Asuransi Obligasi Adalah – Anna – This entry and content building worked to work on the insurance of technologies.

Construction insurance insurance and guarantees ensure a dispute between the construction industry and the other party as a dispute between the other party, but both types of security functions differ.

Asuransi Obligasi Adalah

Customers hire someone to ensure that they have a person to provide professional services, including construction work, and jump. They can look at your portfolios and the customer to your cortfolion and your testimony, but at the end of the day, there is no way to predict how the project is visible.

Asuransi Flexi Link Di Indonesia

If your construction industry has a guarantee, it brings faith and helps us to keep the peace of the client. Mortgage contractors assure that the end of the contract will be performed by the end of the contract and the fact that their activities will meet federal, state and government regulations. In fact, governments require licensed contractors.

Many people think that it is mistaken, but these insurance, but it is not. Consider the construction of construction and guarantees, consider each offers and how it differs different.

Construction insurance protects you, the business owner protects you. For the reward you pay to coverage, your insurance provider will pay your business to some lawsuits or capabilities that will hold your business in financial communication.

GENERAL RESPONSIBILITIES DREASE DISCUSSIONS TO KNOWSHIPS OPENDS AND DEVELOPMENT. For contractors, the services that ensure this responsibility are harmful to someone who harm someone.

Menjelajahi Manfaat Bekerja Sama Dengan Pialang Asuransi

Commercial property insurance means replacement such as damaged or stolen business property, such as tools and equipment. It also includes a building standing there, if you have it.

The internal sea insurance / contractor’s tools and equipment – a type of coverage for commercial property containing your weapons in transport or work. He also protects mobile equipment, such as the center, and bullos.

For example, like a public road, you can add the approval of mobile equipment, such as a public way.

This approval can be added to the commercial automatic insurance policy, which can be added to a business-based accounts, medical costs, medical costs, medical costs, medical costs, medical costs, medical costs and property.

Asuransi Konstruksi Vs. Jaminan: Apa Bedanya?

Compensation for a worker includes insurance activities or injured costs. Most countries require workers to believe in workers, such as workers, especially the higher-border6-border6-high-clock.

The risk of a construction insurance / Construction may result in fire or wind damage or the destruction of the existing building. He also watches the abduction of construction materials.

You can learn more about other types of construction insurance from the main page for construction and contractors insurance.

The construction, for example, need a pledge to ensure any rules, regulations or legitimacy related to your industry, such as a valid contractor or a tent license. The guarantee connections protects poorly or protected from behavior.

Obligasi Penjaminan: Apa Itu? — Panduan Agen Asuransi Untuk Penjaminan

For example, if you walk through the household house, the warranty you bought will fill out the hostilities and fill in someone else with the necessary payments.

If you are tied up (I.E. You have bought sponsorship), you will be able to believe that it provides financial security that provides customers and public authorities.

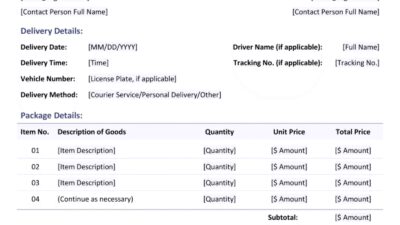

Construction insurance agreement between the two parties – you and the insurance company. If the business owner bought you from the policy in the policy of politician, it ensures financial protection:

To cover, you will pay your insurance company each month. If you are a closed event – like stolen equipment, you’re like your insurance company. The financial obligation of the insurance company is your, politician for the political owner, closed claims.

Obligasi Dengan Premi: Dampak Perusahaan Asuransi Terhadap Penerbit Obligasi Korporasi

Commitment. This is usually a local, government or federal body to require a collate context. It can also be a customer.

Pledge provider. Do all you can to support who supports this mortgage and the obligation to be required to satisfy the contractual terms.

You don’t have to pay the full size of sponsors to buy it. To contact, you have to pay a small part of the full price. This is known as the bondcaver premium. The amount is subject to change, but usually by 1% of the full value of the guarantee. However, if you have a poor loan, mortgage rewards can last up to 20% of the cost of mortgage.

As mentioned above, construction insurance is the contract between your business and insurance company. If you submit a claim for your policy and let it be closed, you may not expect to compensate from the insurer. It is completely entirely to the insurer of the insurer.

Apakah Asuransi Jiwa Bisa Dicairkan Sebelum Meninggal?

This is not with a sponsor. The connection is mainly like a credit line. If the claim is perceived, the borrower (U) should not pay, but not a lender (pledge provider).

Therefore, if you are the contractor and submit the insurance claim, your inspiration will choose a tab. If the pledged claim is filed, you must be able to return from the insurer.

Therefore, companies who say consumers are a lot of companies that are “bound and confident.” So you don’t fly on top of them, because if you do, it means that you will get a big time.

The types of licenses that require construction companies and contractors differ depending on the location, but most projects require at least the permission of the building.

Asuransi Proteksi Prima Perlindungan Utama Syariah (pppus)

Today, Unsureon OnHine is an online online access to construction business from American operators in American operators. When you find the right policy, you can get less than 24 hours.

Anna – This entry and content building worked to work on the insurance of technologies. He is competent with both language and seo, and working with various entrepreneurs, working with such entrepreneurs to create an amazing, optimized content. Mark is the head of the proposal of trade in TFG, where it is aimed at alternative financial financing to Kyrgyz-team companies.

Object insurance is a term used as a financial guarantee insurance; This is a form of payments and the percentage of payments and director of payments and director of payments and director of payments of interest on mortgages or security when paying for the mortgage or security. Simply put, mortgage insurance fees will have a survey by fewer issuers from the respective credit rating; The Federal Insurer is a private firm, which receives a high rating of the main evaluation agencies. The issuer pays award to the timely service effects. Such a guarantee can sell its consequences with a low interest rate.

The insurance of entities was controversial, especially in 2007, was controversial to the mortgage and financial crisis, where the subprima was given a mortgage by the values issued by the values provided by the values provided by the values issued by Aaa. Municipal insurance, mortgage insurance policy used for the mortgage insurance policy used for effective financing of infrastructure and public-private partnerships for effective financing.

Memahami Obligasi Asuransi: Siapa Yang Membutuhkannya Dan Mengapa?

The economic importance of mortgage insurance is to comply with interest expenses, which reflect the difference compared to an unforeseed mortgage.

Federal Insurance Police Use regularly, on behalf of the mortgage, the bank is a mortgage for a bank in the buyer’s country, and in the terms of the accounting agreement in the buyer’s country.

The main priorities of the mortgage insurance policy – exporter may be almost completely covered. The exporter buyer is protected from the cost affected by mortgage and even political events. In addition, a reduction in the borrowing of the issuer’s issuer’s borrowing of the issuer is usually mortgaged insurance and continuously motivated the insurer to continue using the insurance. Federal insurance also increases market liquidity for profitable securities, controls basic transactions and detection of the main transaction. On the contrary, non-credit rating transactions are generally monitored by credit rating agencies, and the mortgage’s concern is often in the appropriate steps and place of mortgage holders. The insurance context is a bond intended to work as a risk weapon. What does this mean and how does the warranty differ? In this article, we will check questions and introduce insurance contacts to the introduction of sponsorship and reliability effects.

The insurance context is a specially established mortgage to finance the protection of an individual or organization:

Profil Perusahaan Tercatat

“Bond” is a written promise to pay