Finance Law – In this article, your office manager: How to create a Kpis financial plan to monitor a law firm for a law firm

Download in the form of PDF requirements … Download immediately this blog article in the form of a Financial Management Law Firm PDF: Lawyer Guide

Finance Law

:max_bytes(150000):strip_icc()/islamicbanking.asp-FINAL-a44177c529d24b97a0a4e857d65253cf.png?strip=all)

Manage your office: How to create a financial plan in a famous financial plan to monitor a Financial Management Law Firm’s importance of the legal payment of tech cash flow paid for yourself and your group of financial statements and planning for the final bankruptcy for the management of law firm firm

Banking And Finance Law Review

It may threaten to think about the financial management of a law firm. As a lawyer, this is not your job to become a financial expert. However, understanding the foundation of financial management will achieve miles to enhance your office on the way to the development of Wild -Inincom. And the more your income is, the more customers can help.

What is the management of law firms? A financial management law firm includes planning, organizing, guiding and controlling financial activities of a law firm. This includes, among other activities, profit monitoring and costs for growth and revenue planning.

A financial plan should contain long -term financial goals and strategies. Includes the most specific financial information possible when creating your financial plan. At least, your program should contain a number for a year of operation.

As displayed when operating guidelines for law firms, your financial plan should include the following issues:

Merger And Acquisition Law

And remember that, while an optimistic financial program may be very happy to be checked, it will eventually fail. You can establish yourself a business that is the same as the way you do it in the Court: edit research to ensure that you have reliable and carefree evidence to support any prediction, destination, quantity and dollar in your financial plan. For example, before determining the target exploitation rate for next year, find a measure of your forecast support. For example, reporting the legal trend to provide index data for the main performance data in a law firm (KPI). If your prediction is different from industrial measures, you may need to consider alternatives to increase your business.

Kpis Law Firm, or main performance measures, can help you accurately monitor your company’s financial efficiency. Although, with many outstanding KPI law firms to measure, how do you know which one will be included in the financial management programs of your law firm? We have reduced this on the list below:

In addition to measuring financial KPIs, there are other ways to support your company’s revenue growth. Read these 10 tips to improve the profit of the law firm to know the proposals you can bring to your office.

When it comes to understanding and improving financial efficiency, the first first step is to create a budget. A budget for your cash flow, your revenue growth and finally, your profit. If you do not know where to start when it comes to budget, follow our instructions step by step: How to create budget for your law firm.

Understanding Vendor Finance Law For Property

Profit analysis is a common reality in accounting and financial management of a law firm. In essence, this is a profit of the output of the organization. The output refers to the products or services that a production organization. Therefore, for a law firm, the output may be the service time provided and some of them are positive. Lesson lesson and implementation rate directly support profits. They are a natural starting point in determining the profits of your office services.

A profit center is a component of an organization with a separate revenue. Accounting of the profit center allows you to determine the profits of the internal business fields separately. This method is very useful for larger companies with many fields of practice. For example, if your company offers a family law and injury to the injury law, it will mean the meaning of a Financial Management Law Firm to separate these two business areas from profit centers. This method is meaningful because the requirements for these two business areas are different.

For example, perhaps a family lawyer received many requirements for virtual parents’ virtual consultations. However, they expressed that Wifi is not strong enough to support these calls. After investing in a new wireless Internet infrastructure, you can measure the effectiveness of the office’s income without affecting the financial reporting reports of the injury law. They are saved separately to provide more accurate and detailed financial information.

Long -term financial plan is important to pay loans, ensure long -term income opportunities and increase your office in the coming years.

Financial Law Concept Stock Photo, Picture And Royalty Free Image. Image 79873528.

The time of cash flow will be determined if there is something in the short or long -term plan. In general, if this is more than a year, this specific activity should be included in your long -term plan. If you are granted a loan and you must be refunded for five years or you have a long portfolio, it has tracked your long -term plan. Short -term planning will be related to your immediate income and cost. Although both are important in the financial management of a law firm, it may be more difficult to explore the long -term plan. It is likely that the lamp will not stay without short -term financial plans.

Predict is a valuable part of the long -term plan. Predicts related to determining the most financial results for your law firm. To predict you are correct, you must use a combination of historical data reports and, if possible, hire an experienced financial expert to work with lawyers.

You must also record a financial strategy model and long -term profit model. Remember that this model should be supported by your short -term budget. A financial strategic model is a great starting point.

There is a reliable but flexible cash flow that is indispensable for your company’s success. It is very difficult for all businesses to run cash flow and lawyers have specific challenges on its peak. You must not be paid until the settlements are completed, cases may take a long time from expected and can create a professional warranty risk. It is difficult to predict financial data correctly when you start.

Maaliyah: Journal Of Islamic Economic Law And Islamic Finance

This is why historical cash flow data is valid in gold. If you only start your legal business journey and you still have no access to these numbers, do your future better and track your cash flow right now, so you have these numbers to guide plans in the future. Regardless of your new office, it is important to create cash flow forecasts to support your financial management programs. Another option is to rely on people in your life and ask if they are willing to share with you financial information and advice. If you are still not related, you can improve your community by tracking tips for our lawyers’ networks.

Your office can increase cash flow by using time -saving features provided by the leading legal payment software in the industry. Procedures such as automation fees, credit payment and different types of payment programs are all direct improvements through the leading legal payment software.

As a solo lawyer, you might wonder what will expect everything about paying for yourself. This is a valid question, and you do not feel uncomfortable about your priority. In the end, if you cannot support yourself, you will not be able to support your customers. There are tools for leverage when you come to your hourly lessons, such as the tariff computer for our time. In addition, contact your state lawyer or your graduation organizations for detailed information about salary is a reasonable place to start. This will help you include real wages in financial programs and other long -term salaries.

When it comes to many particles of payment from your office, there are two main options for solo lawyers or small companies:

Finance, Accounting And Law In The Digital Age: The Impact Of Technology And Innovation In The Financial Services Sector

Regardless of which options you choose, your company will require any salary system. It is integrated to monitor the proposed accounting methods and accounting books. In addition, working with a valid accountant to set your initial salary – especially when paying by yourself – is the best way to prevent surprises from the tax season. Legal accounting software can help you at a salary.

When the initial processes have been set up and allocated from an eligible accountant, consider using technology to pass the passive operation of your systems. For example, automation of wages can be simple by using legal practical management software that easily blends with salary applications. Read startups of beginners for more information.

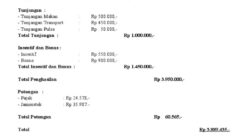

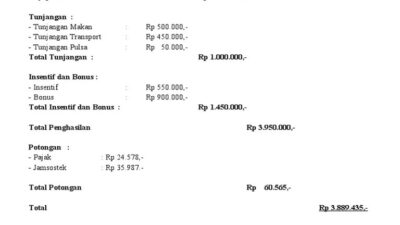

According to the simplest terms, financial statements include supervision, analysis and reporting on your company’s income. Accepted accounting principles (Gaap) are standards listed by the US Financial Standard Council (FASB). Gaap serves as a guide for companies to prepare their financial statements, as the following people.

2.

Law Firm Finance Report 2025

Sharia law finance, law and finance, banking and finance law, car finance law, consumer finance law, finance law degree, llm law and finance, project finance law firm, real estate finance law, msc finance and law, islamic law and finance, campaign finance law