Car Insurance Quotes Ottawa – Ottawa drivers are very lucky when it comes to car insurance costs – they pay some of the lowest prices in Canada. And yet there is always room for an agreement on car insurance in Ottawa.

For beginners, as with any substantial purchase, it is worth buying the best car insurance rates in Ottawa. If you already have coverage and come to innovation soon, it might be worthwhile to get some quotes from other suppliers – if you only confirm that your insurance prices are still competitive.

Car Insurance Quotes Ottawa

In addition, there are several other ways in which you can lower your car insurance rates. This is what drivers need to know about comparing car insurance quotes for Ottawa.

Looking For Cheapest Car Insurance In Canada🇨🇦, 📞 647-402-1121 , 📞 431-263-1313, Email- Ankit@dig.insure, My Car Insurance From A Quote Of $746 ❌ Came Down To $433✅, That’s Just Wow, A Lot Of Savings

Insurers base their prices on risk -related factors. Some of them are out of their hands, and others are not.

Age is a big factor when it comes to car insurance. Insurers see younger drivers as riskier perspectives because of their less affected decision skills and a lack of driving experience, so that their prices are usually higher. Statistics support these concerns. According to the Ontario Highway Safety Report until 2021 (the newest available), for example, the age category with the largest percentage of drivers involved in collisions was the 21 to 24 -year drivers.

In Ontario there are three sexes recognized by insurers: man, female and gender X. Not all insurers offer the option to select Gender X. This should change until January 1, 2026, when the Ontario Financial Services Authority (FSRAO) says that all provinces insurers must include gender X in practices.

In Ontario, men’s drivers are usually behind the wheel during accidents; That is why insurers will probably cover them more through car insurance. This also applies to Ottawa drivers. “Nearly three bedrooms (70%) of the 128 drivers involved in the 84 fatal collisions were male. This percentage was higher compared to the 52% of men in the population of recognized drivers,” says the Ottawa Fatal Collision Review Committee in its annual report of 2020.

Understanding Your Car Insurance Policy

Residents of densely populated cities – say, Toronto or Vancouver – run the highest risk of car accidents and car damage. Ottawa, with a much smaller population density, gets a break in this respect. But something that Ottawa drivers need to know is that the city has the sixth car theft claims in Ontario, according to the Canada Insurance Bureau (IBC). In the future, this can affect Ottawa car insurance rates – especially if you drive a popular vehicle among thieves – that is why it is worthwhile to look for ways to reduce your prices.

Do you want to pay low car insurance costs? Then carefully consider the car or truck that you drive. According to the IBC, these are some of the factors with which insurers take into account what reimbursement they must charge:

The more coverage you select, the more you pay for car insurance. Although you absolutely do not want safety, you may not need complete collision coverage if your car is on the older side.

On July 1, 2026, Ontario’s drivers can be able to resign certain types of coverage of the accidents that were needed earlier. The two for which everyone should continue to pay are medical benefits of rehabilitation and service. All other benefits of accidents (such as lost wages and healthcare costs) are available for La Carte in the insurance system without the debt of Ontario.

Best Car Insurance In Ohio For 2025 [top 10 Companies Ranked]– Carinsurance .org

Some insurers offer a discount insurance discount if you follow an educational course for beginners approved by the Ministry of Transport.

Complaints, convictions, accidents or car insurance fraud In the past of a driver, the awards of the vehicle insurance can influence. (Insurers can find some of them who are looking for their director registration.) Not all violations remain in their record for an indefinite period of time. Deméricit -points, for example, are removed two years after the violation.

Ottawa car insurance is usually at the bottom of the rates in Canada. To give you an idea, we investigated the rates for a 38-year-old man who leads a four-door four-door Honda CRV EX-L and 2025. Depending on the gender they select in the driving license, they would pay the following for Ottawa Automobile Insurance every year:

To estimate the costs of guaranteeing different vehicles in Ottawa, the Leia guide is to compare the car insurance quotes.

Best Insurance For Young Drivers Ottawa Ontirio

Combine in less than 60 seconds with an adapted list of loan providers based on your needs and approval opportunity. No sin is needed.

High car insurance prices are not inevitable. The following tips can help Ottawa managers to get a lower rate, says the regulatory authority of Ontario’s financial services.

Directors who want to pay a higher franchise when submitting a complaint will be charged less for car insurance.

The less you drive, the lower the chance of becoming involved in an accident. People who switch every day and/or drive long distances to start working usually pay more for car insurance than those who don’t.

5 Best Insurance Companies In Ottawa [2025 ]

The reimbursement for adding your teenager to your car insurance policy as an incidental or secondary driver is cheaper than adding as a main director.

Although car insurance in Ottawa is cheaper than in other large Canadian cities, it is still increasing, so look as many discounts as possible.

Share Share this article on Facebook Share on Twitter Share on LinkedIn Share on Reddit Share per e -Mail

Alex Mlynek is a writer and editor with more than 20 years of experience. She wrote for magazines as a report on matters and digests. His first job was outside the journalistic school.

Car Insurance Quote: Get On The Road To Insurance Savings

If you travel from Canada, or even outside your own province or territory, you should therefore consider buying …

Whether you leave the city for the weekend or a trip around the world, protect your property with these tips.

How much income do you need to buy a house in Canada? A look at the accessibility of homes in May 2025 made by Takehub

How much income do you need to buy a house in Canada? A glimpse into the accessibility of housing in May 2025

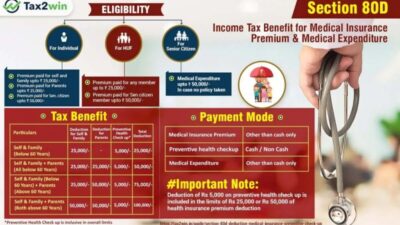

Insurance In Canada: Infographic

These impressive Canadian travel -reditcards can help to turn their daily expenses into flights, hotels and more. That too …

Your franchise influences the costs of your car insurance. See how franchises work in Canada and how to choose …

Saving for an advance is only the first step. Here are the other costs that many Canadian house …

If you get the best life insurance policy of your type, it will be on your current task list, keep reading to find out which …

Car Insurance Ontario

Do you have the best life insurance policy for your phase of life? Experts say that young Canadians are usually under -segred. Here it is …

Comparing house insurance fits is essential to obtain the correct coverage at a good rate. We ask a specialist … If you need a quote for car insurance, it is now faster and easier than ever. If you want to change your car insurance in renewal, buy a new car, get married or you just want to buy a better business, you have many options. In this article we will investigate the common ways to get a quotation from a car insurance policy in Ontario.

If you are looking for an insurance offer in Ontario, you have many options as a customer. Ontario has private insurance companies that compete with each other for their company. You are free to buy quotes and to choose one that best meets your needs. This means comparing coverage and customer service – and who of course has the best price. In Ontario you have the option of three different roads to receive an automatic quote:

We will see each other better – emphasize some advantages and disadvantages of each method. Here are the most important ways to get a quotation from car insurance.

This Is The Cheapest Time Of Year To Get Auto Insurance In Ontario

A direct writer is an insurance company that subscribes and sells its own policies. They also employ their own insurance agents who are experts in everything, from coverage to invoicing. When you talk to an insurance agent, talk directly to the insurance company. For many of us who want to save time and money, it is a better option to get the insurance company an ON -Line quotation through a direct writer. If your needs are simple or if you only have to mention one car, doing an online is almost immediately.

When entering important information, an insurer can secure your data securely without having to enter the information. However, with many insurers you have to call to buy after receiving an online quote. After purchase you have access to your account 24/7. You can get your documents immediately, update your coverage and payment method when you need an online complaint and even register. Many insurance companies provide automatic telephone quotes (unless it is a direct digital insurer). You can get your autoction with one of the recognized agents of the company. If you want to buy the policy, you can do this with the agent.

An insurance agent is a professional who represents a single insurance company (or, in some cases, different insurers). An insurance company employs them to represent this company to customers and to sell their products. Because insurance agents directly represent a specific