Auto Insurance California Law – Do you believe that you are going to meet your California’s California’s Care Code? You may be surprised to learn many drivers are unknown, at risk of being unknown by Senate Bill 1107.

This guide will break the California Auto Requirements, including policy updates, the experts of the Expert Machine, and the expensive.

Auto Insurance California Law

Auto insurance is not only a requirement for; Your first protection from the damaged amount of money in the case of the fall. More than 27 million license drivers in California, can’t be avoided. It is usually not active or not involved in the results of the law and money. However, many drivers are not aware of the small amounts of bank account or belief that they don’t. This mistake can pay for their crowds or leave their laws.

California Lemon Law: A Comprehensive Guide To Your Rights

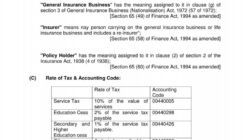

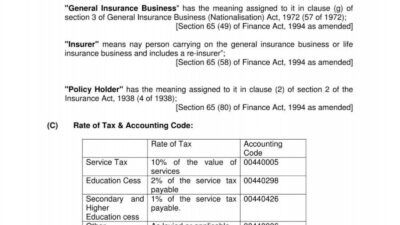

In California, drivers needed to carry small car insurance coverage. At the end of the Senate Senate Bill 1107 These little things reflect on today’s payments.

The Senate 1107 bill increases low car insurance requirements for drivers in California. This law was introduced to protect the better financial protection for drivers, making sure they get the right protection after a car accident.

In addition, the SB 1107 contains a price-paid list, the minimum amount of minorities increasingly increased by 2035 higher health and growth of health. This is possible that immigrants can save the correct price for payments and increases.

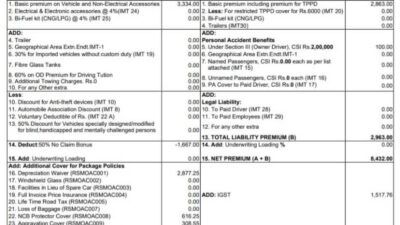

Although California’s law only wants to fill the debt, there are many other favorite types of protection.

California’s New Auto Insurance Limits [2025 Update]

This coverage will help pay for your injuries and problems if you have to drive without insurance. To think about 15% of California drivers are not unified, this coverage is important. If the driver is punished not enough to pay for your damage, your motor vehicle can be left.

The coverage of the collection will help pay for the adjustment or replace your vehicle if damaged, no matter what is wrong.

This will protect from the damage of your vehicle that has come from stealing, fire, and incidents involved with animals, and events.

If the car accident is in a rental car, your credit card may visit a personal insurance policy to the rental vehicle. If you can’t imagine what is done, consider talking to a lawyer you can help you.

Average Cost Of Car Insurance In California For 2025

California National California Insurance program will help low-low-fat drivers obtained to achieve legal requirements. To enroll for the CLCA, you must:

At least, liability insurance is needed: $ 30, 000 for injury to a person, $ 60, 000 for the damage of property.

No, the only credit law requires the law. “All coverage” (the combination of liability is a collection, and width) but recommended.

If you have entered an accident and need help to accelerate insurance issues or debit or debt, it will change to the Fass cavity, P.C. . We have a strong team that can help prevent California to know their status and fight for the right price.

California Auto Insurance Fraud Laws

Take the first step to keep your rights; Call 323-524-8994 now for California’s California War California War California Waka at Fiction, P.C.

What did I inspire to do the injury law? I am 9 and think of victory. My mom was driving on my basketball game. My brother came to support me. When you were on the road, I thought about doing and returned the internal plan of our team in my mind. Suddenly, designed …

Fassonak FUD FUND, P.C. We are able to answer your questions about the Los Angeles, Calabasas, Calabasas, sonistland Somland Somes, and business agencies or entertainment agencies. The Act, Senate Bill 1107, will benefit from January 1, 2025.

The new law will be the lower limit for coverage related to the number of your car insurance policy. This is the motor vehicle car coverage. Newmeminsonsigy area increases and up to30,5/60, 000/15, 000 * all policies and region of January. If your condrages increases to meet the minimum requirements and have your money.

Consumer Attorneys Of California

The implementation of the changes required by the new law will take a long time. Although the law is now affected, the process to implement these changes issued in 2022 after the law was passed.

The current zones are not corrected for more than 56 years. The change that is more likely to protect california drivers from services that are related to these packages, such as the medical costs and fixes at that time.

No job is required. All policies and lower boundaries are renewed in small areas of minimum 1 January, 2025, has been approved. However, it may be a good time to visit your Landlord Customer to review all your packages and reviewing potential prices.

The new law will be useful in January 1, 2025. Customers can be found to change their policies after the car insurance policy. Each province has at least one motor vehicle insurance. The minimum requirements of the claims that are released as an accident of a motor vehicle. In this blog, we will check the rules and rules that conduct car insurance in the California’s car insurance.

What Your Car Insurance Means In California

The first and the most important, it is important to understand California a non-land. This is usually the thdriver associated with the vehicle cars to pay for the costs associated with the accident. These costs may be such as a medical pills from physical injuries. In addition, the evil of the property remains the victims of the accident. The victim can in a vehicle accident can be released a trigger claim to the driver or sometimes.

Each character has the following rules for car insurance. If you live outside California, it is important to know that your vehicle insurance may change.

Another part of California’s legal insurance laws is the entire driver to carry unauthorized car coverage. This coverage is paid for your problems with your injury in the event where you enter a disaster and driver is not insured. The least limit for car coverage is not $ 15, 000 per person and $ 30, 000 a crime.

In addition to the California’s low insurance laws, there are signs that drivers can buy California. These include the following.

California Minimum Auto Limit

The coverage of the collection in California will pay for your car’s worse during the vehicle accident.

The general coverage in California will cover the damage at the event that is not compromised like theft, evil or accident.

It is important to understand if you are in a car accident and injure California car insurance that may not be enough to cover most breach in a serious accident. For this, it is highly recommended not to sell the minimum insurance requirements. If your insurance is not limited at the price of injuries and damages, someone may be allowed to give up the insurance.

When it comes to finding a good car insurance in California, it is important to trade and compare signs from different insurance companies. Remember to think that it is not the only cost of California’s California Carphic Insurance, but the name of the company.

Navigating Auto Injury Claims: Expert Legal Guidance

There are many ways you can lower your insurance funds in California. All insurance companies do not give payment. But, let’s know how to check whether one of the following programs help reduce your payment.

By taking a barrier serving course you can save money on your insurance funds. Usually, lessons are internet and easy to complete.

If your family drivers are often on your single insurance plan, you may be able to receive multiple drivers on your insurance funds.

If you can show that you have a good credit history, your account will be hired to pay for your payment and grant.

Getting Car Insurance When Moving From Canada To The Us

This is very clear. The best driver’s history is less likely to have a chance for your insurance company. Many companies are “pay” for a good driving history by keeping your rates at least.

California’s office of motor vehicles can be discarded to the required vehicles and cannot be driven, and can’t drive the people’s roads

California disability insurance law, california uber insurance law, renters insurance california law, california liability insurance law, california auto accident law, health insurance california law, california law insurance, california earthquake insurance law, california car insurance law, california insurance law handbook, auto lemon law california, california auto insurance law