Car Insurance Comparison Singapore – Age and gender is two main factors in the insurance company that will be used at the time of car insurance premium. Insurance companies do not reduce the information as the information you can understand about the driving experience and the chances you will be in a car accident.

You are less dangerous based on the two factors, the company is not less companies, ensure you, and you will receive lower quote you will receive.

Car Insurance Comparison Singapore

But this variation makes it difficult as a potential customer that can see that you are given a matching level or if you are ripped.

Car Insurance / Car Insurance Renwal, Announcements On Carousell

With this idea, we create a number down the number to find the highest auto-insurance cost depending on your gender and group of gender. I hope this person has the knowledge you need to know good deals when you see it.

Those who collect the major insurance companies in Singapore in Singapore to see what age are affected by car insurance fees.

The following rates assumed that a five-year driving experience (NCD) (NCD) (NCD) (NCD) (NCD) (NCD) (NCD) (NCD) (NCD) (NCD)

For example, for those who have a clean driving record, NCP she can save more than 50% on the car insurance premium.

8 Best Car Insurance Plans In Singapore: A 2022 Guide

Generally speaking in Singapore, the highest level for young drivers generally drivers are old (up to half of interest.

We find that the 20-year-old drivers claimed $ 2 for at least 36% exceeding the average rate of the driver at 40 ($ 1 637). This is because the young drivers increased the risk of dangerous because part of the less driving experience.

In addition to lack of experience, driving increased rates for young drivers because of her insult for reckless driving. It is displayed when the quote collected, all drivers have the same driving experience but different ages.

The 20-year-old driver should be noted that the premiums may be in addition to excess young and / or no $ 3 to pay the claim.

5 Factors Affecting Your Premiums

This is very important to pay attention as a different company determines different age definitions for young drivers and drivers.

What does I mean if I’m classification of age “youth and / or / or without the refioned experience”? ប្រសិនើគោលនយោបើគោលនយោបាយធាបនាបនបន លើសពី 6 ្លារ្លារ លើសពីលើសពី្លាន លើសពីលើសពី្លាន ិងក្មាន ិងក្មាន ិងវ័យ្មាន ិងវ័យ្មាន ដែលគ្មាកឹងតរ 3 500 ដុល្លារ 100 របស់អ្នគ្នចេញពីហោប៉ៅផ្ទាល់ខ្លួ្លួ្លួន គ្របនកគ្របនក គ្របនក.

If you are 20s, we recommend you read a very close printing to see how much you are mandatory before you do car insurance plans.

It may have to pay a higher premium if the plan is served with the driver and / or driver that does not experience the experience.

What Are The 3 Main Types Of Car Insurance In Singapore?

While car insurance premium reduces, car insurance premium down for 30 drivers and 40 years, we find that the insurance premiums are generally starting up to 50 years.

This is because many of the insurance companies consider the driver’s easier to be angry when they are old. We find that the driver at the age of 50s have an average of $ 1 784 or 9% increases from 40s.

Many insurance companies have been charged for higher rates in men and women for 60 years instead of 50s. We advise strong advice for older customers to pay attention to this problem because they treat the plan.

We find that men drivers usually pay the premium for car insurance premium compared to women. The driver at 20 years old has the largest cost between 12 percent, more than women with car insurance policy.

6 Cheapest Car Insurance Options In Singapore For 2021

2024 data we show that the 50s ages are 50s still pay more than a few dollars.

Men must pay a premium about women in each area because the insurance company thinks more dangerous and therefore risk is high.

This interest rate was undergoing five years and no discount (NCD) of 0% and, because it does not matter more important discounts higher than higher and NCD years.

For example, for those who have a clean driving record, ship c. They can save up to 50% of car insurance costs.

Car Insurance: Best Places To Get In Singapore

** Based on the same woman / woman in the 2020 Toyota Corolla the same Altis 1.6 (0.0 MDM), a 5-year-old experience).

** Based on male band / girl single by 2020 Toyota Riya Riya Riya 8 (0% 0% 5 years of driving experience).

To reach our car insurance area for Singapore customers, we make data achieving and collecting quotes from the insurance provider in Singapore.

To create a standard standard, we must create a specific conclusion about the type of plan and level covered with user average user.

Buy Car Insurance In Singapore: Get Quote Online

The research considered the standard coverage, because the big coverage is the obligation to the car owners driving a car younger than 10 years. Due to the car cost in Singapore to make the most common insurance types purchased.

In an effort to ensure that the extract represents the comparison rate, we are an important standard that is usually considered the “optional” plan “.

The driving software profile used is used to quote differently about different variables from gender. Toyota Valis 1.6, and a new car owners and new driver has not been spoken by NCD (NCD).

The extract and information used for the purposes of the study collected from five insurance companies in Singapore.

Carro & Ntuc Income Launch Usage-based Insurance In Singapore

The company is selected based on popularity with users in Singapore as well as easy to obtain quotes and details about plans.

Customers must make decisions and calculated by collecting more information on products by viewing all facts and comparison carefully. Why do you distract the best car insurance in Singapore to have a car have many features to ensure the security and well-passenger security?

Also, because there are times of the story out of your control over the street – where and without warning.

Therefore the best car insurance in Singapore should be one of the main priorities before traveling on the road. However, the car insurance can be expensive and the difference in Marketing Insurance option can make the head roll easier.

Owning Vs Renting A Car In Singapore: A Cost Breakdown

Singapore car insurance comparison can also help you all, we’ve seen all the options available on the island and take the best car insurance for your comfort.

Before we continue to choose the above car insurance, we have sent a complete guide on the best car insurance in Singapore 2021 to help you choose the best option for your needs. But if you know what you want, click free to skip the main list.

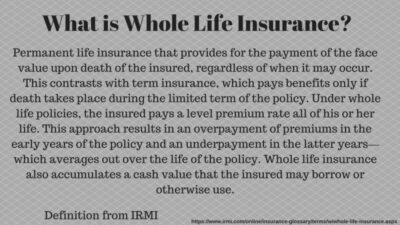

In Singapore before you can drive on the road, you must have car insurance. According to the vehicle (risks and risk of the party risk) acting without the insurance cars can lead to a fine of a fine and even unable to remove the driver’s license.

In addition to legitimacy, Singapore car insurance helps you have financial issues when injury and destruction in case of danger. So get car insurance not only protecting and loved ones, but also others on the way.

Things To Know About Car Insurance In Singapore

According to the Singapore police tourist reports for the year 2019, 7.666 injured in more than 9,000 people injured. All, 116 severe accidents have been reported to have 117 died.

And even when there was a trend down in a traffic accident since 2016, we could not say that we would not participate in the statistics. That’s why you should prepare for all the safe nets that can do when it happens when it happens – and get the right car insurance as the first step.

According to the gobear, only three types of car insurance in Singapore: Third-party (TPO). Third parties,