Insurance Premium Explained – Clean premiums, the accounting of the insurance industry, is calculated as the expected value (PV) of the advantages of the insurance policy,

The planned PV of future premiums. The calculation of clean premiums does not take into account future expenses related to the maintenance of the insurance policy.

Insurance Premium Explained

Clean the premiums, along with dirty premiums, help insurance companies to determine how ten state taxes.

Understanding What Is Life Insurance, Its Types And Benefits

The thin value of the insurance policy is different from the gross value of the policy, which takes into account the expenses in the future. The difference between the clean and the dirty thin is the same as the expected PV of the cost load,

PV planned for future costs. Thus, the gross value of the policy will be less than the net value when the value of future expenses is less than the PV of cost of cost.

The tax laws of various states can allow insurance companies to reduce their dirty premiums to count unacceptable expenses and premiums.

Since the net calculations of premium do not take into account the costs, the company must determine how much they can add without causing loss. Types of expenses that must be considered by the company, including the commissions paid to agents selling policies, legal expenses related to liquidation, salary, tax, cleric costs and other general expenses.

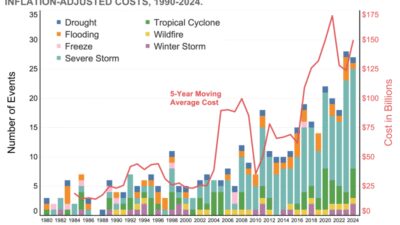

Why Are My Insurance Premiums Going Up? 2024 Insurance Premium Increase Explained.

Commissions often vary with politics premiums, but general and legal costs may not be related to premiums.

To estimate the allowed expenses, the company can add the amount of fixed costs to the clean premium (called a flat load), add a percentage of premiums or add a combination of fixed amounts and a percentage of premiums.

If policies are compared with different clean premiums, adding a fixed amount will cause the same proportion of costs as premiums whenever the costs vary proportionally with premiums. The determination of what method will be used depends on the general costs and the laws related to policies, because they are related to the commissions with premium.

Most politics calculations that leave the margin for contingencies, such as when the money generated by the investment premiums were less than expected.

Understanding The Life Insurance Waiver Of Premium Rider

Clean the dirty premiums and premiums help find out how many insurance in taxes. State Department insurance for your company’s income. However, tax laws can allow companies to reduce their premiums, seeking a displacement that cannot be issued. The Guarantee of the United Kingdom uses the calculation of the annual equivalent of the premium (APE) to determine its premium income.

For example, if the state of Ohio imposes a gross premium tax written by the Ohio Insurance Company, but the tax does not apply to the amount deducted for reinsurance, it will not apply to dirty premiums that are not obtained because the insurance company or the owner of the policy cancel the policy before the expiration.

Players pay insurance premiums. Prices are based on them on individuals or parts of a group. The paid premium is the costs associated with purchase insurance for people or companies.

Clean premiums are reduced, including premiums written with commissions and reassured reinsurance. This is a measure of the number of dollars in written policy. The net obtained is the real size of the dollar received from the sold premium.

What Is An Annual Premium Equivalent (ape)? Calculation Defined

Premium Tax Credit (PTC) is a credit available to families who help them pay for premiums for health insurance through the Health Insurance Market. This is a credit that can be returned.

Clean premiums are important metrics for insurance companies to determine how much taxes pay to comply with tax legislation. Use a clean premium and dirty premium allows insurance companies to better manage accounting.

It requires writers to use primary sources to support their work. Includes white book, government data, original reports and interviews with industrial experts. We also refer to the original research of other leading leading editors. You can find out more about the standards we continue to produce accurate and impartial content in our publishing policy.

The offer that appears in this table comes from the collaboration of which it receives a compensation. This compensation can affect how and where the list appears. Does not include all offers available on the market.

Basic Life Insurance: How It Works & Different Types

Premium Balance: What is, how it works, and examples of risk transfer: definition and operation in premium insurance to surplus Automatic Business Policy Examples (BAP): What is and how it works and how it works and how it works:

The net risk amount: what it works and works together: what it is, how it works and examples of policy holders: what is and how American land title association works (high): what is the Inchmaee clause: meaning and example. Payment for your insurance, the balance of the premium is reduced until the policy is paid in full. / Zoe Hansen

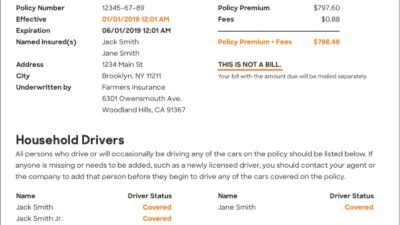

Premium balance is the amount you have to pay in the insurance policy after starting to make payments for quotas. Many insurance companies allow the fees to make payments per fee because they are more affordable. Say the total amount you owe to your policy is $ 2,000 and extends in the same four $ 500 payments. If you make a payment, the premium balance is 1, $ 500. The balance goes down every time you make another payment. Payment of quotas you make to keep politics active. Policy takers can request a refund for each of the remaining not paid premiums.

Many insurance companies allow the pre -members to pay their policies with quotas. Paying the full value of the policy premium can be a challenge for your budget at the same time, and offering a different payment structure allows insurance companies to reach a wider market. These types of policy features are more often seen in car insurance, which can offer monthly, quarterly, semester and annual quotas.

Driver Risk Premium And Driver Penalty Point Premium Changes Explained

The guarantor allows the lawyer to pay the premiums for a long time because they can extract the costs of the quota for privileges. For example, a car insurance company can allow premium balances to be paid each month, but will add a little cost to the monthly premium due. In addition, the insurance company can collect the cancellation rate if the policy is annulled before the period of the policy is completed. This cost, called short level, is usually a percentage of the remaining policy premiums.

Insurance accounts for premiums in different ways, depending on whether the premium has been collected, if it is considered “obtained” as a function of time without claims and what premium is paid in advance.

Unpaid premiums are considered obligations with the balance until it has passed enough between premium collection and claims are not made in politics. If the insurance company business increases from year to year, the premiums are likely to be less than the written premiums. This is due to the fact that the premium is considered to be paid entirely when it is carried, and the balances that are not received, represent premiums associated with politics that is not expired.

Reduce the balance that needs to be needed. Lands can pay premium balances in various ways: cash, checks or credit cards. Paying with credit card facilities may be useful if the card holder has a reward or a return card, benefiting at the time of payment. This way, you can reduce your premium by 2% or more, in general, or get a mile of airlines or other advantages, depending on what the card is offered.

Age And Travel Insurance

When choosing an insurance policy, generally paying to the store, especially if you have been with the same company for many years. Many online places will compare many policies and give you price budgets. Finally, check if you pay the insurance functions you don’t need. Perhaps the extent of the attraction is in your car policy and you have AAA, or maybe your deductible is too low.

Even if you cancel your current policy to go with other insurance companies you can generate unwanted costs, long -term transfer profits may end up saving money. In addition, if you tell your current insurance company you will be captivating to stay by providing certain reduced advantages or premiums. It is always worth asking -you can do insurance companies if you have become a customer for a long time.

John bought a new car and bought car insurance to protect in case of car accident or theft. He bought his insurance policy at ABC Insurance. This policy is worth $ 1,000 a year and John decided to make quarterly payments, which amounted to four payments in the year $ 250.

The year continues and is now at the end of June. Two quarters have passed and John has made two $ 250 payments each for their car insurance, with a total of $ 500. The amount left in this year’s policy is $ 500, which is the premium balance.

Expat Health Insurance (in The Netherlands)

The offer