Insurance Policy Comparison – In one of our previous posts, we discussed various parameters during the purchase of health insurance plans. The type of coverage may vary in various health insurance plans. In this paper we collected five health insurance plans from various health insurance companies. These five plans will be compared with the parameters listed in the previous post.

We have to explain that we have selected the above five plans from the universe of available health insurance plans, only to display functions. We do not mean that these are the top five or five best health insurance companies on the market. There are many other health insurance plans (other providers) on the market that can better meet your requirements. When choosing a health insurance plan, one size corresponds to all approaches, it will not work. So there is no full health insurance plan. Each person/family has their own health insurance requirements. You need to choose a plan that best meets your requirements.

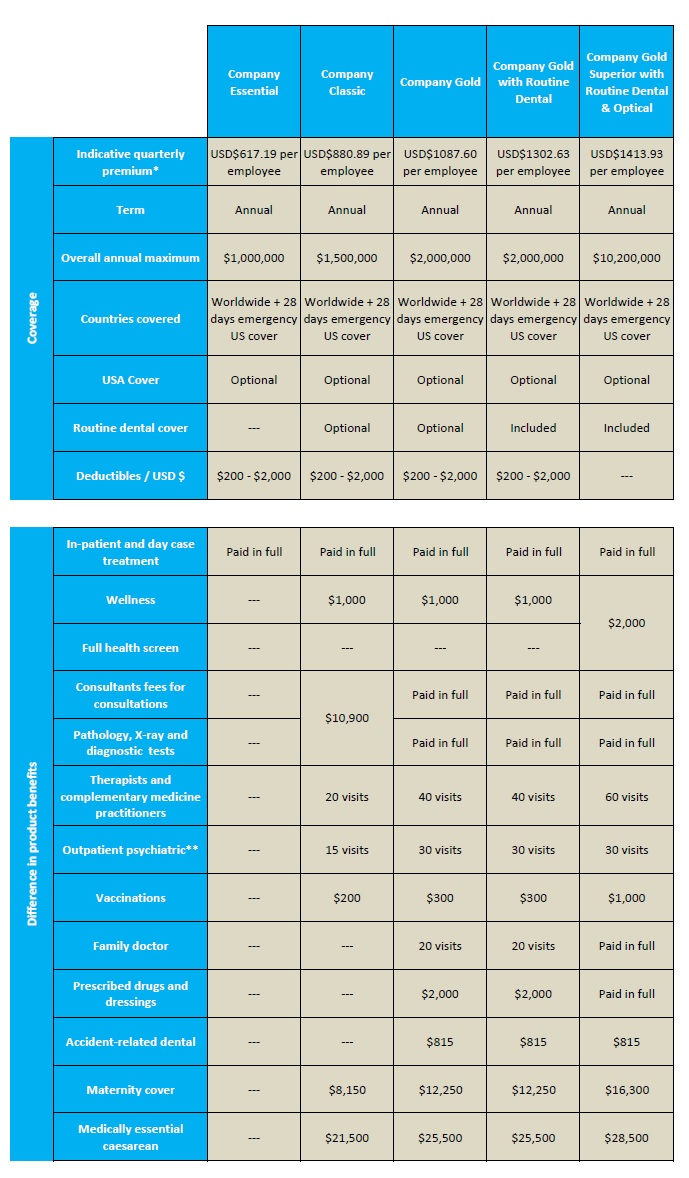

Insurance Policy Comparison

The comparison is designed for a family float (2 adults -31 -years) who live in Mumbai for the sum, secured by 10 Lac. The family float ensures the whole family coverage in the extent of the secure amount.

Solved 3. Private Health Insurance

Keep in mind that the above information that is characteristic of functions is not complete and coverage in these functions may be subject to other conditions. In terms of accurate details, you may need to refer to the political words of the plans. As we discussed, there are no two rules that would offer the same features. Therefore, it is not so easy to compare health insurance plans.

In medical plans you can see a premium range for the same pair. The difference in the payout of the bonus is not only due to the extent of guaranteed coverage (characteristics), but also because of the experience of receivables (dependent on the age group and individual history) of the relevant insurance companies.

For example, if Apollo Munich has witnessed a higher percentage of people’s demands in the 30-35 age group, as Tata Aig (in the same age group), Apollo Mnichov probably appreciates its policy higher than AIG (all else) for the age group 30-35 years. The insurance premium increases with age as a probability of hospitalized with age. In addition, the larger the functions (better coverage), the more expensive policy.

This should be noted that insurance plans cover events affecting the insured, eg hospitalization due to an accident or any disease. Exceptions are the advantages of birth and newborn child. Therefore, there is no accident to expect plans to ensure that such coverage is expensive. You can collect from the table that two of the most expensive politicians are those with maternal benefits and a newborn lid.

@texastdi’s Video Tweet

We have seen that various health insurance plans provide different coverage. Unlike life insurance plans, therefore, it is not advisable to compare health insurance plans only to the payment bonus. First you need to find out what you need from the health insurance plan. Talk to friends who have purchased such plans and received their feedback. You can even talk to the financial planner. The bonus is also important. However, there are ways to reduce bonuses. You can choose to be deductible or pay. You can choose a plan that only provides a common installation (during hospitalization) and not the only private room. You are never thoroughly thoroughly on your decision. Find out what you want from your medical plan and pick up a plan that best meets your requirements and pockets.

In one of our following jobs, we will discuss some inhibitions that they will not buy a health insurance plan, tax advantages and how to start the purchase of a health insurance plan.

Photographer: 401 (K) 2012. You can download the original picture and information about using rights with Flickr.com

Registration provided to yourself (INA1002719), BASL membership (BASL1359) and Nism Certification does not in any way ensure the success of the intermediary or provides any provision of returns to investors. Investments in the securities market are subject to market risks. Read all related documents before investing. If you buy insurance via ISLECT, compare the market or compare the club, you get a percentage of premiums. If they don’t get a commission, they won’t show you policy even if it’s the best for your needs.

Reiseversicherung.com Is The First Comparison Platform In Germany To Integrate The Innovative Ipmi Comparison Tool From Health Compass

Canstar and Finder deserve fees of involved insurance companies that affect what they show in their comparison. By default, these insurance companies only show you – you need to clean the box to show insurance companies that do not pay for fees.

How is it different? First, we will not start fees from health insurance companies. You pay us directly for finding and using our professional scoring to find the best value principles that suit your needs.

We are also a non -profit organization and we are not here to sell -so you will not have any inclined phone calls or messages.

The table updated April 2025. We include insurance companies only with insurance companies available from that date and without resources intended for enterprises only.

Direct Insurance Contract Structure

Our experts are not here to sell politics or deserve a commission. It is for you and reveals politicians that give real value.

In this section, we have provided tools for information and health insurance to help you find health insurance that best suits your needs.

We do not provide you with special financial tips or support any specific product. We help you with a procedure that will create our own direct question from health insurance providers and, if necessary, get our professional financial advice. The information we provide does not replace these steps. For convenience, we have included links to some providers, but it is not a confirmation of these providers or their products. We do not receive commissions from health insurance providers.

We do not give you any form of medical tips for your specific circumstances. If you have a question about any health, you should see your GP or other suitable medical specialist. In most cases, the information we provided is obtained from third parties. Although we try to check this information, we do not provide any guarantee of its accuracy or correctness. Your reviews of this information should again observe your questions from the relevant providers.

Plan Comparison Worksheet (available In 8 Languages)

For the above reasons, it rejects all and all liability for any errors or incorrect description of health insurance data and will not be responsible for your use or reliance on this information or use of the tools in this section.

Good price, corresponding needs, do not have to provide contact information that leads to sales calls. Damian – Member

It will save me more than $ 100 per month for the same policy with a much better rating. Marcus – Member

I use it every year. It helps with the tool that health insurance is much less confusing. Tony – Member

Small Business Health Insurance Broker Vs Peo

The proposed insurance was at an insurance company that I have never heard of before, so I would never decide to change it to them if it wasn’t. It is definitely worth being a member. Sandra – Member

The only comparative point that compares all resources. The choice of health insurance is one of the most difficult and lengthy tasks. After using your site, I chose a fund. Thank you !!! James – Member

Private health insurance can contribute to what you pay for stay in the hospital and other health expenditures, such as leaving for dentists or physiology. This is additional costs, besides what you already contribute to Medicare with your taxes, but depending on the level of coverage, you can choose a doctor and stay as a private patient in a public or private hospital.

You can buy health insurance that includes both hospital costs and hospital costs. This usually contributes to the cost of a hospital room and a selected doctor, but you may need to contribute extra from your pocket. Health insurance, which contributes to the costs of hospitals, is commonly called “accessories” and helps pay services such as dental and optical.

Health Insurance: Compare Policies From 40+ Insurers

The average annual cost of private health insurance in Australia, without the highest level of Rabate, is $ 3020 for one person with a combined hospital and additional policy or $ 6530 for family policy that combines hospital and other coverage. The cost of a couple is often the same as for the family. Health insurance prices can vary very much depending on the country or territory in which you live, and at the level of coverage you are buying, as well as which government subsidies and fines apply to your personal circumstances.

Private health insurance and Medicare cover exactly the same treatment and services. The main difference is where you are treated: public or private system. If you are a permanent Australian resident, Medicare You Free

Policy comparison, home insurance policy comparison, auto insurance policy comparison, life insurance policy plans comparison, car policy comparison, group policy comparison tool, auto policy comparison, opic policy comparison, pet insurance policy comparison, life insurance policy comparison, insurance policy comparison tool, term policy comparison