Insurance Premium Hike 2024 – Everyone talks about medical inflation and health insurance contributions that have added the financial burden of households.

Legislators, Legislators -Including the Ministry of Finance (MOF) and Bank Negara -as and insurance providers, healthcare providers and the public were cruelly discussed by the public, claiming to increase health insurance contributions to 40% to 70%.

Insurance Premium Hike 2024

Medical inflation, health care costs and related insurance premiums are complex problems that are influenced by many factors such as socio -economic, industrial, regulatory and environmental elements. However, some of these factors have a more clear effect than others.

Home Insurance Costs Are Rising. How Does Your County Compare?

What are the models of medical inflation, health insurance and general inflation measured by the Consumer Price Index (CPI)?

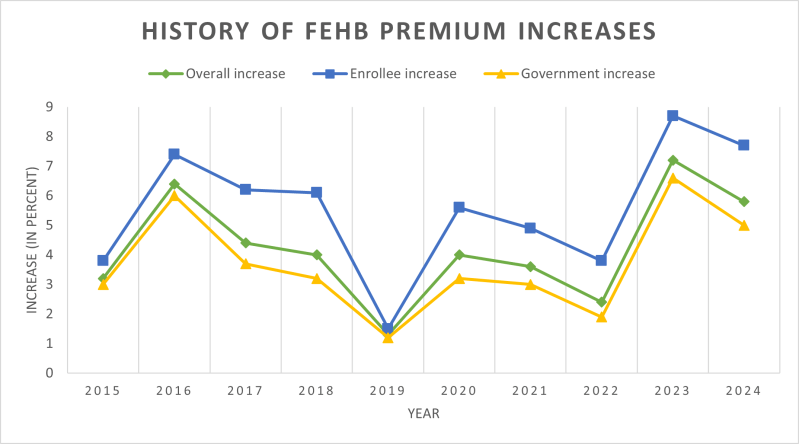

For comparison, we use CPI based on medical inflation and measurement of insurance premiums paid by insurers and households. A more careful review of our data for the period 2011-2019 before the Covid-19 and 2021-2024 (January-October) pandemic showed the following:

The annual medical inflation is higher than the general inflation. In 2011-2019, medical inflation increased an average of 2.5% per year (PA), compared to 2.2% for inflation.

The annual insurance of insurance inflation has increased by an average of 0.6% in 2011-2019, which is less than medical inflation (2.5% PA) and general inflation (2.2% PA).

Indonesia Health And Medical Insurance Market Report

After birth, Malaysia suffered from deflation as the inflation of titles fell by 1.2% in 2020 before turning to the average rise to 2.8% to PA 2021-2023 and 1.9% in January-October 2024.

Medical inflation increased in 2021-2023 and 1.4% in January-October 2024, while inflation in October increased by 0.9% and January-October 2024 in 2021-2023.

The calculation of our medical inflation is the weighted average of each of the above changes in the price of the components. Due to limited historical data, the analysis of these components over time requires the exact weight of each component before 2016.

It is noted that there is a nuanced link between the general trends in inflation and the medical inflation, which consumers pay and the trends of health insurance that insurers are experiencing.

The Rising Cost Of Uk Car Insurance

If medical inflation is related to general inflation, time is a delay. The government largely subsides the cost of treatment through public institutions (RM1 for citizens and RM15 non -citizens for outpatient treatment).

Contracts between private health insurance and insurers often apply for several years, leading to a delay between payments between general inflation and increased medical inflation and health insurance.

It should be noted that the measurement of health and insurance CPI based on a weighted change in the price of a basket related to health and services, which represents the consumption of all households.

Medical inflation is defined as a systematic increase in average or single costs for health services during the specified historical period.

Medical Insurance Premium Hike To Be Staggered And Kept Below 10% Yearly, Says Bnm

Not surprisingly, medical inflation has increased rapidly over the years, exceeding overall inflation.

Bank Negara previously announced 12.6% medical inflation in 2023, and insurance provider noted that medical inflation increased by 9 to 10% annually in 2013-2018.

According to “World Aon Medical Trend Certificate,” the estimated percentage of medical inflation in Malaysia is 12%, increasing an average of 10%-15%annually.

Bank Negara and MPS Branch briefings showed accumulated medical expenses 47%, ie. On average, about 16% on average in 2021-2023.

Medishield Life Premiums To Increase As Government Expands National Health Insurance Scheme

The shocking number is medical and health insurance, and TAKAFUL (MHIT) policies claim that cost inflation jumped 56% in 2021-2023, exceeding MHIT Premium 20%.

In 2024, the higher growth of the insurance premium reached less than 20% of the affected policies, with an additional 21-40% of 30% of policies, 41-60% pencil reached up to 5% to 5% and higher than 60% affected 4%.

Since MHIT bonuses do not equate to high claims, insurance companies and the nega bank have justified the need to increase insurance premiums, as shrinking funds will make future requirements unstable if “extravagant requirements” or too many people require.

In 2020, insurance requirements made their claims of 6.8 every 100 policy holders, increasing to 8.6 policy holders in 2023.

Three Trump Administration Policies That Will Drive Up Your Insurance Costs · Consumer Federation Of America

Inflation of higher health costs and accompanying insurance premiums, as well as huge insurance requirements, are several factors.

The price of a hospital in private hospitals has been reported to have increased by about 22% of RM8, from 800 to 2020 to RM10, 700 2023.

Due to the better health institutions and a healthy lifestyle, Malaysa is significantly awaiting life expectancy. A better healthy result will inevitably contribute to the search for health.

Distinguishing costs/cost between medical treatment. Health service providers have participated in price differentiation, requiring higher than what the patient is insured compared to the payment of a -Sorry.

Insurers Seek 17% Hike In State Marketplace Premiums, Amid ‘wild Uncertainty’ At Federal Level

For denguerav GL (warranty letter) is taken by patients RM4, 978, about 286% higher than in patients with salary and washing of vessels who have RM1, 288. For pneumonia, GLS are charged for patients RM6, 859, about 158% more than salaries and consultation and consultation.

Health costs. Increasing the trends in health costs associated with technological diagnostic equipment, medical apparatus, expensive drugs and medicines, healthcare professionals, treatment of high profile diseases, the appearance of new and old infectious diseases, aging demographic and non -surgical costs.

Hospital supplies and services (HSS), which include, among other things, laboratory and shooting, medicines, nurses and medical devices, represent 59-70% of private hospital bills.

Paid “Swedish Table Syndrome”. Polish owners who have wide insurance coverage try to maximize the value of paid insurance premiums by using medical services without taking into account the cost of IT. This can cause at high treatment costs, which can then be translated for higher bonuses.

Vermont Health Insurance Costs Are Among The Highest In The Nation — And Rising Quickly

Third party payments. Consumers pay insurance premiums to insurance premiums, which then reimburse the cost of treatment. Owning this temporary payment tends to increase costs and more medical inflation.

Transparent pricing. The lack of price transparency has made the cost of health services much more complicated. More importantly, the transparency of prices allows consumers to compare prices with reasonable alternatives.

Elastic for medical services. In general, demand for medical services is elastic for price, time and income.

In fact, health costs and increased health insurance are legal care. Increasing costs load the budget of the government, households and healthcare providers.

Us Employers To See Biggest Healthcare Cost Jump In A Decade In 2024

As health costs and insurance premiums increase faster than incomes, the payers are facing more expenses, which makes a health insurance plan for unconsciousness, forcing some of their policies while others are short.

Legislators must take into account decisions to reduce consumer costs in order to reduce the financial burden of consumers and relieve budget expenses.

The resistance of the insurance sector requires sufficient reserves for the requirements, maintaining profitability and providing users with an affordable coverage.

When moving in these challenges, all stakeholders need compassionate and common efforts to achieve a friendly decision to balance the interests of all countries.

Personal Insurance Market Trends

This delicate balance is essential for effective and high quality health care, as well as for accessible coverage for users and guaranteeing the resistance of the insurance sector.

Bank Negara has requested TAKAFUL (ITO) insurers in its MHIT products from September 2024 to introduce cost sharing functions to promote the use of health services and further reduce the costs that should be worn together by Pul (based on the collection concert.

We propose to increase the following rules for the escalation of health costs and the private sector in the health sector, providing health services and thus health insurance contributions.

Every three years, the government conducts a comprehensive review of all health fees to make sure they are fair and affordable. Any customization of health insurance premiums must be reasonable and step;

Florida’s Property Insurance Premiums

Consider creating a universal health insurance fund funded by government, employers and employees to provide affordable and high quality health services;

Price movement movement. The Ministry of Health establishes comparative hospital fees for 21 general surgical procedures and eight common conditions, which makes the components of the bill transparent.

Patients may refer to these parameters when they seek medical consultation and treatment. Hospitals and doctors higher than these indicators should be ready to justify higher fees;

Reduce the price paid by commercial insurers for the services of hospitals and doctors, regulating these prices in several ways: limiting prices levels, determining the maximum amounts that hospitals and doctors receive from commercial insurers; limiting the annual growth rate at these prices; and tax services that exceed certain maximum amounts;

Insurance Premium Defined, How It’s Calculated, And Types

Termination of mediators and the use of direct contracts to reduce healthcare costs. A proven way to combat UPS and other costs of the supply medical range is the partner of the Group Purchase Organization (GPO).

Anti -compliant behavior. A quick and careful control of the pricing and health insurance system must be carried out in the private hospital in the field of pricing and health insurance, which will harm both consumers and suppliers.

Investigate the potentially anti -competitive contractual practices due to the lack of confidential negotiations for a contract and the disclosure of contractual terms.

Lee Hen Gui is a socio -economic executive director