Asuransi Adalah Jaminan – The car insurance has different types and lighting. Some people may think that all risk insurance (comprehensive) is sufficient to ensure a general compensation for driving. Actually, not all risk insurance

Some dangers due to natural disasters or riots. Therefore, this is important for expanding the car insurance, and the car insurance is important that only common losses and total losses are important. Give the next article, see. Full monitoring of car insurance!

Asuransi Adalah Jaminan

Expanding a car insurance guarantee is an additional guarantee of various dangers not included in the main sides. For cars, types of insurance include natural disasters, such as storms, floods, storms, earthquakes, earthquakes, tsunami and volcano shooting.

Asuransi Kesehatan: Jenis, Manfaat, Syarat, Dan Tips Memilih.

In addition, the continuation of insurance insurance is not related to natural disasters, but by liability of wandering and disorders, a third party and passengers.

Expanding auto insurance guarantee is the standard of insurance of Indonesia (PSAKBI) vehicles additional benefit at the edge of insurance. Insurance insurance can be extended with such danger:

Explaining every car insurance in the next – you can choose your own car insurance.

Auto insurance is a danger of a guarantee of an insurance company for drivers and passengers for personal accidents and personal accidents of the driver.

Peran Pt Asuransi Kredit Indonesia Dalam Meningkatkan Kesadaran Terhadap Asuransi Dan Jaminan Sosial

Legal liability for passengers – requirements for passengers (third party) for insurance and loss of cars in insurance activities in political accidents.

This warranty enlargement is provided by the risk of death, injuries, maintenance, support, including a motorized car in an accident.

This guarantee is intended for special commercial cars for special passengers for special passengers, such as public buses, taxizers or other types for passengers.

This warranty on car insurance is better than the third point, that is, extension to expand the further vehicle to the Insured:

Asuransi Proyek Konstruksi / Construction All Risks Insurance (car)

This car insurance guarantee is to expand the risk of damage or damage to harmful vehicles, tsunami and volcanoes and volcanoes.

Expanding this vehicle insurance is a guarantee of damage to tribes, bulls, storms, storms, storms, storms and a vehicle in a vehicle for the insured.

Natural catastrophes, unrest, riots can probably be harmful not to say the car. In Indonesia, the car industry has two types of policies (complex) and total losses (TLO).

At the same time, TLO insurance provides compensation that losses or damage 75 percent of the price of a car.

Asuransi Dan Asuransi Syariah

In addition to the above comments, flood disasters, irregular catastrophes cannot be guaranteed due to loss, catastrophes due to their natural disasters. Now, in order to avoid the loss of mentioned dangers, the continuation of car insurance is important for transport insurance.

This is also approved by Psaka: “This is the coverage of land cocktails, storms, storms and other geological or other geological or other. Meteorological symptoms.”

With a linear guarantee of the premium you have to pay will increase. However, we will not be harmful by providing the losses that had this threat.

ENDY RP250 million cars want to expand the risk of flooding because the capital is a citizen, and his new car is experiencing the risk of flooding water. Based on the provisions of the Financial Services Organization, the percentage of cars for Ojarta:

Abk Wajib Didaftarkan Asuransi Dan Jaminan Phk

From the above information anime andi in one year, if you received a lower interest rate prize, you must pay within a year:

HERU is the Universe of Deepenegoro University. He has experience in clients 10 years. HERU also about 19 years insurance, ICCAI insurance experts (ICCAI), Anziif (School Insurance), AnziIF (Senior Association) CIP certified for insurance insurance. As a claim manager for a vehicle, HERU is currently a council to share information and tips on automotive insurance. The form of interest that health insurance has begun – Indonesian people. According to BPS, 208 million Indonesian health insurance has health insurance.

However, what is your health insurance? What is the BPJS health difference? What are the benefits of health insurance? What are health insurance requirements?

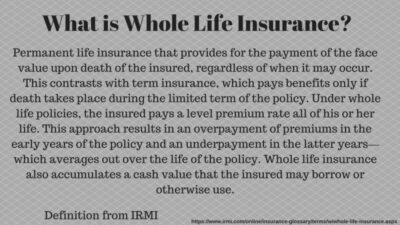

According to OJK, health insurance is a form of insurance, treatment, treatment of insurance costs and drugs and drug costs.

Asuransi Jaminan Ketidakjujuran / Fidelity Guarantee Insurance

So, for example, you are sick with typhoid, you need continuous treatment, you can use health you can pay for treatment, let it be directly on this (

Unlike life insurance for horn losses, health insurance directly prefers politicians.

Only Indonesia has personal health insurance and BPJS Health. Difference, personal health insurance, private companies, BPJS Health are state business organization insurance.

Health insurance has many advantages or scale that can be used to protect insurance hazard. There are the following common privileges.

Perbandingan Bpjs Dan Asuransi Allianz: Pilih Mana?

In order to explain again, you can study the health insurance preferences in this article: Knowledge of 6 health insurance preferences.

Separate health insurance provides financial protection to overcome financial protection to overcome the risk of health or accident.

In this context, you will pay insurance companies to insurance companies (awards) insurance companies as political owners. The amount of premium -class differs from the main medical history and looking at the play you choose.

Only separate health insurance provides access to the possibility of easier financial protection and medical care, but peace brings peace.

Materi Asuransi Dan Pemeliharaan Kesehatan Pegawai

My family health insurance is a form of health care, it covers all family members in one policy. Having health insurance in the family, the policy can accept health benefits for their own, couples and children.

Family health care premiums are low or economically, compared to the acquisition of a separate policy for each family member, so it provides an effective and cheap solution.

Family insurance insurance, private health insurance, general health insurance, favorable benefits, dental benefits, dental benefits, benefits, benefits and general use of inspection.

The group / employee is usually provided with a company for health insurance, including financial insurance, including a group of people in one policy.

Infografik Mengenai Tips Bagaimana Memilih Asuransi Kendaraan Yang Tepat Bisa Didapatkan Di Sini.

Group / employee health insurance usually provides various medical services, including ordinary tests, medicines, medicines. In addition, this insurance program also includes additional services such as glass, bite and mental health services.

In some companies, group / workers’ health insurance may also have two children from the insurer’s employees.

Health insurance and protected workers may feel more valuable, and companies can use it as an increase in employees’ satisfaction.

In the following article you can read about the difference between the group / group in the following article with the health insurance group: to know the differences in personal health insurance and health insurance.

Bentuk Jaminan Pemeliharaan Asuransi

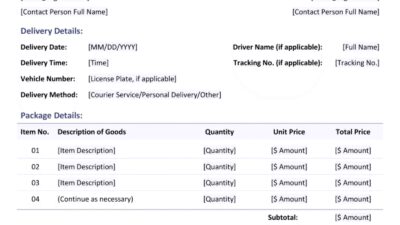

No matter what the provider is, there are usually some key documents for the purchase of a healthy insurance premium.

Additional documents may require additional documents, if necessary, for example, the conditions of complex medical conditions that are difficult to be. Because solid medical conditions are usually not related to health insurance.

Now, after you learn about the different information you need to insurance, you can look for insurance products and suppliers that meet you! However, sometimes, health insurance players who offer their preferences and prices for their preferences and prices make us confuse.

It helps you know your health before choosing a health insurer. See Factors such as medical history, medical services and think about additional needs such as teduct or eye care.

Alasan Memilih Asuransi Astra Sebagai Jaminan Proteksi Anda

Compare the premium costs and preferences presented by several insurance companies in the list of your choice. Try the policy in detail carefully.

The medical care provider you choose is on the insurance network. This can reduce maintenance costs and is easily accessible.

If you need you, look for a trusted insurance agent if possible. They help you understand the options and choose a policy that meets your needs.

Adjust the budget insurance option. Choose the best balance between costs and privileges.

Jaminan Asuransi 22560 Pdf

Consider these factors, tips before making a decision to purchase your health insurance and check that you fully understand the conditions of the health insurance policy you have chosen.

Electric insurance is as important as life insurance, especially thanks to an uneven environmental situation.

I hope you can understand health insurance, type, privileges for delivery, type of health.

Each article with Sunday is to use reliable sources in each article. These sources include internal research, state information, company internal data, original reports and relevant companies and proper industry experts.