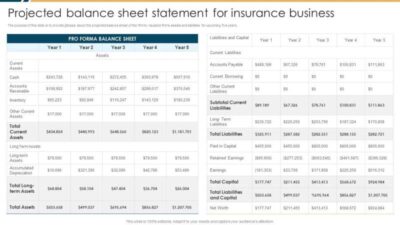

Insurance Broking Meaning – The vehicle insurance company in 2025 (specified differences) Changers can pay different costs from $ 25 to $ 50 per month or commission (10-15% of the costs of this policy).

Tonya Sisler was a technical insurance polite for over five years. Using his great insurance and financial information to write informative articles that answer the questions of the top students. His work is to provide students with accurate, timely and accurate details that allow them to determine their insurance needs and choose the best coverage. Tonya currently leads a group of 10 insurance policies …

Insurance Broking Meaning

:max_bytes(150000):strip_icc()/Reinsurance-assisted-placement_final-a465db6a2248432fb36bdf769fe837dc.png?strip=all)

Jeffrey Manola is an experienced insurance agent from the Topquotelifensinsinsinsin.com and ArthimexangQootes.com. His work was to provide Internet consumers to search for insurance with the most expensive prices available. Not only are you trying to offer the buyers the best price coverage, but also want those in insurance market …

What Is Insurance?

Advertising Display: We try to make sure you make decisions on car insurance. Comparison should be easy to buy. We are not dependent on any of the vehicle insurance providers and cannot confirm the quot from any single provider.

Our insurance industry participation does not affect our content. Our ideas are ours. To compare several different companies quotes, please enter your zip code on this page to use a free quotation tool. When comparing the quotes, you are more likely to save it.

Editorial Instructions: We are a free source of anybody who likes to learn more about car insurance. Our goal is to be a redirected and third party source of everything in a car insurance. We will update our site regularly and all content is reviewed by car specialists.

If you think of the automotive insurance company before the seller, it really lower the following. The seller can help you buy and compare the policies of different companies and give them many options and flexibility, but it can pay you.

Top Insurance Brokerages In Australia

On the other hand, motor vehicle insurance company offers you directly, usually simple and without seller’s cost. If you want to find many options and get advice, the seller may be appropriate.

But if you like easy and cheap experiences, the purchase directly from the insurance company can be the best way. This is all about what you need and your budget.

Do you want to quickly look at car insurance quotations before checking the difference between the automotive insurance company and the vehicle insurance? Comparing a car insurance in your area, enter your zip code to the free comparisons tool above.

When choosing a car insurance, it is important to understand the difference between the vehicle insurance deal with a car insurance company. Car Insurance helps find the best coverage with the performance of different insurance companies.

What Is An Insurance Broker? Definition, Types And What Do They Do?

Choosing among the vehicle insurance company and trader depends on what you have simple or broad range of comparisons. Karen Condor Insurance and Financial Armor

They do not sell specific policy, but they provide advice and options from many insurance, work for you to help you find the relevant policy. Changers allow you to compare the amounts and coverage of different companies, which can help you save money or get better covered.

On the other hand, car insurance company creates policies, prices, and control applications. When you buy a car insurance company, you receive this policy only, not different options. Choosing between the two depends on you select broad options or just want to go with a simple company. Everything about better to you.

When looking for car insurance, it is important to understand the difference between the seller against the agent in insurance. The insurance broker works for you and provides options from many insurance companies. They help you find the best coverage by providing programs from several carriers.

Buying Insurance Direct Vs. Through An Agent In 2025 (side-by-side Analysis)

On the contrary, insurance agent works for one company and can only sell their policies. If you are looking for independent advice and the ability to select different options, the seller chooses the most. While changers do not always confirm the cheap premiums, they can help you find the best money than different companies.

Usually changers paying additional costs to customer because they receive a commission from the insurance when purchasing policy. Insurance vendors provide extra flexibility, while car insurance company offers its plans and can give discounts or power. Your decision is based on selecting a variety of options or you want to have a direct relationship with one company.

Find that the car insurance company determines your Premium and different features can affect your rating, help you find the best coverage of your needs.

When you compare insurance for insurance against the company, the sellers allow you to access many insurance options and help you to find the best. Insurance companies sell their policies, so you are limited to what they give.

Saudi Insurance Industry Components

When asked how much the car insurance charger, the answer usually is more expensive. Changes from the Commission Insurance company, not to you. They help you find a good deal without adding additional costs.

Finally, even if you choose a car insurance broker in front of a motor insurance company depends on as you want more options or simple and straightforward experience. Changers give you many options, while companies offer simple services.

If you want insurance, it is important to understand the difference between the insurance agency and the insurance agent. The insurance agency represents one or more insurance companies and provides its specific products to customers. They also work specific companies and help you buy policies.

On the other hand, your insurance seller, customers apply. They do not represent one company. Instead, they will help you find the best insurance by searching for several insurance companies.

Ams Insurance Brokers Ltd (@amsinsurbrokers) / X

If we compare the insurance agency in front of the insurance company, the agency is the sales agency of these policies, while insurance company is an insurance company that provides insurance coverage and risks.

Knowing this difference can help you decide whether you want to work with the seller in a broader version of the options or agents of the specific Policy.

See our auto insurance guide to get a very cheap coverage to see how different savings options can help reduce your premium.

Buying car insurance without seller can save a lot of money. If you look at the difference between the insurance vendor against the transport company, go directly to a communication company means you do not have to pay the vehicle insurance costs.

Life Cover: Protecting Your Loved Ones

These costs can call your policy more than required. Choosing a non-meaning vehicle allows you to work directly with companies such as Geico, a state or developing farm. This often gives you a clear idea of cost and more control of your choice.

While a motor insurance vendor can help you to buy all around, their cost can cancel any money. If your insurance requirements are simple, purchase directly than the provider is usually cheaper. You avoid additional costs, can make changes and select a better policy for you without additional costs. It makes it easy and very soft.

Independent Agents Receives a lot from the Commission on the policies they sell, but their salaries are very different. When comparing insurance agents are representative representatives of manufacturers, private sellers are working rather than being arrested by a particular company.

On average, the salaries independent merchants vary from $ 40 000 to $ 100, $ 6,000 per year. How much adults depend on things like their experience, place and business. For example, the seller in a full market such as New York or Los Angeles can build more to have a strong customer network and sell multiple policies.

Hine Chartered Insurance Brokers

In addition to commissions, merchants tend to pay for car insport and other income policies. The cost of these costs can change according to services they give and what state laws allow.

While some people try to refuse to pay these expenses directly to the insurance company, others, such as their services and consumers, provide advice. This makes many expenses of many customers seek professional help.

In addition, independent agents are receiving the commission, incoming agencies from $ 40 to $ 100,000. Insurance rights may vary, and compare insurance rights, and compare insurance rights generally perform more money, especially with vehicle insurance at the cost of insurance.

As we mentioned before, car insurance agents can import your car as a customer. They help you search a car insurance policy that meets your needs.

What Is Reinsurance

According to Investopedia, the explanation of the Traveler Tracker “insurance expert towards insurance policies on behalf of consumers.”

The vehicle insurance agents are not against the organization, so they cannot