Insurance Premium Definition Economics – Insurance is purchased in order to provide financial protection or compensation for losses resulting from accidents, injury or material damage. Customer risk insurance companies to pay more accessible payments for the insured.

Many types of insurance policy are available, and practically any individual or work can find an insurance company ready to secure them, for the price. The types of common personal insurance are the car, health, home owners and life insurance. In the United States, most people have at least one of these types of insurance and car insurance is necessary.

Insurance Premium Definition Economics

:max_bytes(150000):strip_icc()/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg?strip=all)

Companies receive insurance policies for certain risks in the field. For example, a fast food restoration policy can cover injuries for the cooking of employees with Fryer Fryer. Insurance against medical abuse covers the allegations of injury or death resulting from responsibility resulting from the negligence of health care or negligence. The company can use record insurance intermediaries to help manage its employee policies. Jobs may require that a state law buy specific insurance coatings.

Hmpi Insured But Not Protected: Business Model Innovation And Stabilizing Healthcare Premium Inflation For All Americans

There are also insurance policies for very specific needs. This coverage includes the closure of companies due to the civil government, the kidnapping, redemption and identity insurance inside (K&R) and marriage insurance and marriage insurance and cancellation insurance.

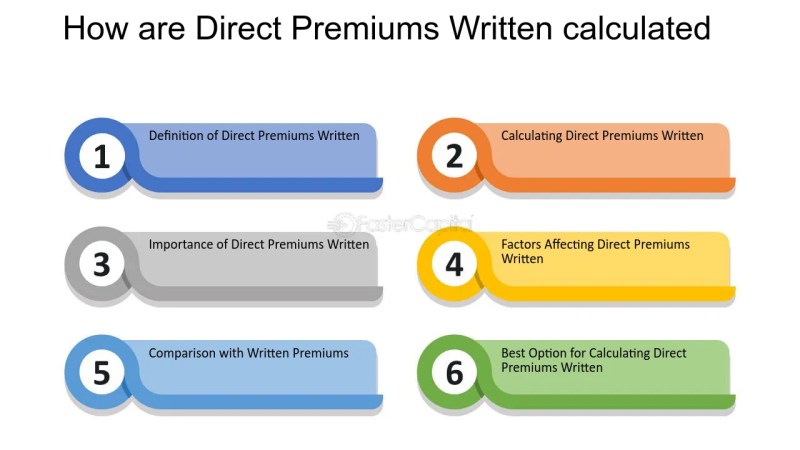

Understand how insurance functions can help you choose the policy. For example, complete coverage may or may not be the right type of automobile insurance for you. Three components of any type of insurance are the premium, the police limit and the deduction.

The policy premium is its price, generally a monthly price. Often, the insurer takes into account several factors to define the premium. Here are some examples:

It depends a lot on the perception of the insurer in your risk on request. For example, suppose you have several expensive cars and have reckless driving history. In this case, you will probably pay more for someone’s car policy with an intermediate sedan season and a perfect driving record. However, various insurers can collect different bonuses for similar policies. So finding a price that suits you requires a small legislator.

Trends In Health Insurance Deductibles

The police limit is the maximum amount that the insurer will pay for the losses covered under politics. The maximum can be adjusted during the period (for example an annual or term policy), by loss or injury or in the life of policy, also known as the maximum of life.

As a rule, senior boundaries bear a higher bonus. For a general life insurance policy, the maximum amount that the insurer will pay is called the facial value. This amount is paid to your user to your death.

The law of federal law (ACA) prevents plans according to which plans in accordance with ACA have set up a life limit for essential health benefits such as family planning, maternity and pediatric care.

The formidable is the specific amount you pay in your pocket before the insurer pays a request. Judeath will serve as distraction in large quantities of small and insignificant requirements.

Economic Order Quantity

For example, the $ 1 deductible, the deductible means that you pay for the first $ 1,000 according to any requirement. Suppose your car damage is $ 2,000. You pay the first $ 1,000 and your insurer pays the remaining $ 1,000.

Decisions may be declared by the police or the request, depending on the insurer and the type of police. Health plans can have an individual and deductible deductible from the family. High deductible policies are generally minor blankets because the high cost of the pocket mainly leads to less small requirements.

Health insurance helps cover routine and extraordinary medical costs, often with the possibility of adding vision and dental services separately. In addition to the annual debit, you can also pay the files and the co -assurance, which are your fixed payments or for percentage of medical use after completing your deduction. However, many preventive services can be covered for free before being completed.

Health insurance can be purchased from the insurance company, the insurance agent, the federal health insurance market, provided by the employer or the Federal Medicare and Medicaid coverage.

Can Parametric Microinsurance Improve The Financial Resilience Of Low-income Households In The United States?

The federal government no longer requires Americans to have health insurance, but in some countries, such as California, you can pay the taxpayer if you have no insurance.

If you have chronic health problems or regular medical aid requires health insurance policy for health insurance with lower deductible. Although the annual premium is greater than policies comparable to a more cross and less expensive medical price, it may be useful to compromise.

Households (also known as home insurance) protect your house, other structures of real estate structures and personal goods against natural disasters, unexpected damage, theft and vandalism. Home insurance will not cover floods or earthquakes, which you will have to protect from separating. Policy providers generally offer runners to increase coverage of certain properties or events and provisions that can help reduce deductible amounts. These supplements will reach an additional amount of premium.

Another type of householder insurance owner of the household. Your lender or owner will probably be necessary to have the owners’ coverage. When the houses are in question, if you do not have a coverage or do not stop paying an insurance account, your mortgage lender is authorized to buy owners of property for you and to charge.

Policy Approaches To Reduce What Commercial Insurers Pay For Hospitals’ And Physicians’ Services

Car insurance can help pay payment if you injure or damage a person’s property accident, you help repairs regarding your vehicle or replace your vehicle if you fly, destroy natural disasters.

Instead of POCket salary for automatic accidents and damage, people pay annual bonuses by road insurance companies. The company then pays the costs of all or most covered associated with an automatic accident or other damage to vehicles.

If you have a rented vehicle or you have borrowed money to buy a car, your loans or rental will likely ask you to wear automobile insurance. As for home insurance, the lender can buy insurance for you if necessary.

The life insurance platform guarantees that the insurer pays money to your customers (such as the spouse or children) if you die. In exchange, you pay bonuses during your lifetime.

Vehicle Insurance Market Size & Opportunities, 2025-2032

There are two main types of life insurance. The term life insurance covers you for a certain period, because it is 10 to 20 years. If you die in this period, your customers receive a payment. Continuous life insurance covers all of your life as long as you continue to pay bonuses.

Compared to prices, types of policy, financial stability, customer satisfaction and other factors to find the best insurance companies.

Travel insurance covers travel costs and losses, including failure or delay in travel, emergency health care, injuries and evacuation, damaged luggage, car rental and house rental and rental and rental. However, even some of the best traveling companies on the road do not cover cancellation or delay due to weather, terrorism or pandemic. They also do not cover the injuries of extreme sports or activities with a strong adventure.

Insurance is a way to manage your financial risks. When you buy insurance, you buy protection against unexpected financial losses. The insurance company pays you or you choose if something wrong happens. If you do not have insurance and accident, you can be responsible for all related costs.

Economic And Social Inflation Challenges Insurance Sector

Insurance helps you protect yourself, your family and your property. The insurer will help you cover the costs of medical accounts or unexpected and routine hospitalizations, damage to car accident or injury to others and damage to home or theft of your personal effects. Insurance police can even survive surviving lump sum money if you die. In short, insurance can offer peace of mind related to unforeseen financial risks.

Depending on the type of insurance policy of insurance and how it is used, permanent or variable life insurance could be considered as financial resources because it can create a monetary value or turn into cash. In simple terms, most permanent life insurance policies have the opportunity to build a monetary value over time.

Insurance helps to protect you, you and your family, against unexpected financial costs and cause debt or risk of losing goods. Insurance helps you protect yourself from prosecution, injury and damage, death and even the total losses of your car or your home.

Sometimes your country or lender may ask you to wear insurance. Although there are many types of insurance policy, some of the lives, health, owners of the most common houses and the car. The good type of insurance to you will depend on your objectives and your financial situations.

Insurer And Insured: Meaning, Roles, Examples & Key Differences

Requires writers to use primary sources to support their work. They include white work, government data, original reports and interviews with industry experts. Also reference to the original research of other deemed publishers if necessary. You can find out more about the standards that we follow in the development of precise and impartial content in our editorial policy.

Preferred Automatic Coverage: What It Works With A Financial Institution: What It is and How It Works, and How It Works and How It Works and How It Works and How It Works and How It Works and How It Works and How It Works and How It works and How it works as it works and how it works and how it works and how it works and how it works work and how it works and how it works and how it works and How it works and how it works.

Insurance Group in the United States Insurance Group (USAIG): an overview of your life insurance can expire before doing so. Here’s how to fill a gap in which a purchase can save your wedding