Insurance Policy Declaration Page – Housing owners often face insurance terminology when buying or buying home insurance. Insurance agents can help you move through the process and answer questions, but it is also important to understand what you are buying and how to affect your premiums.

So, what is the insurance statement page? Read more about this important document, what it involves, and what you have the opportunity to review this first page important about what to look for when receiving policy confirmation.

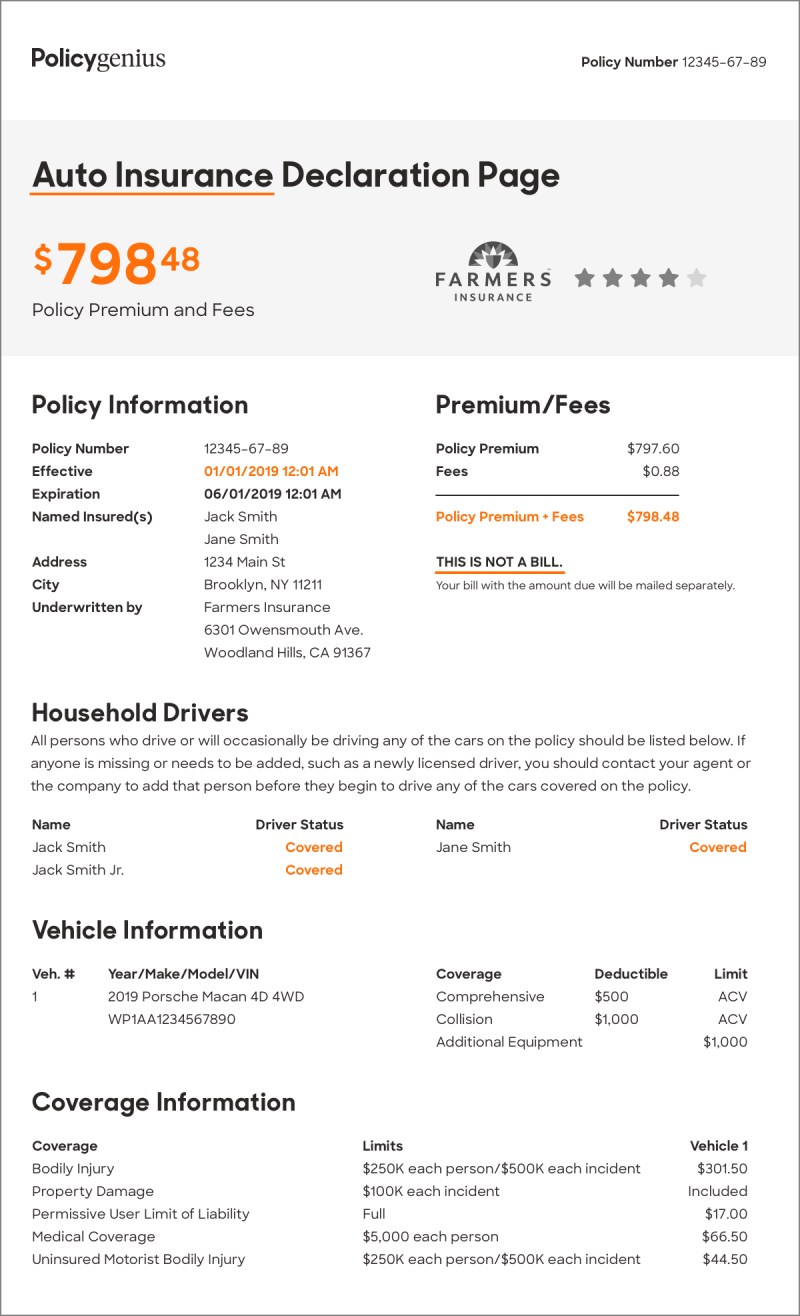

Insurance Policy Declaration Page

A homeowner’s statement page, or “December page”, is a rapid layout of the insurance policies offered by an insurance company when renewing or buying a home insurance policy. This includes important information about your policy, such as your address, policy period, reduction amount, and approval.

This Is Your Declarations Page Commercial Auto Insurance Coverage Summary

This overview will help you quickly see the coverage you have and you can see what changes from year to year. Keep the statement page in a safe place. That way you can refer to it if you need to submit a request or show proof of your insurance elsewhere.

The statement of the insurance contract package is a summary that provides the essential information you need about coverage. The rest of the cover packs dig more in this information and explain exactly what your coverage involves and how to explain your insurance statement, but statements on the page do a very good job of summarizing the information at a glance.

Without having to sift from various pages to find the details you need, the home insurance statement page tells you the length of your insurance policy, the coverage you have, the limits on your cover, which is insured, and how many are premiums for that policy period.

As mentioned earlier, your home insurance page is intended to be a summary page for the homeowner’s insurance trial and a quick review, so you can know what you can expect to see in this document (and why).

National Insurance Day

Whether you are refinancing your home or applying for an initial mortgage, understanding inside and out of the statement page can work long. Let’s take a look at what includes this.

Perhaps the area of the home insurance statement (HOI) that refers most often is the insurance information section. This part contains all the most basic information you need to know about where policies and coverage apply.

Insurers can list their lenders and contact information. This is because after submitting your request, you will be notified whenever your control is issued for damage covered to the insurance provider.

Is there anything that you may not appear on the home statement page? The name of the insurance company thinks you are buying insurance. This may seem weird, but there is no need to panic.

How To Find Your State Farm Declarations Page

One important section of the homeowner’s insurance contract statement page is the designated insurance section. The area lists key individuals eligible for the owner’s insurance policy, including the main homeowners.

Here you will see “insured mentioned” such as the main bill holders and “second insured” which is usually the spouse or additional homeowner. You can also take additional insurance. Some may be listed as individuals who are interested in the home but have not been extended under policy terms, such as unmarried partners or long-term roommates.

These people need to be added individually to your insurance policy to be covered and listed on the DEC page. If you have a housemate or live with a long-term partner to make sure it is properly covered, we recommend checking this section.

What is the main purpose of the home owner’s insurance statement page? We quickly inform you about your chosen coverage and limits.

The Insurance Data Intake Platform

The declaration page cover section also covers restrictions that can reduce home insurance for insurance contracts. This is the amount that insurance providers have to pay out of pocket before taking action to cover the remaining costs (up to insurance policy restrictions). We also notice the maximum amount of coverage you receive when presenting these policy restrictions or eligible requests.

Insurance companies can offer a variety of discounts that help you save money with premiums. If you qualify for any of these discounts available, it will be noted on the policy statement page or in the full policy document.

They may vary from carers to another, but depending on a typical homeowner insurance includes discounts such as:

Are there any discounts listed on the statement page? Be sure to ask the insurance agent you can use when renewing them to deliver them in addition to your insurance for next year.

Solved Commercial Property Cpos 00 10 00 Commercial Property

When buying home insurance coverage, you have the option of adding specific approvals to your policy. These approvals can help you better protect your home from hazards that are not automatically included in basic policy. Other add-ons will expand current coverage, including added policy restrictions on personal affairs and home protection.

If you choose to add policy approvals, these layouts (including new policy restrictions) are listed on the statement page. This allows you to get a quick and comprehensive picture of everything you cover. If you choose to add additional approvals throughout the year, you will automatically receive a new statement page with this added information.

Now that you know what the home owner’s insurance statement page is, it is important to note what and what is not included in this document. A homeowner’s statement of insurance page is a simple way to see what has been done with coverage, but it is not as extensive or detailed as an current insurance document.

The policy document contains a lot of information that is missing from the statement page. This includes a list of specific insurance exclusions, approvals, full insurance applications, and current insurance contracts for each coverage category.

Insurance Investigation • 1-800-hurt-911® Ny

When you receive these documents, it is important to read them properly to make sure you get exactly what you are intended by politics. This will help you avoid surprises and make sure your premiums are moving to the protection you want.

When you see the statement page, you must take a few steps to make sure the policy is insured and that everything is going well.

Your statement page will act as a summary of your policy, so do not be afraid to check with your insurance provider to see if you are not looking at what you have paid or if there are any differences from what you want.

Are you trying to determine how appropriate its owner’s insurance coverage is? Contact one of your friendly insurance agents to build the insurance you need.

What Is Sum (supplementary Uninsured/underinsured) Coverage

The statement page is usually the first page of the insurance cover package, whether it is an owner insurance or other coverage, such as car insurance or life insurance.

Your policy statement page and insurance certificate serve a similar purpose and contain much of the same information, but are not the same document. The statement page is simply a summary of the picture and is intended to provide policyholders with a short benchmark for their policy. On the other hand, a certificate is an official document generated by a carrier providing proof of coverage to other stakeholders.

Generally, the first page of all insurance cover packages is the insurance contract statement page. This is not a legal requirement, but this is almost always the case regardless of the policy you have purchased or the type of carrier you are transporting.

Insurance statement pages are usually only one page unless multiple pages are required to list all relevant information.

Esurance Policy Number Format: Fill Out & Sign Online

Virginia owner insurance: Important considerations promote your property with rent owner insurance with Alabamime on condo insurance in California

We are CST from 7am to 8pm from Monday to Friday, and CST from Saturday to 6pm. We are closed on Sundays. For assistance outside these times, please email with email protection or contact us during normal times.

“” Mean Analytics Inc. D / B / A “insurance services” refers to a licensed insurance agency in 50 states (Californialic. No. 0K96532, Texas Lic. No 2213178), resident in Delaware and has a major business in California. We sell property and victim insurance for our affiliates and non-affiliated insurance companies and other subscription entities (“insurance companies”). You usually receive compensation from the insurance company in the form of a basic committee based on a particular percentage of premiums. Please contact us for more information about the coverage you expect to receive. This site does not change the terms or conditions of the insurance contract. The amount of coverage selected and the amount of coverage is the buyer’s decision. Coverage, terms, availability of payment and qualifications