Auto Insurance Agent – An interesting career in the world of car insurance can be profitable and interesting in the right situation. Some companies only hire ground experience, while other companies only need a four -year degree from a recognized institution. Most agents work themselves and work for themselves on the basis of commission. This means that you are working as an agent but receive a percentage of policy holder’s premiums. The more successful you get to buy insurance, the more you will make money. It is important to get good customer service skills as it is one of the key to success as an agent.

If you can’t keep your clients happy, it is likely that they will not renew their auto insurance policy with you. It is very important to know the rules in your state about selling insurance and getting a client to buy from you. You should be able to answer any question that a user may have so that you do not get angry. Many people like to call auto insurance agents with a question about their car insurance before buying a policy, however, some people want to know more about how their insurance work they work before purchase. If you have a good understanding of the law, and you know how to answer some simple questions, how to use your own customer service skills, you will have a better chance to buy insurance with this person.

Auto Insurance Agent

To become an auto insurance agent, there are many needs that need to be met. One of them is that you should be at least 18 years old. You also have to check the background, including a criminal record check. It is also important that you meet the minimum training requirements and pass the licensing exam before starting your career as an auto insurance agent. Car Insurance Premium is the amount you pay your auto insurance company to protect you and your car. An insurance company determines the amount that you have to suffer from an accident on the basis of your best estimates or someone else’s claim to claim for compensation.

Vektor Stok Car Insurance Concept Man Insurance Agent (tanpa Royalti) 2206596531

Premium depends on numerous factors, including your selected defects, driving records, location and age. Depending on how much time you cover your chosen payment project and your policy, you can pay your car insurance premium monthly, every six months, or once a year.

The higher the risk of insurance you are, the more your premium is. If you fall into a driver’s category that can make any claim based on your age, driving record, car type, car theft, or other factors in your city.

The most premium drivers are the only men under the age of 25, as millions of drivers show that they have the highest accident rate. On the contrary, without the date of claims, accidents or tickets, a middle -aged person will likely pay less premiums. Statistics show that the person’s claim is less likely.

But the premium is also calculated on the basis of a widespread increase in claims of claims. These include auto repairs, theft, fraud, legalization, administrative costs, and eventually, increasing medical treatment for those in auto accidents, inflation costs.

Reliable Car Insurance Agents In Pune

Each state has a risks to the classification of every insurance, and a similar coverage can get you different. That’s why it pays for purchase for insurance.

In each state, insurance needs to show the factors used to calculate premiums. Take a closer look at some of the most famous factors here to determine the premium.

In most states, the following is considered. According to researchers from the insurance website The zebra, some or all factors in these states cannot affect your premiums, including California, Georgia, Hawaii, Massachusetts, Montana, North Carolina, New York, and Pennsylvania.

Your state sets the least amount for responsibility insurance, covering the damage to other people and vehicles that you are responsible for. Some premium cost factors depend on the coverage you buy.

Car Insurance Purchase: Online Versus Agent

In 2024 the national annual average for the car insurance premium was about $ 1, 759, or 7 147 per month. There are some other national 2024 average based on coverage and age groups. They come from zebra.

*Full coverage here is defined as a high responsibility limits of 50/100/50 and a comprehensive and collision coverage with a deduction of $ 500.

Enter the price from high car insurance companies. Compare rates with your employer, association, organization, or even your local financial institution or group insurance plan from a buying club.

The easiest and safest way to buy insurance is to get your quote online and buy a direct policy on the insurance company’s website or call a local independent agent.

Cheap Auto Insurance For A Sports Car In 2025 (10 Best Companies For Savings)

Leave your comprehensive or collision insurance on a car at least $ 2,000 at a cost or drop. At least, you can increase your deductions for collision and comprehensive insurance, if you can afford to pay most repairs from the pocket, they do so.

If you live in one of the few states that need personal injury protection (PIP) and offer medical payment (Med Pay) coverage, consider the demolition of Med Pay. Generally, PIP Med Pay covers everything and even more.

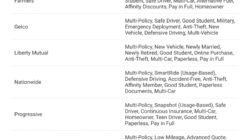

You can benefit from standard discounts with your insurance companies, such as home and auto or auto or discount to pay your policy fully. Various insurance companies offer different premium waivers, including good students.

Take active steps to improve your driving and claim records, accidents, auto theft and tickets. Whatever you claim, you can increase your premium rate.

Why You Should Bundle Auto And Homeowners Insurance In Connecticut With A Local Insurance Agency

In addition, think twice before filing a claim that if no other individuals or property were included, such as a fender-blower-which only includes your fender and garage wall. Also, weigh the wisdom of filing an auto insurance claim if your deduction (the amount you pay first) is slightly less than the payment of any claim that you can get back.

Read your policy or talk to an agent to understand any fees that can be received in the premium payment process. Find out how to avoid these fees. For example, autopsy can ensure that you can avoid late fees, while paying for one year can help avoid installment fees for monthly payments.

Some changes to your situation can reduce your rates, such as if you go to a different locality, drive less car, have less drivers at home, get married, get married, or 21, 25, or 29 years old.

Depending on your payment plan, you have to pay your premium every month, every six months or annually. You can usually only pay only 12 months of policies annually, but many insurers only offer six months of policies. You can often save money by paying the entire bill in advance.

Progressive Insurance Agent Santa Ana Ca Auto Home 2025

Usually payments give you a discount to pay a curse, but your budget can make it easier for monthly payment. If your premium is too high, the monthly payment allows you to make purchases around without having to earn a refund or pay the insurance cancellation fees.

Car Insurance Premium is the specific amount you agree to pay for implementing your policy, while a car insurance price estimates what your policy will cost before buying your policy. This number may be the same, or once you provide more details about your situation, your insurance reference may change.

The car insurance premium is what you are willing to pay for your policy. A car insurance deduction that you have chosen to pay for specific types of claims, usually those who are filed for comprehensive or collision coverage.

In recent years, many drivers across the country have seen an increase in their car insurance premiums in recent years due to inflation, natural disasters, high car accidents, and repair costs. Your car insurance policy can increase at the time of renewal, even if your defects, driving records, or other matrix are not changed.

Auto Insurance Agent At ₹ 3800/year In Deoghar

Car insurance premiums are the price when you bought your policy, you agreed to pay for auto insurance. Purchasing for annual coverage to earn the best price can help keep the premium low. You can do many other things to reduce your premium, including timely payment, increase your deductions, and make sure your insurance is the latest information.

The authors need to use basic means to support their work. These include interviews with white papers, official data, original reporting, and industry experts. We also refer to the original research of other well -known publishers where it is appropriate. You can find more information about these standards in producing accurate, neutral content in your editorial policy.

Is your car insurance breaking the bank? Learn how to fall this coverage can save you more than $ 1, 100 preferred auto coverage: What is it and how does this car insurance work that returns you? This is one thing – here you should know ‘I hope I will never know’: How far will you go to save car insurance? Are you paying too much price for car insurance? How these states of August 2025 are taking the wheel at high rates 5 Best Universal Life Insurance Companies Why would you not see any dim if the tsunami collided with your home with the best life insurance companies of August 2025.

The best dental insurance companies