Assurance Adalah Bahasa – The term insurance in its development in Indonesia comes from the Dutch word Assuranti, which later became “insurance” on Indonesian. But the term assertie does not come from the Dutch, but stems from Latin, namely an assortment, which means “belief of people.” While belief means that something that will happen in the law no. 2 of 1992 in connection with insurance operations, an agreement between two or more clients that secured the lieutenant with a premium premium to ensure a replacement on stage for loss, damage or loss of expected profit or legal responsibility of a third party.

According to the National Sharia Council of the year when he issued Fatwa on Islamic Insurance. In Fatwa DSN/no.

Assurance Adalah Bahasa

Insurance history began more than a hundred years ago, from the Dutch colonial period. At that time, the Netherlands colonial government in Indonesia had planted a huge plantation in Indonesia and at the same time performed a trade company. He successfully founded the first insurance named De Nederlanden Van 1845, this financial protection system was finally introduced in Indonesia. The first insurance company in Indonesia, founded by the Dutch called Bataviasche Zee End Brand Brand Asrartie Maatschapppi, based in the insurance sector, losses due to fire, and also losses that can cause transport problems (transportation).

Berkas:pt. Prudential Life Assurance.png

The history of the founding of Sharia Insurance began in 1979, when the insurance company in Sudan, namely Sudanese Islamic insurance, introduced Sharia Insurance for the first time. Then in the same year, the United Arab Emirates Society also introduced Sharia Insurance in the Arab region.

In a positive law, which is a legal basis in Sharia Insurance, Law no. 2 of 1992 regarding insurance companies, which is still globally. Meanwhile, Fatwa DSN Mui no. 21/DSN-MUI/X/2001 regarding the general guidelines for Sharia Insurance. Since DSN Fatwa has no legal force, the government and regulations are diverted by the Government relating to Sharia Insurance.

A. Opinion of prohibited scholars. Yusuf al-Qardlawi and Isa ‘Abduh. In their view, there are elements that are forbidden today, such as gambling, because addiction will expect a certain amount of resources, such as happiness. And also contains vague and uncertainty (Yachahaat and Ghoror) and scoring. B. Authorization of opinion. Musthofa Ahmad Zarqo and Muhammad al-Bahi. This opinion can be explained in the following description: that insurance does not have the text of the Qur’an or hadith, which forbids insurance. So, until the law is described in halality and prohibition in both sources, it is worth

When conducting its business, the insurance will be held by the following provisions: 1. Akkad A. Explanation of reason in the practice of muamalah is the principle because it determines whether Sheriath b. The requirements for buying and selling transactions are sales, customers have prices and goods are traded. c. Sales and shopping on the usual insurance vague (Gharar), that is, how much will provide or receive insured 2.GHAR 3. Tabaru ‘4.Maysra 5. Riba 6. Dada.

Kualitas Sebagai Layanan

1. The principle of mutual assistance and cooperation 2. 3. 5 investment of funds collected by customers managed by Shariah insurance companies must be carried out in accordance with the provisions of Sharia Insurance 6.

Sharia insurance has a Sharia Supervisory Board (DPS), which is obliged to control market products and investment management in funds. The Sheri Supervisory Board was not found in the usual insurance. A contract concluded on a shari’ah insurance based on assistance. While conventional insurance is based on the purchase and sale of investment funds in Sharia Insurance based on the division of profit (mudharabah). Although conventional insurance uses interest (Ouury) as the basis for calculating investment in ownership of sharia insurance, it is the right of participants. The company is only as a manager of management. In normal insurance, assets collected from clients (premium) belongs to the company. Therefore, the company can freely determine the investment award.

11 Continuing …. In the Sharia Insurance Mechanism, he does not recognize the burned funds contained in the usual insurance. If the participants could not continue the premium during the contract period and wanted to resign before the reverse period, they could return the funds entered, except for some small funds intended for the taber. “Payments for Sharia Insurance have been taken from Taber Funds (Vrlin Funds) all participants who have been eliminated from the beginning that there are a funds supplement that will be used as AIDS for a disaster disaster.

In order to promote and improve Sharia insurance, LKS must develop leading information technology and increase promotion and socialization at all levels of society. According to him, all clients must do a strong effort to introduce the Sharia Insurance System in Indonesia, so people know that there is a solution to management of Islamic risk. The Government must also support Sharia insurance, today economists in the cabinet should leave the capitalist economic system and follow capitalist rules so that they can get out of the crisis. The increasingly widespread use of sharia from the financial industry and capital requires regulations that do not deal with each other or overlap with the rules of normal economic systems. Sharia economic actors really hope that their regulations for the Islamic economic system will make it easier to spread instead of limiting them. Currently, capital regulations are still an obstacle to Islamic banking that penetrates and the wider market.

Whatsapp Image 2021-12-20 At 10.25.36 Am

The Government was invited to establish an Indonesian Sherry Insurance Association (AASI) Bumnu (AASI), which asks the Government to establish a company owned by a state -owned company (Bumna), which deals with the management of Sharia insurance services. President Aasi, Adi Praman, said there is currently no Islamic financial institution owned by the Government. Even if they exist, Islamic units or Islamic financial institutions. Is a branch of the boom. (13.10.2015)

Insurance products are a product that offers a wedding, and the insured has accepted and chose it, where the product contains objects in the form of objects and services, body and soul, healthy people, legal responsibilities and all other interests that can be lost, damaged, lost and reduced.

1. Savings individual products have elements of savings, which means that the product that is intended for individuals and specially made, in which element taboos also has “there is a element of savings that can be taken at any time. Some examples of individual products that contain elements of savings

Unusual individual products are Sheria products that are individual, and in the structure of their products there is no element of savings or all the soles’ helps with the means. Examples of not frugal products are as follows: an individual individual of such individuals of al-Khairat.

Software Quality Assurance

Specifically, the product, designed for many participants who are more in the structure of the product, contains a savings element and some do not contain elements of savings. Examples of his products are: TakaFul al-Khaiirat + TakaFul Hajj Rescue TakaFul Tourism and Takal Travels of accidents individuals Takalis TakaFul Pembia Combinet Collecation

We record the user data and share them with processors to work on this website. To use this site, you have to agree with our privacy policy, including a cookie shelf.2 Understanding insurance insurance stems from the word or insurance (English), which means guarantee or protection. Understanding insurance from a risk operator’s point of view is the contractual transfer of risk. In accordance with individual views, insurance is an economic tool in which individuals order some small rhythms (premium) for uncertain losses (unforeseen events).

3 definitions of insurance contains four elements of the insured, namely the insured party, who promised to pay the sum of the premium at once or in installments. To ensure, a guarantee that promised to be secured at one point or gradually pay money. An accident that is an event that is previously uncertain and unknown. Interest, namely interests that could suffer losses due to uncertain events.

4 risks that may be protected loss, as it is possible to determine the risk and measurement of risks that have similarities and many losses must occur due to random or because of the losses of accidents that are not caused by accident, the likelihood of occurring not too high

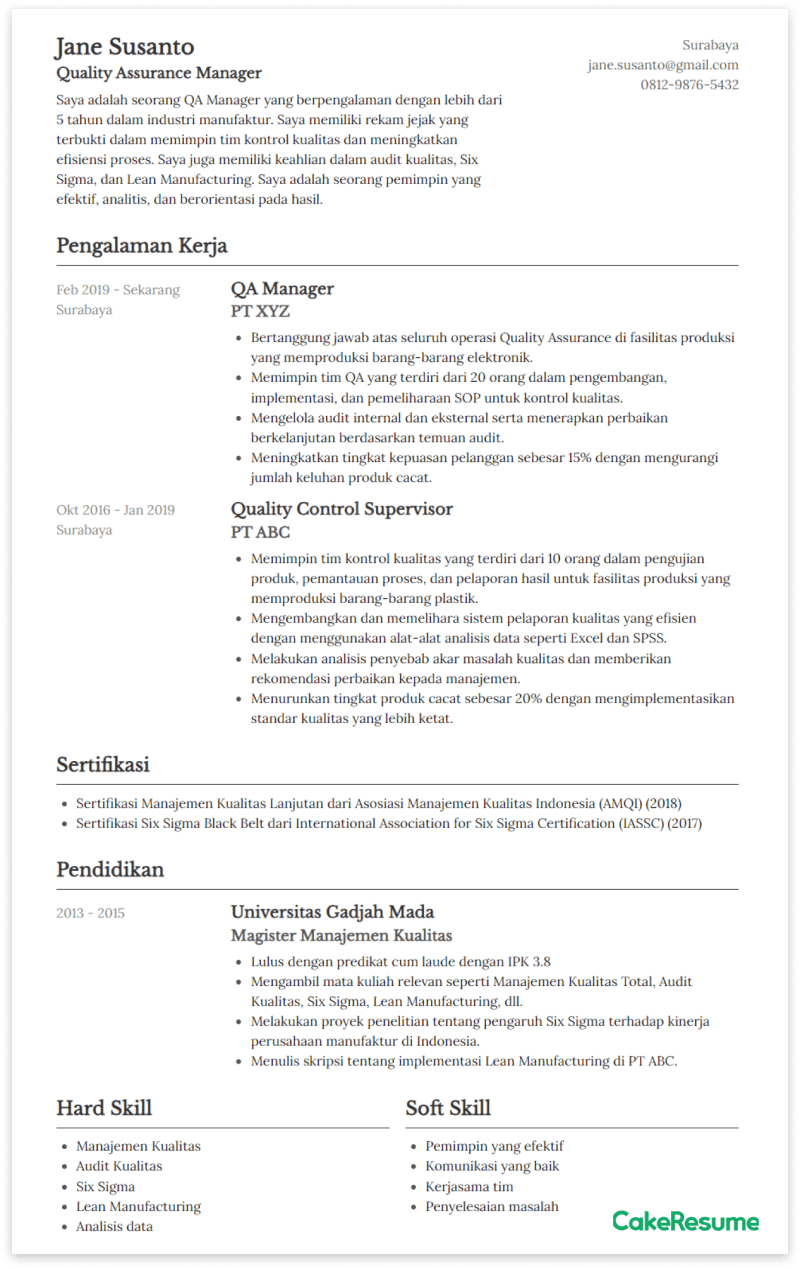

Cv Quality Assurance: Tips Menulis, Contoh, & Template Gratis

6 principles of principle of the principle of temporary interest in the principle of suburogation of extraordinary good religion

7 Advantages Resources to protect the risk of investment risk have been completed with credit requirements that reduce the fear of reducing capital costs that ensure that the company’s stability may even compensate for the provision of professional services to promote companies to prevent health care

10 Social Insurance Principles are obliged to sustain a sustainable membership in evaluating their obligations in the future.

11 Private Insurance principles are a direct and proportional relationship between costs (premium) and benefits (money for coverage). Pay attention to actuarial sound so you always measure the likelihood of losses with a high degree of accuracy and