IndoBeritaTerkini – Best Bakersfield, CA Auto Insurance in 2025 (10 Standout Company) State Farm, Geico, and Progressive providing Bakersfield Best, CA Auto Insurance, with a monthly rate starting at $ 42. These companies offer reliable coverage and affordable prices, making them a great choice for affordable auto insurance in Bakersfield, CA, with excellent customer service.

Home »Cheap Auto Insurance in California for 2025 (Save with these 10 companies)» Bestfield Bestfield, CA Auto Insurance in 2025 (10 prominent companies)

Auto Insurance Bakersfield California

Rachel Bodine passed from college with BA in English. Since then he has worked as a feature writer in the insurance industry and has gained a deep knowledge of state and national insurance rates. Its research and writing focus on helping readers understand their insurance coverage and how to find savings. His expert advice on insurance has been displayed on websites such as Photoendent, Allwo …

Seguro De Auto En Bakersfield

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. Its insurance expertise has been featured in several publications, including investopedia and effinancial. He also performed digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Advertisement Disclosure: We strive to help you make confident insurance decisions. Buying -Comparison must be easy. We work with top insurance providers. This does not affect our content. Our opinion is our own.

Editorial Guidelines: We are a free online source for anyone interested in learning more about auto insurance. Our goal is to be objective, a third party resource for all related to auto insurance. We update our website regularly, and all content is reviewed by auto insurance experts.

State Farm is the top choice for Bakersfield, CA, best auto insurance, offers cheap rates and extensive auto insurance coverage options. Although State Farm offers the best bakersfield car insurance, Geico and progressive should be considered for their various discounts.

Fallgatter Rhodes Home Page

This article covers the most important elements that affect Bakersfield auto insurance, including discount availability, coverage levels, and specific protection requirements.

You can save your auto insurance by entering your zip code above and comparing rates for the best Auto Bakersfield insurance, CA.

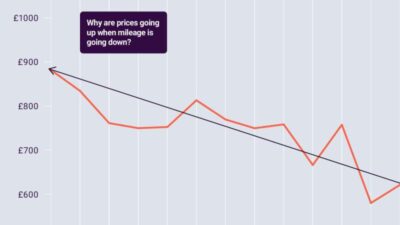

Companies that offer California auto insurance policies can calculate your premium based on factors such as credit, age, marital status, or even the stone you drive each year.

If you are a responsible driver, you should take every opportunity to change these factors in your favor. But not everything is so easy to control. It is important to know what they are planning to make you Bakersfield, CA, the most affordable auto insurance.

Ca Auto & Home Insurance Agent Danielle Lehr

Bakersfield, CA, auto insurance rates are different from the coverage you need. State farm, Geico, and progressive is the best provider for drivers looking for cheap auto insurance companies

The following provider offers good coverage at affordable prices. They provide minimum law coverage to register your car in California and help you get coverage that suits a small estimate.

Full protection providers are the best option if you want the perfect coverage for age, not only on other vehicles but also on your own. This is a good choice for people who want greater peace of mind.

This provider lets you choose from a variety of flexible plans with competitive price offers. That’s why they are so suitable for people looking for affordable auto insurance in Bakersfield, Ca.

Personal Express Insurance

Let’s check the various discounts offered by the highest suppliers, which may contribute to the lower prices of your insurance and give you more options about your coverage.

Auto insurance claims in Bakersfield, CA, start with a car or stolen vehicle accident. Report the incident to your insurance company as soon as possible. Ideally, this should be within 24 hours. You will be required to have copies of policies and other supporting documents, such as pictures or police reports if you have it.

Most insurance agencies are open to everyone, so you can submit your claim through their online platform or mobile application.

With a monthly rate starting at $ 85, Geico stands out as the best option for a fast and efficient claim process, keeping you back down the road quickly.

Omni Safe Insurance

After you file a claim, the adjuster must evaluate. He can contact you to get some information, estimate the damage, determine who is responsible, and determines the amount of compensation based on your protection. Proper communication with your insurance company is important in processing complexity free claims and maximizing your potential benefits, including a free insurance discount if this is your first accident season.

Knowing a person’s choice for discounts greatly increases choosing the right auto insurance with low cost at Bakersfield, Ca. Each auto insurer offers a number of discounts tailored to different driver profiles.

Auto insurance companies in Bakersfield offer a lot of discounts to help car buyers reduce their premiums. The most available discounts include coverage for safe driving records, many policy mergers, and student coverage. It simply means that there are open roads where more customers can benefit from saving their costs on car policy purchases.

In addition, continuous protection insurance discounts can benefit those who have maintained uninterrupted coverage. Given some of the options outlined above, residents of the Bakersfield area may find lower rates and protection they need behind the wheel.

Procolor Collision Bakersfield Central In Bakersfield, Ca, 93304

Auto insurance companies in Bakersfield, CA, have introduced online and digital procedures. Currently, most companies have websites and applications that their customers can access to monitor their accounts, compare quotes, and even manage policies via mobile phones. It enhances the experience but speeds up the demands for easy resolution.

Online resources empower customers to make decisions about their auto insurance requirements. They allow one to understand the factors that determine car insurance through easy access to study coverage options and various price structures.

More importantly, it allows Bakersfield companies to study customer data in real time using complex algorithms that can provide excerpts based on one’s driving behavior. This makes the services and choices of the individuals available in relation to the purpose. Accessing auto insurance at Bakersfield is easier and easier as the focus is on the digital process.

Safety features are very relevant to the protection and auto insurance rates, especially on minimum car insurance requirements. Modern safety features, including anti-lock brakes and collision warning systems, have made cars eligible for discounts by various Bakersfield firms.

Cheapest Car Insurance In California For August 2025

However, as automotive technology becomes safer, all of this can eventually be launched into the terms of auto insurance company. As such, more vehicle owners can have the latest security features, thus making the auto insurance company part of the Push for Bakersfield roads to be safer while offering to reward the drivers responsible for saving.

We will discuss some of the most important things that Bakersfield, CA, your auto insurance company is curious before they release your policy.

To evaluate risks and set premiums, Bakersfield auto insurance companies evaluate driving history, vehicle types, and local accidents. A strong profile, marked with safe driving habits and reliable vehicles, can lead to lower monthly rates.

They need this information to determine how risk your driver is and how much they need to charge you for their services. The better your profile, the better your monthly rate.

Car Insurance In Bakersfield

Well, more than 300, 000 people live in Bakersfield now -376, 371, right. With so many residents driving their cars and sharing their way with you, the possibility of accidents is very high.

Unfortunately, you do not necessarily control your profile aspect. Big cities tend to cost drivers more money in monthly premiums – and it’s not easy to take and move just to pay a little for your coverage.

It is possible that the people of Bakersfield will have a fatal accident and perish below 1%. But that doesn’t mean there’s no risk at all.

The risk below this average can benefit some drivers by saving money at Bakersfield, CA, auto insurance if they will not drive in the first place. However, “how accidents change your car insurance rate” is a thing to consider because even small accidents significantly increase your premium.

Affordable Commercial Truck Insura…

Last year, 3, 048 cars were stolen in Bakersfield. It is almost 805 vehicles per 100, 000 residents, with many insurance companies can consider the risk of auto theft higher than average.

Prove them wrong by installing an anti-theft device and parking your car in a safe place at night, such as a garage or other guaranteed area. Doing this can help you qualify for anti-theft device insurance discounts, lower your overall premium while protecting your vehicle.

Did you know that California is one of the three states where it is illegal for your car insurance company using your credit score against you in determining premiums?

It may be an incredible blessing to people with credit problems, but it can be a mercy that is disguised for people with good credit. Many gambling car insurance companies by making everyone pay more money.

Insurance Agent Jasmin Samano In Bakersfield Ca

A person with good credit may pay less than he or she is in another situation, and one with a weak credit may not get any discounts.

Old drivers who have their license for years -years