz, director of the housing policy to integrate North Carolina, said inflation and climate change are part of the reason why home insurance fees will rise. Because the coastal area is more exposed to natural disasters, he says, completely attractive insurance companies and will not be assured of customers.

“On the side of the landlord, some things can happen,” he said. “You have your monthly mortgage, you also have a monthly insurance plan, and means that 99.4 percent – it’s astronomical, and in fact doubled the bill used by the public.”

Watkins-Cruz also said that the proposed increase in insurance rates could affect achievable housing real estate and their entrepreneurs.

According to him, developers who have been imposed on financing a host of costs needed to understand how to pay for a new cost without endangering their ability.

N.c. Auto Insurance Rates Are Going Up

“It can be easy for people to try to ignore the housing crisis affordable if they don’t experience it,” said Watkins-Cruz. “However, this is one of the real issues -it will be common, it will be very common in its effects.”

Sarah Weinas, director of the Department of Housing and Community Contesting in Chapel Hill, said that 60 percent of the tenants in Chapel Hill were burdensome, which means they spent more than 30 percent of their revenues for rent and services.

If there is an increase in the price of a rental home maintenance, they can be transferred to tenants in the form of renting rent, he said.

The CHAPEL COUNTER COUNTROVED FINANCING IN THAR’S BUDGET TO SUPPORT LOW-INCOME HOMEOWNERS WITH THE PROPERTY TAX-WHICH IS INTDIGED TO ADDREST THE DIFFERENT EFFECTS OF THE CST OF LOW-IN-IN-IN-INCOME POP POPO POPOF.

North Carolina Expanding Inexperienced Driver Surcharge

Russell Pierce, CEO of Housing at New Hope in Duram, said a significant increase in the value of the property, affecting the cost of rent.

The Said Shaduham Pierce has the percentage of residents in rent and the number of unbalanced tenants. According to him, the increase in insurance will even more aggravated the cost of the community in Dor -Dad -Set influenced by genius and housing on housing.

“We see a very high deportation rate here, especially among the colors,” he said.

Two public comments forums will be held in Hungan. 22 to allow people to deal with the proposed rate rise. Community members can also submit public comments until February 2. Watkins-Cruz said it was part of the process through which people should be involved; Send comments and data on how changes will affect housing costs.

North Carolina Homeowners Insurance Calculator (2023)

To the news and headlines in your inbox every morning, register our E -MEL.

Sophie Bagaloni is the city’s editor and a 2024-2025 help. He was a city writer and a senior state. Sophie is twice as a result of communication in media and journalists and political science, when smaller in Spanish for the profession. Select one of the following options to view vendors submitted in your situation, or a focus change

The Bureau of North Carolina Farm of the Joint Insurance Company’s ranking is fully based on written customers’ reviews. This rating is determined through the analyzes that analyze different inputs from our free community, including:

The algorithm also takes into account the percentage of what the bureau of North Carolina’s insurance farm says is that it complies well what the company says.

Coastal Beach Towns To See A Collective 31.9% Increase In Homeowners Tax Over The Next 2 Years

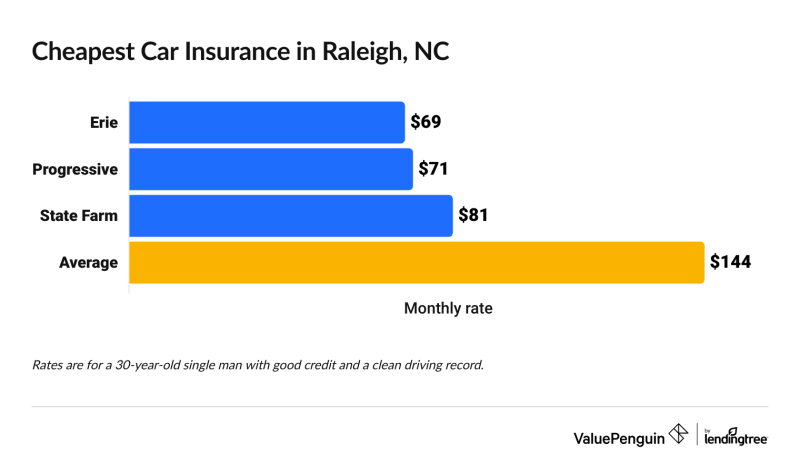

Cost is an important factor in choosing an insurance company. Car Insurance in North Carolina tends to be lower than the average US car insurance cost, which is $ 1, $ 171. In the diagram below, you can see the average cost of the North Carolina Agricultural Bureau Insurance for the adult compared to the average cost of car insurance in North Carolina.

NC Farm NC’s car insurance rates for a single adult are lower than the average cost of car insurance in North Carolina. Please note that this is an average car insurance rate based on a specific profile and your rate may be higher or lower based on your unique features that affect the car insurance rates.

Just like car insurance in North Carolina, homeowners also tends to be below the national average cost of home insurance rates in the US. Depending on the features specifically for you, your home and your home area is located in the diagram below, you can see the average cost of homeowners’ home bureau of NC compared to the average home insurance cost in North Carolina. Worth $ 400, 000.

NCFB’s average homeowner’s insurance rate for $ 200,000 home and a home of $ 400,000 is lower than the average cost of home insurance in North Carolina. Note that this is the average homeowner’s insurance rate based on a specific profile and that your tariff may be higher or lower based on your unique features that affect the homeowners’ insurance rate.

The Average Cost Of Car Insurance In All 50 States

If you have any questions about coverage, contact your NCFB local agent. Their local agents offer personal facilities and services before and after purchase.

The North Carolina Bureau’s insurance rate is based on a single mature profile with the North Carolina Bureau’s insurance policy. A single adult lesson is based on a profile for a single 35 -year -old adult driver without a driver event for the past three years. The car used is Toyota Highlander LE 2015. The full coverage is used for 100/300/50 and a collision of $ 500 and comprehensive deductible. The driver has a good credit score.

North Carolina’s average tariffs presented in the diagram are based on the average cost of car insurance from the largest company in North Carolina and is based on the same single adult drive profile. All tariffs presented only for comparison can be used as individual lessons will change. The pace data is provided by the information service to a quarter.

The home insurance lesson of North Carolina North Carolina’s home farm is based on two different home profiles with the home insurance policy of the North Carolina Farm.

Who Will Buy My House If They Can’t Get Insurance’

The average prices of the North Carolina state presented in the diagram are based on the average cost of homeowners from the largest company in North Carolina and is based on two home profiles. All tariffs presented only for comparison can be used as individual lessons will change. The pace data is provided by the information service to a quarter.

The North Carolina farm has a variety of car insurance and home owners who will help you download your premium. You may be entitled to discount if you have a lot of policy with the Bureau to experience NC. For further discounts are available below.

The NC farm companies give members access to more than just insurance. You can get discounts on selected hotels, vision plans and more. The advantages of the Bureau to experience NC provide access to quality products, plans and services with custom -made local agents. With offices in all 100 districts, the company is ready to help and protect the insureds as members of the community and families.

They have many different options for payment programs. You can sign up for your account to be able to manage payments using electronic balls, submission claims and watch policy information. If you don’t have time, you can file a claim or pay your accounts without an account.

Law That Increases N.c. Auto Insurance Rates Goes Into Effect July 1. Will It Impact You?

In addition, Federation of the North Carolina field was established in 1936 as a public farm organization that is not gaining agricultural and protecting the interests of the agricultural community. Over the years, the Federation has grown to the largest farm organization in the country with more than 500,000 members of members. She is currently serving as a local, state, national and international protection lawyer, providing educational, economic, public and marketing services to her friends.

In addition, N.C. The Agricultural Bureau offers young adults who are interested in agricultural programs called farmers’ programs and the Young Farm (YF & R). YF & R members support agriculture by service in the Special Agricultural Bureau Committee, the Bureau of Agriculture in the District, and to refer to the concerns of farmers and farmers in the public hearing.

Available