Insurance Premium Increase 2025 – Insurify project insurance premiums will increase in each state of each state by the end of 2025. The owners of typical houses will increase domestic insurance costs by about $ 261 in the next 12 months.

House owners will have to pay more money to protect their homes and prizes will be more expensive by the end of 2025.

Insurance Premium Increase 2025

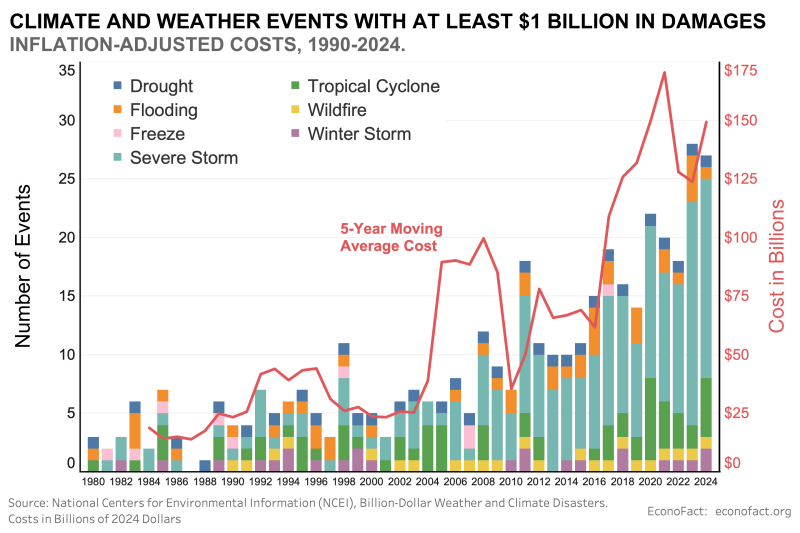

According to a study by Insfify, natural catastrophes are the main cause due to climate change. Fires to the west, hurricanes in the south and hail in the Midwest led to greater losses and higher claims.

Starting January 1, 2025, Dubai Residents Will Experience An Increase In Health And Motor Insurance Premiums, As Insurers Adjust Rates To Align With Rising Healthcare And Vehicle Repair Costs. Industry Experts Anticipate

The study provides that by the end of this year, the annual cost of domestic insurance will increase by 8%, with a national average by $ 3,520, and the owners of typical houses will increase their cost by approximately $ 261 in the next 12 months.

“The most sensitive offices to climatic risks will naturally experience more obvious insurance, but the areas subject to disasters will even see an increase in prizes, simply because repairs become more expensive”, explains Joel Berner, Senior economist of Realtor.com®.

“The costs of work and material continue to grow, which puts insurers in a position in which they have to pay more alternative complaints and therefore have to charge higher prizes”.

Natural catastrophes have caused losses more than $ 1 trillion of dollars since 2017, according to the National Center for Environmental Information (NCEI).

How Much Does Insurance Increase After An Accident In 2025?

The increase in domestic insurance premiums is due to operators who try to remain profitable, so they will transfer the losses increased to customers through higher prizes.

But some states will cost more than others. Depending on the part of your country, the prizes will vary on the basis of meteorological factors or other threats that can cause damage and requests for home owner.

For their approach, the insurance data scientists have used a real -time database of partners operators, as well as a total rate demand for dial information services to determine the state of the insurance of families in 2025.

:max_bytes(150000):strip_icc()/BestHealthInsurance-BestHealthInsuranceCompaniesfor2024-0900100921544c0fbabd1358eaebd691.png?strip=all)

Florida remains the state with the most expensive domestic insurance premiums, with an average of $ 14 per year and $ 140 in 2024. The average annual cost in the Sunshine state should rise to $ 460, growing 9% by the end of the year until the end of the year. Hialeah has the highest average cost, any city in the United States: $ 26, $ 693.

Homeowners Across The U.s. Are Facing Notable Increases In Insurance Premiums This Year. According To Forbes, On Average, Rates Are Projected To Rise By 8% In 2025, With Some States Experiencing Hikes

On the coast of the Gulf, the five most expensive states pay the highest home insurance premiums. Hurricanes are the main factor that causes ownership damage.

Insurify stated that high losses caused the exit of the state coverage 16 insurers. The fema puts the risk of hurricane damage in 34 counties in 67 florida “very high” or “relatively high”.

Louisiana ranked second, paying the largest number of insurance premiums for the house owners. The average annual cost for 2024 is $ 10, $ 964. Due to its greater loss ratio, Louisiana remains the lowest profitable state for insurers, which is the gap between the paid complaints and the prizes charged.

Oklahoma is among the three states where the owners of houses pay more. In 2024, the average annual commission is $ 762. By the end of 2025, the estimated cost should be $ 8,369. Tornado, hail and huge winds are the greatest threats. In the meantime, the farmers, the second largest state of the state home insurance company, said that he will not renew his 1,300 insurance policy due to the risks for fires.

Car Insurance Rate Increases

According to Insurify calculations, the owners of houses in California will see their insurance growing from 21% to an average of $ 930 per year. Palisades and Eaton devastated the county of Los Angeles in January, a regulatory change in the insurance guidelines of the state that allowed insurers to evaluate future climatic risks when the price prizes were the factor that led to this increase.

Not only is Louisiana the most expensive state with domestic insurance, but the prizes increase the most: 38% in 2024. The average cost is $ 10,964. By the end of 2025, the amount should go up to $ 13,937.

Economic accessibility is a problem. Louisiana has the third lowest family income in the country, according to the United States Census Office.

“The increase in domestic insurance premiums further complicates mathematics for potential houses owners,” said Berner. “The additional monthly fee means a domestic burden that buyers can afford.

Swiss Health Insurance Premiums To Rise 6% In 2025

Insurify’s results show that the owners of houses in each state will increase prices, from 2% to 27%. Louisiana, California, Iowa and Hawaii should grow more than double the national average (8%).

The owners of Case of Iowa are collecting domestic insurance premiums. According to Ncei, there were 131 tornadoes in the state in 2024. Furthermore, hail and floods of last year forced the evacuations and thousands of houses to be damaged. Now, corporateization should grow by 19% by the end of the year.

In each state of the United States, the owners of company projects will see a level of price increase, from 2% to 27%.

24. 959 people recently played “Crossword Daily game”. Can you solve it faster than others? 24,959 people recently played the game of daily crusaders. Can you solve it faster than others? Proposal of the market insurance company of the press release in 2025

The Perfect Storm In Home Insurance

According to a new analysis of preliminary interest rate applications, the ACA market insurers propose a median increase of 7% in 2025, similar to the increase in the 6% prize filed in 2024. The variations of the tax rates proposed by insurers, most of which are reduced between 2% and 10%, can change during the revision process.

Although the vast majority of the market participants will receive subsidies and it is not expected that it will have to face these increased costs, an increase in prizes will often lead to greater federal subsidy expenditure. The reasons why insurance companies provide for these advanced changes have also shed light on what guides health expenditure in a broader way.

Insurance companies believe that the health care prices that insurers will grow, in particular for hospital care, will be the main premium growth factor in 2025, as well as the growing use of weight loss and other special drugs, according to the inspection of documents available to the public.

This year, the increase in prices paid by insurance companies for medical services often affects prizes that exceed the growth of medical use. Insurers say that the lack of labor and the integration of the hospital market can increase the health insurance premiums in 2025.

Crop Insurance Decisions For 2025

In the meantime, there is a growing demand for GLP-1 Ozempic, Wegovy and other expensive drugs to treat diabetes and obesity and are increasing the expenditure for prescription drugs.

Peterson-Health System Tracker provides a complete analysis of health costs and other data on health costs, an online information hub for monitoring and evaluation of the performance of the United States health system. In three years, this could increase by 35% among most of the Singapore compared to April 2025, but for most of the Singapore, it will be full of measures supported by the government.

Singapore: while the government expands its national health insurance plan, the Medishfield life prize will increase from April 2025.

This comes after the Medihild Life Commission examined the insurance plan. He asks for more restrictions on statements to better protect the singaportians from great medical expenses and expand coverage to help patients provide new types of care and care.

Personal Insurance Market Trends

Since the statements are higher and the coverage expands, the prizes can increase by 35%. From April next year to March 2028, it will be divided evenly into phases within three years.

In this way, by the end of the third year, the reward will increase by an average of 22% per insurer.

To finance this, the Council recommends issuing about 600 million dollars from the Medisield Life Fund at once to increase the total prize to 35% and uniformly.

The highest award will support changes in the Medisield life plan. Here are some new advantages:

Aca Marketplace Subsidies Expiration

4. Update existing outpatient outpatient complaints and reduce outpatient cohaustization from 10% to 3% to 10% of hierarchical structure.

By explaining the change, the Council stated that the increase in the health invoice Herod the coverage of the limits of existing complaints, which now covers completely less than eight of the 10 subsidies.

This is less than nine of the 10 subsidy invoices that the program is designed to completely cover.

The report states that more and more patients with great invoices must pay part of their cash commissions.

Marketplace Insurers Are Proposing A 7% Average Premium Hike For 2025 And Pointing To Rising Hospital Prices And Glp-1 Drugs As Key Drivers Of Costs

The new complaint limit should restore the plan to its original task, which is to completely cover nine out of 10 invoices.

In addition, due to the movement of gravity from hospitals to outpatient, community and domestic environments, the committee has said that it is necessary to improve patients access to outpatient care and at affordable prices.

Tuesday, in a press release, the Moh said that the government accepted the Council’s recommendations and added that it would strengthen the program to better protect the singaportians from the main health events that translate into great medical expenses.

The Moh has said that the government will fulfill the restrictions of abstinence from Medisave so that patients can use Medisave to cover co -insurance and magazine franchises.

Preliminary Health Insurance Premium Rate Increases For 2025

Chinese life magazine