Insurance Policy For Parents – If you want to thank your parents for taking care of you and supporting them in golden years, you can buy them life insurance! Life insurance is the best way to set money, especially for their care or related costs.

The basic idea of life insurance is to offer a financial pillow to support the immediate family and friends to cover the final costs. But in addition to buying a life insurance policy for yourself, it is necessary in some cases to buy insurance for someone else.

Insurance Policy For Parents

Even if you as an adult child can buy a life insurance policy for parents, you still have to meet certain requirements and this is usually not possible without their knowledge and permission. Your parents may often need a medical exam. As in the case of purchasing your own life insurance, you have more options and a cheaper premium, if you buy a policy when you insure your parent, it is younger and healthier.

How Much Does Health Insurance Cost?

Just like a normal life insurance policy, when the insured dies, the fixed sum of the policy can be spent on everything you want. People usually decide to buy a life insurance policy for parents for the following reasons:

According to some studies, an average of the 75-year-old pays around USD 7,000 in medical costs every year. This sum is even huge for an important disease.

Thanks to regular life insurance policies, such as your entire life, you have a cash component in a policy with which you have access to money while the insured person is still alive. Thanks to the cash component you can use this money to cover all medical costs.

The benefits of life are one of the many benefits of the entire life policy for parents, as well as for the entire life of insurance and the possibility of obtaining dividends.

How To Choose The Best Insurance Policy For Your Parents In India

Zorg is another important costs. As our parents get older, it is more difficult to live independently. Or you welcome them to live with you or pay for housing when it happens.

Some people even take free from work to take care of a parent who needs help. In any case, you can cause certain financial problems. But thanks to your life insurance policy you have a tool that will help you cover these costs.

Funeral services are more expensive than ever before and will continue to grow. The average amount of expenditure for the funeral starts from approximately USD 9,000.

This is certainly a considerable amount to pay, and that is why you have to talk to your parents at the end of your life about their wishes and develop a plan according to their wishes. Debtors from Life Insurance can help to pay some (or all) of these costs, especially if the death benefit of the policy is quickly received.

Buying Health Insurance For Your Parents? Here’s What You Should Know

Nobody wants to leave their unpaid debts when he reaches, but sometimes it happens. We know that life is unpredictable and that having a life insurance policy can be the only way to cover all debts and help you not fight financially.

Due to inflation and the total price increase, it is difficult to cover all monthly costs. It is extremely difficult if you have one parent with one pension. A life insurance policy can therefore replace some (or all) pension benefits and help with the cover of daily expenses for life.

So we all have at least one reason, if not all to get a life insurance policy for our parents. This is a normal human cycle in which we age and have more needs in the field of medical care, and ultimately funeral or related costs.

That is why questions are much more important: how to buy a life insurance policy for parents and what is the best life insurance policy? Read on to find out!

Health Insurance For Senior Citizens

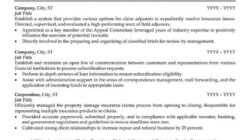

We have taken steps that you should follow if you want to buy a life insurance policy for parents and protect yourself against financial costs.

As we said, the average amount of expenses for the funeral is approximately USD 9,000, but often, even more, depending on the style of services. So you have to talk to your parents about their wishes and investigate how much it costs to be able to choose a plan and an amount of the insurance.

Depending on the reasons for obtaining a life policy, you must take into account all costs of debts or other costs at the end of your life, such as unpaid medical accounts to determine how much insurance your parents need. After calculating all the costs of the future, you need to know how much life insurance policy.

There are many different types of life insurance policies and they differ in a monthly price, functions and application process. This article will relate to what the best rules of our experience turned out to be, but you can read more about other options.

Can I Be On My Parents’ Insurance For A Car That’s In My Name? (answers For 2025)

For most rules you need a signature and permission from the parent to buy a policy for them. Depending on the situation, you can become the owner of the policy, because your parent is not suitable for a medical exam or another reason. Before you buy a life insurance policy, you must talk to your parents about their wishes and you must examine different options.

If you want to buy a life insurance policy for someone else, you must be able to prove “interest in insurance”. According to the insurance, life insurance companies think about people who have more losing than profit after the death of a person.

Because people must be able to prove that they suffer financially if the insured parent dies. So relatives have real insurance interests. That is why children usually have insurance and they have no problem proving it.

Depending on the type of policy, some companies will require the insured person for a medical examination to be eligible for insurance or to sign an application. If a person suffers from considerable health problems, there is a life insurance policy without a medical exam, but usually has less life insurance policy and is more expensive.

Term Insurance For Salaried Parents: Securing Your Child’s Future

Your personal financial situation influences the decision that is most suitable for a life insurance policy. Usually a person who pays insurance premiums is also the owner of the policy.

However, some rules expect a specific person to be the owner. If you are not sure who you decide to be the owner, consider talking to an insurance agent and getting advice.

The availability of politics is more important than who owns the policy. The owner must understand his responsibility and wants to be a contact point with the insurer.

In most cases the answer sounds as follows. We know that talking with parents can be very difficult to get politics for them. Nevertheless, this discussion will be useful in many ways.

Indian Dental Association

Official parents ask about their finances – especially life insurance and final costs – can feel uncomfortable. But it is worthwhile to have a conversation because they might need your help to prepare for the future.

Moreover, your parents must be legally competent to agree. During the application you must also provide their social insurance number, last name and address.

Some people are afraid of death and don’t want to talk about it, so it’s crucial to explain the purpose of this conversation. Your parents must know that you will support their wishes and avoid financial difficulties.

Moreover, parents must understand everything about life insurance and how it works. Only if they really understand the need for life insurance will they agree.

Canara Bank Mediclaim

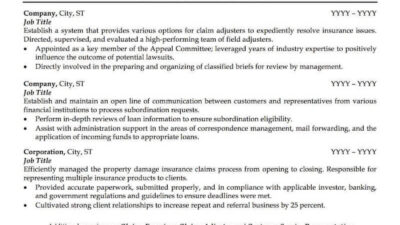

Monthly expenses for life insurance policies depend on various factors. A life insurance company calculates the costs of the applicant, gender, general health and insurance amount.

You can always consult financial professionals to help you better understand and predict monthly payments. They consider your personal circumstances and estimate how much you pay. A conversation with a financial professional can be useful to know if a political is for you or not.

Insurance costs will also vary, depending on the type of policy. For example, timely life insurance is more affordable, but it has fewer options. On the other hand, your entire life is more expensive, but you can use them for living benefits and build a value in cash.

Available options are mainly dependent on the age and health of parents. But the right options for them also depend on their wishes and plans for the future.

Why Including Parents In Your Ghi Policy Is A Win-win?

Term insurance offers protection for a specific period, usually from one to 30 years. The date of cover also ends with the date of politics.

People who want to exchange income or pay back a mortgage or other specific debts usually opt for timely life policy. One of the most important benefits of the period of life is the price accessibility.

On the other hand, this may not be the best choice if you or your parents have the 60th and 70s of the 20th century. In the case of time insurance policy, hospital bills or funeral costs cannot be covered and wealth for inheritance, as in the case of fixed rules.

Moreover, the life insurance policy has a maximum age limit, i.e. usually at the age of 50. This means that people aged more than 50 cannot choose long -term policies. And as people get older, their contributions are more expensive.

Is Your Health Insurance Plan Being Withdrawn? Here’s How To Quickly Adjust And Stay Protected

There are many small differences with installment policy, depending on life insurance companies that provide them. Comparison of insurance companies for life before buying a policy is needed to get the best possible offer.

This is a permanent life insurance policy, which means insurance