Takaful Insurance Adalah – Takaf predominates in Malaysia, Indonesia, Saudi Arabia, UA and another coupling countries. Michelle Botignol / Inventopody

TakAful Insurance is a type of Islamic insurance in which members contribute money into a group system to guarantee others or damage.

Takaful Insurance Adalah

The takip is a type of supply insurance in which the members contribute with money in a Poiscozes look against damage or losses. Brand insurance for Takaf is based on Sharia or Islamic Religious Law, which explains how individuals are responsible for mutual cooperation. Takaful policies cover the needs of health, life and general insurance.

Islamic Insurance Principles Of Takaful In Depth Analysis Of Islamic Finance Fin Ss V Ppt Presentation

Takaful insurance companies have been introduced as an alternative to commercial insurance, which was welcome to contravene Islamic restrictions on Riba (intest),

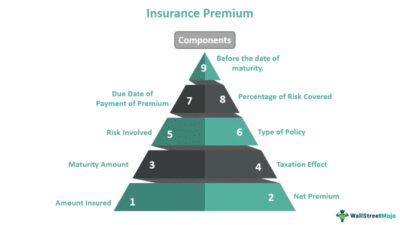

All paintings paint in a takafularradaggree to guarantee others and contribute to a basin or mutual background instead of paying the prizes. The collected contributions group creates the customer customs Takafuly functions. A Takafulspecial contract The nature of the risk and the length of the coverage, similar to that of the conventional insurance policy.

The Takaful Fund is administered and administered on behalf of the participants from a Takaful operator, who loads an agreed to cover the costs. Like a conventional insurance company, costs include sales and marketing, underlining and management.

Each embodiment made by the participants is paid from the Takafiu Fund, and any remaining SOPs, after the proof for future dating and other reserves, belong to the participants. These foundations were distributed to participants, such as cash or future contributions.

Takaful Ties: Unravelling The Experiences Of Islamic Insurance Industry In The Uk And Indonesia

According to the attached market, the global market Takafa was valued at $ 31.7 million and is designed by 2032, a year of 1523% to 1523 increases to 2032.

As the 60% global Muslim population is composed of young Muslims is 25 years old can be a base of fried customers as their wealth increases over time.

Some remain the Takafulato market name, according to a research and market report, it was believed to be as follows:

Most Islamic Jesus concludes that inaccessible conventional insurance inislam because it is not a combination with Sharia for the following reasons:

Asuransi Syariah Takaful

Investipedia requires writers to use primary sources to support their work. These include white dowels, government data, original reports and interviews with industry experts. We also refer to the original search by other renowned publishers, as the case may be. You can find out more about the standards I have followed in a happy, impatient individual in our editorial policy.

Duration table: What is the Horos clause: What happens, how do you work and example, business policy: what is it and how to work a car insurance? This is one thing – this is to know the best insurance companies on July 2025: and the type of Australian alerts also works: Panorromana

Admitted insurance: that is, how your life insurance will be expired before you do so. Here’s how to complete the deletion of insurance operations: which is “mutual”. It has two general types and General Takaur. It is also known as Shariah-Complete Shariah Complete completed by Islamk, which protects the loss or damage to people and properties.

Each participant makes a regular contribution (the last applicant based on the beginning of the Tabarru ”(donation). These contributions are added to the” Takaful “fund.

Informasi Aswata Takaful

The bottom is driven and managed by an insurance operator and chicke a fee for their services. The operator is also responsible for paying debts and keeps لتك es.

In case of loss, the operator pays the request from the Halal Fund. The claim is usually equivalent to the loss of the participant or the limit of the policy (which is low).

At the end of a defined period, surplus funds are divided between participants and operator on an agreed report.

The general operators Takafull usually engaged in retail operations. In Retakufiu, the operator has spread the risks of investing parts of their funds with Retakaful operators.

Pt Asuransi Takaful Keluarga Salurkan Donasi Korban Gempa Turki Lewat Baznas

A group of individual owners contributes with a certain amount of money to a fund with the common hand, in a Shariah, which is a risk sharing. If one of the participants would make an accident, L ‘ل 0 فو ES should cover the damage.

We believe that a person is alone in his family and has to take a floor until you are at speed. If you go or disable, the ل ل ل 0 فل scheme should offer a sum of money to his family. This money is not a profit of their contribution.

“From the concept of 622 announcement in various forms. Islamic selling of Islamic and after USAIU for $ 3.338. There are more than 1,000 business working on these rules, globes.” Historical historical takaf!

The Mudharabah model involves a profit sharing agreement between participants and operator. The operator receives an implicit part of the profits, and the participants lead to losses.

Peran Pt. Takaful Dalam Mensyiarkan Asuransi Murni Syariah Di Kota Lubuklinggau

The Wakalah model is based on the agency. The operator runs investments and receivables and receives a fixed rate from the Takaful Fund.

It is based on the principles of Shirkah and Shaiah with savings savings. In the Musharaah model, all parties contribute to capital and profits and losses.

As the acceptance of the principles of Islamic finance increases, several individuals and institutions gravitate to an لتك ل. The evaluation and insurance of the Islamic bank also saw an increasing number of students participating in their Islamic knowledge. There is a visual request for professionals who are willing to professionals who are willing to develop their expert for Islamic Assains and Finance Finance

There are many unique Shariah insurance features, which they want the policy owners. It offers coverage according to Islamic rules and regulations. There will be no deterioration of interest, and the owner will certainly have the benefits he has asked. There are two basic types Takaful and are usually Takaful and Family Takaful.

Takaful Keluarga On X: “segenap Manajemen Dan Karyawan Pt. Asuransi Takaful Keluarga Mengucapkan Selamat & Sukses Atas Milad Ke-25 Pt Asuransi Takaful Umum. #25versarytakafulumum #mantapberhijrah #takafulkeluarga #sharialifeinsurance #inspiringlife

Insurance plans are meant to meet persons and corporate insurance in relation to material loss or damage for any catastrophic condition.

In general, Takaf, the participants pay their press in the Takaful store as Tabarr ‘. This eliminates the Ghaarar and Bet components. That is, a member of the consent to award his prize to book with a mission with a query taken in accordance with Takata plans, when there are problems. In this way, individuals transmit the danger, and the administrator of Takaful is just a abroad. Musharakah, Mudharabah and Wakalah models can actually be under this approach. For the most part, all properties and physical resources, such as houses, cars and buildings.

The measure of commitment is paid by any members who take the acquisition in any of the general insurance of the general insurance that are carried out and corresponds to the rates that have been insured. The proportion of sharing of the beneficiary will be made in advance for members and agrees with the two meetings.

This policy offers compensation in the case of material damage caused by fire, lightning and explosion. It applies to buildings, stocks, cars and similar content.

Benefits And Advantages Of Takaful Insurance

The Takafa family is a chair contract in which the non -zy gift is made in the ordinary interim, in the WAQF fund from the members. According to this concept, all perceived in human life are assured as disappearance, and the disease, including here, reach the needs.

These elements tend to be normal funds in which a member demonstrates his need to achieve a unique amount of time predetermined later. Within this plan, the members pay their first in the TakAful store. A little bit of the first is allocated for funds and adventures and