Auto Insurance California Best – Best Affordable Car Insurance in California 2025 Why Car Insurance is expensive with California 2025 companies offering cheap car insurance in California to get the best low car insurance for 2025 California in the cheapest cities in car insurance in 2025

California is still one of the most expensive states of car insurance in 2025. High traffic density, often repetitive claims, fire -related risks and stricter insurance regulations, California’s car insurance paints are much higher than the national average. Do you live in Los Angeles, San Diego, Sacramento, San Francisco or even in a smaller city, such as Bakersfield, it is likely that you pay more than you want coverage. That’s why thousands of drivers are looking for California 2025 best affordable car insurance – and the good news is that there are still cheap options if you know where to look for.

Auto Insurance California Best

If you are trying to find budget -friendly car insurance in California, several service providers stood out in 2025 from a combination of their low prices, good coverage and reliable customer service. One of the most consistent affordable insurers is Geico. Known for competitive prices and the first digital first service, Geico offers policies that start up to $ 35/month for minimum insurance if you have discounts. It is particularly inexpensive in areas such as Fresno, Riverside and Sacramento.

Best Long Beach, Ca Auto Insurance In 2025 (find The Top 10 Companies Here)

Progressive is another solid choice, especially for those who want to save on use -based insurance. Their “snapshot” program follows your driving habits, and safer controls can save at least 20%. Located in California, Mercury Insurance offers local insurance with affordable insurance premiums and is a great option for residents of Orange County or Central Valley.

For military families, US is still one of the cheapest and most reliable insurers in California. Although it is only available to military members and their families, prices and customer satisfaction points are the best in the country.

Finding the best low -cost car insurance in California in 2025 does not just mean choosing the right company – it is also about using smart strategies. Start by comparing quotes using platforms such as zebra, gabi or rebellion. Don’t trust just one quote; Prices can vary up to 30% to your postal code, vehicle and driving history.

Another tip is to bundle your insurance. If you own a home or rent an apartment, combining your home/tenant insurance Your car insurance can bring you significant discounts – sometimes up to 25%off. You should also consider lifting the deductible, which will reduce your monthly reward if you can afford a higher pocket for a higher pocket in the event of an accident.

Affordable Auto Insurance For Seniors In San Diego

If you do not drive much, pay miles like Metromile or Progressive’s Smartmiles, you may be ideal for you. Many California residents who work from home now choose this option to save more. Also, be sure to ask about good drivers, students, parents and EV discounts, depending on your profile.

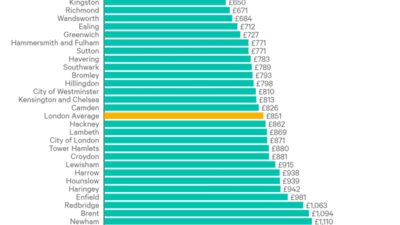

California insurance prices vary dramatically depending on your location. In Los Angeles, the average annual fee for the total coverage of 2025 can exceed $ 2, $ 200, while in San Diego the average prices of about $ 1, $ 700. Sacramento, Bakersfield and Fresno offer even cheaper prices, typically between $ 1, $ 400-1, $ 600 per year. If you are a rural resident, your insurance premiums may fall farther away due to traffic, lower accidents and theft risks.

It is also important to note that the insurance of newer cars, especially Tesla, such as Tesla, may be slightly higher due to repair costs, but you can still find cheap EV insurance through Tesla Insurance, Geico and progressive companies if you have special discounts.

Final Thoughts: If you are struggling with high insurance premiums, now is the perfect time to re -evaluate your insurance and shop. California’s best low car insurance for 2025 is accessible – all you need is the right provider and intelligent design. Companies such as Geico, Progressive, Mercury and USA offer strong alternatives throughout the state. Combine this with quotation comparisons, bundling, whether you live in a big city or in a small town, don’t pay more than you need car insurance in California this year.

Best Car Insurance In California For 2025 [check Out These 10 Companies]

In New York City (2025) the best best of pet and cats for the best pet and cats now in California’s best car insurance company for 2025 (best CA service providers) American Family, State Farm and AAA are the best car insurance companies in California. Prices start only for $ 55 per month. The American family is in customer service, the State Farm trusts reliable demands, and AAA stands out from older -focused coverage, while Geico offers the cheapest prices in California.

Melanie Musson is the fourth generation of her family working in the insurance industry. He grew up in an insurance debate as part of everyday discussion and has studied to obtain in -depth information on state -specific insurance laws and dynamics, as well as a broad understanding of how the insurance is suitable for every person’s life, from budget to coverage. Working out during his years …

Scott W Johnson is an independent insurance agent in California. Scott, the main broker and Marindivecive Insurance Services, brings its clients over 25 years of experience. His five Presidential Council Awards prove that he uses all the Avocet, Sprint Nextel and Farmers insurance for his clients. Scott quickly grabbed his … unique insurance requirements …

We strive to help you make secure insurance and legal decisions. Finding reliable and reliable insurance should be easy. This does not affect our content. Our opinions are our own.

Dui Impact On Car Insurance In California

Editorial Instructions: We are a free online resource for anyone who is interested in learning more about insurance. Our goal is to be an objective, third -party resource for all legal and insurance. We update our site regularly and experts check all content.

California’s best car insurance companies are American Family, State Farm and AAA. The coverage of State Farm car in California starts up to $ 55 a month.

State Farm also deserves high grades for reliable demands and financial strength, making it a reliable choice for many drivers. AAA is ideal for pensioners and offers customized discounts and benefits designed to meet their individual needs.

This guide covers the types of coverage available, including state requirements for the protection of liability, and emphasizes the valuable discounts offered by the top tenderers of California. Browse more success stories from people who got the car insurance properly to save more ways.

Best Glendale, California Auto Insurance In 2025 (top 10 Companies)

Finding cheap car insurance prices can be difficult for California drivers, so enter a postal code to find the most affordable S. in your area, S.

Although the American family, state farm and AAA are not the cheapest options in California, they stand out in key service areas that justify their slightly higher premiums. The American family, which starts with $ 71 per month, leads to customer service, providing responsive support and high satisfaction.

State Farm, $ 55 per month, offers unmatched reliability in the processing of claims and boasts with excellent financial strength, ensuring long -term policy stability. AAA, although the price is $ 78 per month, is tailored to older drivers with specialized benefits, roadside support and strong storage due to its reliable member service.

These companies prioritize quality, reliability and driver -specific needs by offering more value than just the lowest price that helps the drivers of California to buy car insurance confidently.

Best Of San Diego Car Insurance Broker

Car insurance prices in California vary significantly to age. The 16-year-olds paid the highest insurance premiums on all service providers. Geico offers California’s best car insurance for young adults $ 215 per month for 16-year-olds.

The rewards fall steadily with age, and companies give drivers in the mid-1930s to the mid-50s the cheapest car insurance. However, the American family remains only $ 67 per month for the 55-year-olds at all ages.

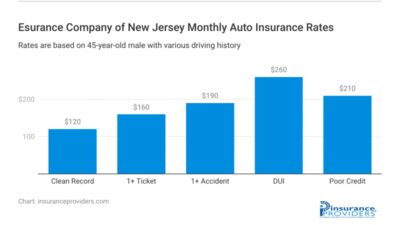

Ajo history has a major impact on California’s car insurance prices. Only one accident or ticket can raise interest rates by 30-60%.

State Farm and Geico offer the cheapest prices for clean drivers for $ 55 and $ 51 a month, but the American family keeps a post -visit.

California Commercial Auto Insurance: Best Coverage

Submitting a California claim can lead to a significant increase in car insurance prices, especially if you have a reason. This is the higher average government claims, such as $ 4,000 for back collisions or 7, 500 theft, pushes costs above.

Even common cases, such as parking accidents or one -vehicle accidents, can lead to at least 20%high heels, especially for drivers with a number of records.

In densely populated or high -risk areas such as Los Angeles, Oakland and San Francisco, drivers often pay more due to increased traffic, accident frequency and theft rates.

The city, which has more annual demands and vehicle damage, usually has higher insurance premiums, even though the total state of the state is low.

The Best 10 Auto Insurance In Glendale, Ca

In order to legally drive California, you need to pay at least the minimum of the state’s minimum liability insurance. Fulfilling these boundaries will keep you legal, but they may not cover the entire cost of a serious accident.

Many California drivers decide to exceed the criteria with higher boundaries or additional protection with full coverage to cover the increased risk of state theft or back collisions (additional information: responsibility vs. complete coverage of car insurance).

There are several optional coverage available