Insurance Company Paid Claim Journal Entry – A diary entry for 12 tickets for the following transactions: I. Monika started a business with money lol. 3.00, 000, shares Rs. 5, 00, 000 and construction of Rs. 25, 00, 000. II. Building the RS Recovery Room. 1.00, 000. III. Insurance Premium paid by Actions Rs. 15, 000 and automatic Rs. 7, 000. IV. Goods destroyed by the fire of Rs. 80,000, submitted insurance claim. v. The Commission received Rs. 25,000, 20% were obtained in advance. VI. The insurance company paid 80% of the entire and final agreement. VII. The salaries paid lol. 48, 000 and because of Rs. 22, 000. VIII. Provide depreciation in construction @ 10% annually.

13 PASS Required logs for logs to correct the following errors: I. Selling a credit of Rs. 1, 700 of Karan was published in the Cartik account. II. Selling money to Rs. 1, 700 for Neema was published on the NEEMA loan. III. Sales of Old Furniture Loans of Prince from Rs. 1, 700 were credited to the sales account. 4. Sales of an old Ronak furniture loan of Rs. 1, 700 was published as Rs. 7, 100. V. Checking Rs. 640 obtained from gauut was dishonest and

Insurance Company Paid Claim Journal Entry

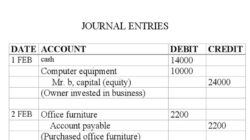

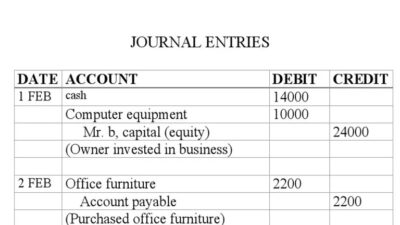

The following logs are made for transactions and errors provided. Each transaction is recorded with appropriate debts and loans, ensuring that the accounting equation remains balanced.

9 Insurance Resume Examples For 2025

A diary entry for 12 tickets for the following transactions: I. Monika started a business with money lol. 3.00, 000, shares Rs. 5, 00, 000 and construction of Rs. 25, 00, 000. II. Building the RS Recovery Room. 1.00, 000. III. Insurance Premium paid by Actions Rs. 15, 000 and automatic Rs. 7, 000. IV. Goods destroyed by the fire of Rs. 80,000, submitted insurance claim. v. The Commission received Rs. 25,000, 20 % were obtained in advance. VI. The insurance company pays 80 % in full and final agreement. VII. The salaries paid lol. 48, 000 and because of Rs. 22, 000. VIII. Provide depreciation in the building @ 10 % annually. 13 PASS Required logs for logs to correct the following errors: I. Selling a credit of Rs. 1, 700 of Karan was published in the Cartik account. II. Selling money to Rs. 1, 700 for Neema was published on the NEEMA loan. III. Sales of Old Furniture Loans of Prince from Rs. 1, 700 were credited to the sales account. 4. Sales of an old Ronak furniture loan of Rs. 1, 700 was published as Rs. 7, 100. V. Checking Rs. 640 obtained from gauut was dishonest and

दो कप a औ b टेबल प दूस े के दू दूदू पप पप दूस हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। हैं। दूस दूस हैं। हैं। टेबल के स दीवा दीवा brand आप क ीब ीब हैं लगभग कपों बीच में। में। में। में। में। में। में। बीच बीच बीच बीच कपों कपों कपों कपों कपों कपों कपों कपों में। आप दोनों कपों की प्रतिबिंब में सकते सकते अब अब आप ओर जाना शुरु करते, मेज दूर, तो प्रतिबिंब पहले हो जाएगा b) प्याला b पहले हो c) दोनों साथ लुप्त हो जाएंगे प्याले नहीं नहीं नहीं नहीं नहीं होंगे होंगे होंगे होंगे

Combine the characteristics listed in List II with the relevant principles of gestal perception. The characteristics are: a tendency to perceive an entire object, even where it does not exist. The objects that move together seem to stand out from the environment. The elements that remain a model will probably be considered as part of the standard. The elements found together tend to be perceived as a unit. Learn how to register an insurance claim from goods destroyed by the fire and the proper entry of the log to mitigate financial losses

This blog directs companies to record damaged goods through fire and fill out insurance claims. It covers records in losses for losses, steps for sending claims and general accounting errors, guaranteeing adequate financial statements and faster recovery after fire.

Question No 27 Chapter No 5

A fire can devastate business at times, but while you react later, you can do everything different. Imagine company A, which recently lost 500 high -value inventory units worth 75 lakhs for fire. Fighting small documentation and delayed insurance claims, they were confronted with even more financial strikes. If they follow the correct steps-registration, timely reports and the correct communication with their insurer, so much to restore the insurer, they could be much softer. In this guide, we will investigate the decisive steps to manage these losses and ensure that you are well prepared for effective registration of an insurance claim. Let’s turn a disaster into a well -planned recovery.

In any business, fire accidents can occur unexpectedly, leading to significant damage and loss of goods. This event interrupts operations and imposes considerable financial burden. The goods destroyed by the fire must be considered careful in order to reflect the actual financial situation of the business.

The presence of an insurance policy can soften financial losses when the fire destroys the goods. The insurance policy compensates for the value of the goods destroyed by the fire, ensuring that the company can recover without a huge economic burden. The submission of a claim for fire insurance includes documentation for loss and sending a claim to the insurance company for evaluation and recovery.

The exact registration of the loss of goods destroyed by the fire in your accounting books is crucial to maintaining transparent financial statements.

Prepaid Expenses In Balance Sheet: Definition, Journal Entry And Examples

When the goods are destroyed by the fire, the first step is to record the loss in the books. This is done by discussing the “Loss from Fire” account and lending to the Inventory account to reflect the inventory reduction. This record ensures that the financial statements reflect the reduced value of the assets.

If the goods destroyed by the fire are not insured, the business will have the loss completely. In order to accurately reflect the financial impact, the loss must be transferred to the account for profit and loss.

This includes an additional recording to transfer the loss of the “Fire Loss” account to the “profit and loss” account, ensuring that the financial statements reflect the costs incurred by the fire.

When the goods are insured, the submission of an insurance request for goods destroyed by the fire shall be mainly for the restoration of the loss.

Bookkeeping For An Insurance Claim

Claims for insurance from fire destroyed by fire include sending a detailed report from the incident, including the value of the lost goods to the insurance company.

The insurer evaluates the claim and reimburses the insured amount. This process involves several steps to ensure that the claim is legitimate and that the value of the recovery is required.

Following a fire incident, legal and regulatory requirements are important to ensure that their insurance claim is valid and effectively processed. Here are some important considerations:

:max_bytes(150000):strip_icc()/Insurance-proceeds-Final-183c4c166d0a4daf807c544886078f50.jpg?strip=all)

Staying in accordance with legal and regulatory standards, you can protect your business, accelerate the insurance process and minimize the financial risk.

Policy Approaches To Reduce What Commercial Insurers Pay For Hospitals’ And Physicians’ Services

When the insurance claim of goods destroyed by the fire is accepted, it is crucial to restore the exact recovery in the books. This includes debit of the “insurance claim” account to reflect the amount of the insurer’s claim and lending the Fire Loss Account to compensate for the registered loss.

Proper entry of the log guarantees that the recovery is correctly reported, providing a clear image of impact and financial recovery. It also guarantees that the financial statements of the company correctly reflect the receipt of funds from the insurance company.

Errors General Errors include incorrect accounting for insurance recovery and inadequate processing of financial statements. These mistakes can lead to defective financial statements that may mislead stakeholders and influence decision -making. The creation of accurate logs for logs is crucial to preventing misrepresentation of financial data. Some examples of log records are:

Fire can cause damage to your business by allowing you to cope with significant losses and a terrible task of recovering. However, the steps you take in the consequences can determine how quickly and effectively your business is restored. Proper reporting of the goods, destroyed by the fire and effective management of their insurance claims, can turn a potential catastrophe into a structured recovery process.

Receiving An Insurance Payment

After all, while you can’t always prevent disasters, be prepared and know how to react, it can contribute to everything. Guaranteeing that your business is well protected by complete insurance coverage and healthy accounting practices is the best way to protect your future.

Take these lessons seriously and equip your tools with the tools to encounter any storm – or fire – it looks.

To protect your business, partner with all your fire needs. With complete coverage and specialized orientation opportunities, it helps to protect your business from unforeseen disasters.

The main objective is to prevent financial losses from damage caused by the fire. It helps to cover the cost of repair and guarantees the continuity of the business after an incident.

Insurance Claims Manager Resume Examples For 2025

Fire insurance, usually known as a special fire and special dangers, is a type of real estate insurance that provides coverage for material damage. The main purpose of fire insurance is to provide coverage of your property against any physical losses, damage or destruction. The policy pays the costs of recovery, costs for repair or replacement of property or any part of the property.

This fire insurance policy covers a loss, damage or destruction of commercial properties, such as actions, buildings, installations and machines, accessories and accessories and other assets of the company for an insured amount up to ₹ 5 crowns.

This fire insurance policy covers

Paid wages journal entry, paid salaries journal entry, insurance claim paid, journal entry for insurance claim, paid journal entry, paid accounts payable journal entry, paid account journal entry, paid expenses journal entry, advance rent paid journal entry, insurance journal entry, insurance paid journal entry, sales tax paid journal entry