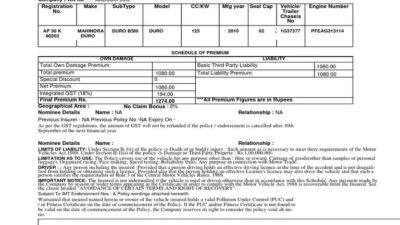

Insurance Premium Meaning – The insurance premium keeps payment to purchase a person or labor insurance policy and to include insurance scope. The insurance premium is income for the insurance company and guarantees protection against the financial damage caused by activities covered.

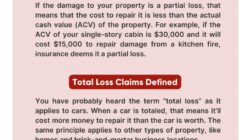

The insurance premium is the income earned by the insurance company and in return, the insurance company provides collateral for damage to the incidents covered by the insured. In the event of an acceptable request, the insurance company must provide reimbursement for damage to the insured person. Depending on the type of policy, the premium may be paid on a monthly, three months, six months or annual basis. If the insured does not pay the premium on time, the insurance policy may be missed and the insured person may be left extensively.

Insurance Premium Meaning

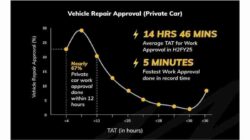

There are many factors that determine the insurance premium paid for policy. There will be various premiums in different policy types such as motor insurance, health insurance and life insurance. The basic principle is that the insurance premium is based on the loss of loss and the use of data using actuarry to determine a premium for insurance policies. Depending on the type of policy, the factors that determine the premium will be different. For example, a health insurance policy premium will be attached to the insured person and has been selected for the premium for the engine insurance policy, and the experience of the old claims has been selected.

Explain Like I’m 5: What Is A Life Insurance Premium?

The insurance premium varies from insurance company to insurance company. There are some solutions that policy holders can reduce the insurance premium listed below:

The premium represents income for the insurance company. Insurance companies, except for these premiums, operational expenses, used to pay insurance requests, bonds, etc. It invests in various assets such as. If the insurance premium and investment income are higher than insurance demands and operational expenses, the insurance company will make profit.

There is an experienced insurance broker in India. Group Health Insurance, Fire Insurance, Cyber Insurance Policy and so on. We are pleased to help you.

Rekha Ramakrishna is a full -time collaborative editorial director covering financial products and services. There are more than twenty years of journalism experience, including educating consumers about personal finance. The insurance premium pays for an insurance policy of a person or enterprise. Insurance premiums are paid for policies covering various individual and business risks. If he cannot pay the policalown premium, the insurance company may cancel the policy.

Premium Meaning In Telugu With Examples

When you register with an insurance policy, your insurance company will request you a premium. This is the amount you pay to implement politics. Policy holders remove infection premiums from Matchoz, one of the vasvarral options. Some insurance companies allow policy holders to pay insurance premiums in installments such as monthly or annual, while others may require pre -payment for each year before any scope starts.

There may be additional fees to be paid to the insurance company at the top of the premium, including taxes or service fees.

Insurance companies earn money in bonds by collecting premiums and depositing this income to secure financial vehicles such as bonds. When the insurance company gains a premium by providing security, it becomes a fourth carrier. Unarmed premiums also represent a responsibility, because the insurance company must scope for demands against politics.

Insurance companies consider various factors to decide how much premium they will receive for a specific policy for a number of scope. Although some of these factors are common in insurance (such as the age of the insured), others vary depending on the type of scope,

Modified Endowment Contract (mec): What, 7-pay Test, Taxes

Save the driving in the main factors that determine how often you use the automobile insurance premium, your geographical location, your car, your car type, your penis, your credit recording and your age. Another idea is a type of insurance you purchased, including the scope zodiac coverage and downloadable limits.

For example, the possibility of making a claim against a young driver living in the urban region may exceed a suburban region, according to a young driver. Similarly, small and new drivers take more risks than older, more experienced drivers. In general, the higher the risk, the more expensive the fuse premium is.

In the case of a life insurance policy, the most important factors that the company sees within the scope of pricing is an insured death risk, interest and expenditure that will spend an expert interest and expenditure waiting to win by depositing your premium. The scope will determine your age, premium amount and other risk factors (such as your current health). The smaller you are, the less your premiums, the more they will be. On the contrary, the more old you buy, the more you pay to your insurance company in the premium. High valuable policies will also carry a high paramal.

Life insurance may have more flexibility as it covers how you pay a period of years. Some insured can offer premium cash flow payment plans. These schemes allow policy holders to pay premiums at short intervals. Some policy holders can use premium financing to pay for expensive premiums, but this includes the risk of process.

Medical And Health Insurance

The 2010 appropriate maintenance law (ACA) has written various rules that regulate how the insurance company can determine how to determine the premium. For companies that offer coverage through the ACA Health Insurance Market, there are five main factors that can be used to determine the insurance rates: Age, insurance plan, geographical location, tobacco usage and registration of a person or family. Market plans should demand men and women at equal proportions and keep your health history in mind.

Insurance companies set policies for risk and premium prices and employment levels and premium prices for the insurance policy. While the emergence of sophisticated algorithms and artificial intelligence changes how and how the price of the insurance is sold, human actress is still important for the process. Actuari uses mathematics, statistics and financial theory to analyze the economic costs of potential risks in a policy or policy group. They rely on computer models to analyze previous experiences and estimate future results, so that they can set premiums that make the insurance company collect competitive prices and make profits.

Once the premium is corrected, insurers use these revenues from their customers to meet the obligations related to the policies they reduced. They can also deposit premiums to achieve high return. This can balance the costs of providing insurance and help a insurance company to keep prices competitive in the market.

While the life insurance premium is generally determined for the life of the insured, accents regularly adjust the premium for health and automobile insurers. The insurance premium may increase after the policy period is over. If the insurer increases the cost of providing risk or collateral associated with an increase in a particular type of insurance, it may increase the premium of the requests made in the previous period.

Meaning And Definition Of Premium (insurance Law)

Although insurance companies can invest in assets with various liquidity and return levels, they must always maintain a certain liquidity level. State insurance regulators determined the number of necessary liquid assets.

Most consumers are the best way to find the lowest insurance premium. You can choose to shop on your own via individual insurance companies or collection sites that provide price from many insurance companies. It is quite easy to get online quotes yourself.

For example, ACA enabled consumers to shop for health insurance policies in the unlicensed market. When the login is made, some basic information such as your site name, date of birth, address and income requires someone else’s personal information in your home. You can choose from many options that are available according to your own situation -with a change in the scope of politics according to the amount paid by you -you can fall, and the poultry. The provider state will create premiums on individual history and other registration factors.

The second option is to pass through an insurance agency or broker. They work with many different companies and try to get the best quotes. Many brokers can connect you with life, automatic, home, health, responsibility and other insurance policies. However, it is important to remember that some of these brokers may be inspired by the large -scale sales commissions gained.

What Is Insurance?

Insurers use the premium paid by their customers and policy holders to meet the obligations related to policies.

Premium domain meaning, automobile insurance premium, insurance return premium, auto insurance premium meaning, policy premium meaning, car insurance premium meaning, capital premium insurance, chesapeake insurance premium, insurance premium estimate, total insurance premium, insurance premium, e premium insurance