Insurance Company Philippines – When I started a consultant, right after graduating, it was a financial asset / advisor of the financial still not a popular career. There were only a few counselors that can be found. There was a sudden change for more than ten years. Young financial advisers are involved. Most insurance companies try to attract the best talents to become one of their financial advisors. With all ads on the task that can be found on the internet, you may think of which insurance company is best for you. In fact, it’s hard to say what’s the best. In fact, my choice, which company participates, can be different. But we have a simple guideline about how you choose the insurance company and the best team for you:

One of the reasons I wanted to be the advisor of unrestricted income is offering it. When choosing which company you have to join, you should ask yourself to ask for your advisers for each of the sales they make. I want the most in the company I am currently compensation, I want to, these trail commissions.

Insurance Company Philippines

How does she work? I work for a financial adviser for more than 10 years, I guess the total value of my clients can now reach about 1 billion pesos. Trail Commission in Manulife is approximately 0.30% of the general investment value. This means that I do not sell insurance or investment, I can have about 3 million pesos for about 3 million pesos.

Stronghold Insurance Company Inc.

Unfortunately, I did not start my career in Manulife. I just thought how nice it was in my career. So I don’t accept a P3m P3m income (Sayang, I have to start manorife). But for you, who still start a career as a financial adviser, long -Terment compensation of the company you will work. Find a company to provide a good passive income. You don’t want to sell insurance and investment. If you had passive sales income.

Usual bonuses are another compensation. For example, companies such as manulife pay 55% of the fourth advisor income. For example, if the Commission’s rate is 40%, then 55% bonus will be 22% (40% x 55%) that the Commission’s rate is 62%. This is the only commission of the first year, each time your customers are still interesting, you will also make commissions.

For those who want to become insurance store managers, thinking a company that reward its leaders. It is something that for the companies that governors carefully protect their financial advisers. Some firms easily advisors to managers in a short time, which is not good for people who are looking for good income that is looking for financial advisors.

During the global digital marketing, you are working for a company that is not only known in the Philippines, but also outside the country. Think you will sell from the Ofw. If you sell a company in the country where they work, you will take a chance of retailing approach when they are going to work.

Sterling Insurance Certificate 2022

I also recommend choosing a large insurance company because it is easier if it’s a great company.

In more than 14 years, as a financial adviser, some customers wanted a short-time investment. For example, some clients were close to me because they wanted to save the house for the house or save a new company. Unfortunately, I had to refuse these clients, because before I work with Manuulife, we just provided investments with life insurance. There are no clean investor products.

If we can only offer insurance products, we cannot be called perfect financial advisers, because some customers need to live. Some only need a pure investment product. As long as we say that the product is in very low life insurance, the fact that there is some insurance will mean less than a clean investment product.

One of the reasons for investing may have small returns is to invest additional money for cash administration. Thinking that investment will have a significant difference in returning 2,75% opposition funding!

Insurance Yang Terbaik 2023

If you invest 100,000 P100, it will search for funding for funding for funding against finance, 716.71 to 1,25% of the Monthly Administration Month. This difference is in P16, 789.07, where customers can save if the customer invests with a funding fees for financial administration.

Anything else to think is that the hidden money management fees. Some companies say that only, 1.5% of cash administration fees, but there are habits. For example, an investment company or insurance is not a manager of the main fund and have a relationship with other companies in your investment. So it’s important to always ask for investment: “Who is the main administrator of this investment?” It is impossible for such a company is not the main administrator of the fund and only remove the Fund from another company, and provide funding funds before it is to transport an investment or insurance company. Many Fund funds for fund administration will reduce investment returns.

Sometimes some customers need insurance or investment, but they only lose P1000. Defense expenses have been increased recently, and sometimes tight budgets. When you are looking for a company that will be a financial adviser, product prices. Are they also people who deeply need financial protection, but are limited in the budget?

Another topic may receive the number of investments that can receive customers by you as financial advisor. Look for a company to allow customers to buy not just investments in the Philippines. Their investments can also fail whether the Philippine problem or political situation is not good. Let’s invest companies that allow you to invest in the United States, Asia, Europe, China, as technology sectors, health care companies. In addition, many continuous investments that investors preferred to invest in companies that produce minimal coal or environmental care.

Top And Best Life Insurance Companies In The Philippines 2017

When a company’s choice as a financial adviser, also achieved the tallest age of the insurance. For example, some insurance companies only take 70 years for their critical illness. Some firms pay for health insurance to 100 years of age.

They discuss the first two elements, which can be accounted for the insurance company you can participate. Both will focus on which team should cause.

Why is the team choice as important as a selection of insurance company? Because the team you are part of the effect of most of your activities and decisions. When playing basketball, team performance significantly affects personal performance. Same in insurance. Most of the time people you have to be affected by behavior, decisions and performance.

The vision is a rule that team wants to go. If you achieve a gain, you need to be associated with a group of success for their future. The team without a vision is like a missing prison without a way.

Security Bank Partners With Philbritish To Provide Risk Management Solutions For Businesses

On the other hand, the mission of the existence is to exist. You must be the team working for a common purpose. In a team that has a goal to serve people and improve a place.

Finally, the basic values are basic when a team that is best. All dams have common values and beliefs. The opposite values of team members may decrease your team. The worst team without any values can cause unfavorable competition. Will not share ideas because people make their success. So the team you are involved must have basic values that resonate your personality. Nothing will save the team by rules and values.

Achiever, integral, loyal, significant and intelligent values that we take in our team. It serves as our textbook to give critical decisions.

These simple leaders can help you choose which company of insurance or team is best for you. If you want to try to be a financial advisor, first step when you can be a financial advisor offer.

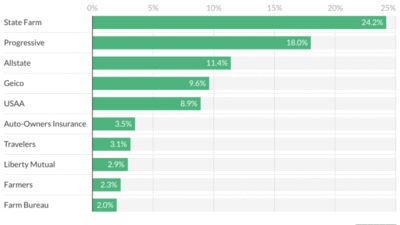

Top 10 Life Insurance Companies In The Philippines (2025)

Mark Fernandez, CPA, RFC, AFA, CWP, CEPP was founded in the insurance advice, and directly working at its 22th birthday after its 22th birthday in SGV & CO (ERNST & Young). He worked a part-male financial exhibition as six months. Despite the absence of origin