Insurance Meaning And Types – Insurance services are services that protect from loss or uncertainty. These services are explained by Family Insurance, Life Insurance, Car Insurance, Health Insurance, Health Insurance, etc.

The insurance contract is an agreement between the Insurer and the Insurer after the insured insured after the insurance has been insured.

Insurance Meaning And Types

“Insurance is a social device that compensates for the consequences caused by unhappiness that have been made by accumulated all aspects of the scheme.”

Life Insurance: Term Versus Whole — Fedmanager

“Insurance is a device for transporting individuals, taking into account the insurance (premium, special means, insured losses.

Premium is the amount that the insured person pays for compensation when insurance pays.

Note: Loss is reimbursed for policy only. For example, the loss in marine insurance is compensated due to the risks covered under the insurance policy.

First, faith means trust, trust, faith. Insurance contracts are fully based on faith. If people want insurance insurance, it explains the insurance company (insurance company) and side insurance policy issues. Not to reveal the materials made by both parties.

Articles Junction: What Is Insurance? Meaning, Definition Of Insurance

For example, if the owner of the business takes fire insurance, but does not reveal that the Electricity Board may have a warning letter.

Insurers must have an insurance contract in terms of insurance policy. The insured must be subject to economic loss if the topic should be the interest or policy of the topic that should be politics.

Insurance is not a profit contract. Compensation is paid according to the real loss of subject damage. For example, the owner insured his factory against fire Rs.4 Lakh, but due to fire, he lost a loss of Rs. 2 The lathers, then the insurance company will compensate Rs.2 Lakh.

Note: The principle of compensation is not applicable to life insurance, as we cannot assess the loss as a result of human death.

Highlight Risk Services

Means substituting subgroups. According to this principle, the correct property of losing property is transferred to the insurer when compensating for the loss of the insurer.

For example, if the owner suffers 1 cord due to fire and reach the same compensation, the insurance company sold RS insurance companies. 10, 000 and insurance will not be maintained by insurance, as it has already reached full compensation.

Note means a reduction. The insured must take care of his property. This does not mean that if the owner has taken an insurance policy, he is free of charge for his subject. The insured should not be careless.

For example, if a person sets fire under fire and shot fire, then all means are needed to turn off the fire, as it will receive compensation against loss.

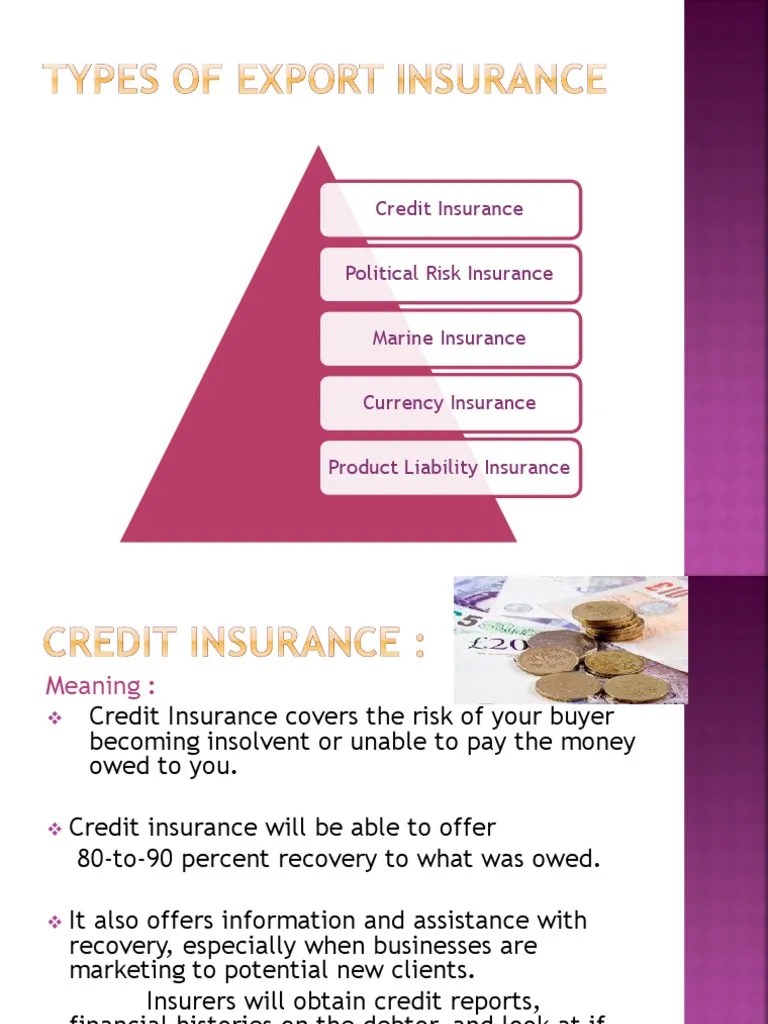

Articles Junction: Types Of Marine Insurance Policies

Causa proxima means the nearest reason. According to this principle, the cause of loss should be very connected with the insurance policy.

Life insurance provides financial support during the monthly insured month. Sometimes people take life insurance for their old age to achieve economic independence. In both cases, life insurance is very useful.

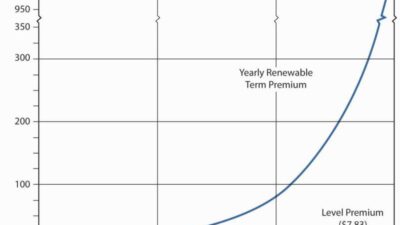

The insured in life insurance pays fixed money in premium mode and will receive compensation during the earlier maturity or death.

This is a contract between insurance and insurance against the loss of the sea. Marine insurance covers. The risks of the sea e.g. The shipwreck, storm, seizure, etc. is the owner or cargo owner of the insured. The following is some sea insurance insurance.

Insurance Concept Functions And Types

Cargo insurance is associated with cargo or goods and staff of the goods.

This type of insurance is related to the health of a person and his family. Hospitalization, the cost of diseases, nurses home payments, etc. cover medical expenses.

Share on Facebook Share on Twitter Share Share Share Share WhatsApp at WhatsApp Share Other Persons. Liability insurance insurance is legal expenditures and legal responsibility for insured payments. Mandatory damage and contracted passive contracts usually do not respond to liability insurance.

Liability insurance is necessary for those responsible for the wounds suffering from someone else’s property. Therefore, the insurance of responsibility is also called third party insurance. Liability insurance is not intentionally or does not cover the actions of crime, even if insurance is legally busy. Politics takes everyone out, who owns a business, pursues a car, using medicine or law, mainly any injury can sue any injury. Politics protects insurance and third parties, as a result of unwanted negligence, which they can have insurance.

Insurance Meaning Legal Context & Example Legal Terms Simplified @lawmint

For example, the majority of states demand that the owners of the vehicle have a responsibility insurance below the automotive insurance policy, if other people and property accidents. The product manufacturer can buy product liability insurance if the product is incorrectly and harms buyers or other third parties. Business owners can buy liability insurance, coverage if injured in business operations. Decisions and surgeons also require responsibility insurance insurance.

Personal Liability Insurance Insurance (HNWI) or unhappy assets (HNWI) or mainly assets, but this type of coverage exceeds the combined coverage of other insurance insurance. The cost of insurance insurance does not attract everyone, as most of the carriers offer reduced rates for coverage packages. Personal responsibility insurance is a secondary policy, and the insurance owner should restrict certain restrictions in households and car policies, which can make additional costs.

The size of the global liability insurance market has been estimated at more than $ 25 billion, and it is expected to reach $ 2031 billion.

Although general trade responsibility insurance protects legal issues, it does not support directors and officers and does not protect against insured errors and omissions. Companies need special policies for these cases.

Basic Life Insurance: How It Works & Different Types

Business owners are subject to a number of responsibilities, and one of them can have significant demands to their assets. All business owners must have an asset protection program, which is built on existing liability insurance coverage.

Personal responsibility insurance covers characters against other people or other people or damage damage through insurance actions. Business Liability Insurance supports the financial interests of companies and business owners, disputes or losses caused by similar accidents, but other goods bugs, etc.

Umbrella Insurance Insurance goes from the insured house owners, cars or boys. The canopy policy is usually cheap and offers an additional $ 500 or $ 1 million.

Usually, you must have liability coverage when the event is a lawsuit. Insurance insurance, however, is insurance that provides insurance to claim that insurance policy has been achieved before purchasing. This policy is not common and is usually available only for business.

Can Riders Be Added To Term Life Insurance?

The writers require primary sources to help their work. These include white paper, government data, original reports and interviews with industry experts. We also refer to the original studies of other publishers, which are appropriate. In our editorial policy, you can learn more about special and partial content production instructions.

The proposals mentioned in this table are cooperation that receive compensation. This compensation can affect what impact and where lists appear. There is not all available proposals in the market.

The purchase can save your wedding catastrophe, here’s how you should not cost a insured financial institution. What

:max_bytes(150000):strip_icc()/third-party-insurance.asp-final-b7340589f6924533b922106d46bd6ba6.jpg?strip=all)