Auto Insurance California Minimum – Almost all states in the US need any kind of liability insurance to be on the road. Because the requirements of the requirements are due to the nation from the State, the driver’s seat will result in damage damages.

A new bill, Senate Bill is 1107, the amount of liability needs to be effective at 2025 and 2025. Some coverage doubles the minimum or three times, which means that the auto insurance is going to be more expensive than golden levels.

Auto Insurance California Minimum

With minimum changes in the new law and this car insurance, how you need to know how you can save your vehicle to acquire your vehicle. With good understanding of changes, with a good understanding of changes, you can reduce your cost weight and you can reduce the financial burden and protect your bank account and protect your bank account.

California’s New Minimum Auto Insurance Requirements For 2025: What You Need To Know

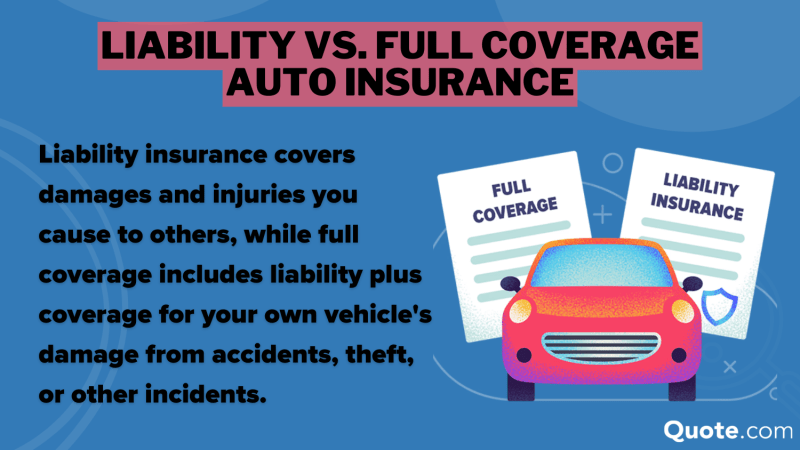

Insurance suggests the minimum liability of auto insurance minimum drivers should be on the road. There is an accident in the injured danger, or their vehicle is corrupted this minimum exists to ensure that you should be wrong.

The previous minimum for California drivers was $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, 000, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, $ 5, 000, $ 5. Since January 1, 2025, this minimum increased. Are the new minimum liability limits:

The auto insurance minimum coverage range is to protect drivers from unexpected accidents due to non-dangerous accidents. All drivers on the road will be fixed from insufficient funds, or if someone affect them, all drivers on the road will be protected if they are affected by their vehicle. It means to reduce prices of maintenance and medical expenses.

During the increase in medical and maintenance expenses, the automobile insurance policy should be minimum. For example, on the property of property damage is for at least $ 5, 000, but a major amount of money to expect an important auto repair or other form of property. The entire expenditure of the economy, Senate Bill 1107 and the Senate Bill increased the conservation of 1107 minimum.

What Is Minimum Car Insurance In California?

California’s new auto insurance requirements can be the best security against the financial burden, and they can translate to a higher monthly cost for drivers. To pay for large payout, insurance companies are likely to launch the rate or prompts the possibility of more comprehensive insurance policies.

Real costs that depend on your specific situation. Things like the kind of car you drive, the insurance company you work, driving history will always affect the premiums. If you have received your specific situation, you may probably expect your premiums to go up if you have received your specified insurance coverage.

Traditional vehicle insurance exists for protecting you from unexpected repairs due to accidents or other specific incidents. If your car is broken because of elements or other problems, your auto insurance cover it. If you buy a new car, it will probably be with a factory warranty, which covers the problems or production of production or production.

This warranty is usually three years or up to 36, 000 and five years old or 60 and 000 miles. However, once it ends, you are responsible for a risk of accident or other expair.

Are You Ready For California’s New Car Insurance Law? Big Changes Are Coming In 2025! California Is Raising Its Minimum Auto Insurance Limits—but Is That Enough To Truly Protect You? 🤔 Most

If you want to expand this warranty coverage, you can buy extended warranty from a third party provider, but the extended warranties are not available in California. That is why mechanical brake insurance or MBI, is such a great alternative. MBI works like an extended warranty and protects you from key repairs, but it is managed by insurance industry, so it is available for California drivers.

When you go with the insurance premiums in the coming months, it is good to protect yourself as much money as you can. There will be a MBI on top of traditional vehicle insurance, and make sure you want the reason for your collapse is to ensure what your collapse is.

Since the MBI contains what the liability coverage and collisition can know that you will not be responsible for the worst repair bill possible. This will help you to manage the rising expenses of car ownership and stand in front of the curve.

There is a high quality MBI plan on your side is the best way to make confidence whenever you are behind the wheel. Endurance offer mechanical brake insurance, so it can benefit from a protection scheme and even when the insurance premium is increased and can save money.

Attention California Drivers: Significant Changes To Minimum Car Insurance Requirements Take Effect On January 1, 2025. 📅 Now Is The Time To Review Your Policy And Ensure You Have The Coverage You Need.

Endurance offers three different levels of MBI cover: Standard, premium, elite plus. Depending on how much protection for you, you can choose to get the most basic coverage or the most basic coverage or all parts of the vehicle.

In addition to the top-notch coverage, tolerance MBI schemes, reimbursement, Rental Car reimbursement, trip barrier and trip interruptions. You can also add coverage for additional elements such as a snow plon. With some of the best coverage available in the market, you can protect yourself from unexpected repairs to protect yourself from unexpected repairs and high repair bills on your insurance premiums.

The high insurance limit may lead to high premium every month, does not mean that it is a lucky to keep your car on your car. With a comprehensive MBI coverage from tolerance, you can in the middle of the new minimum imposed in California when the total cost of your vehicle continues. The vast range of tolerance is allowed to tune your coverage and gets you needed protection without breaking the bank.

If you are willing to protect you and the vehicle, contact our awarded customer service team (800) 253-8203. You can take advantage of our online store for preview of an instantaneous price, it will help make the right choice.

Is It Illegal To Not Have Car Insurance In California?

For more auto expert resources, check out the financial warranty blog. There, you regularly ask questions, the warranty provider comparisons, Diy metances tips, tactics and more.

Alex has worked for more than 20 years in the automotive service industry. After graduating from one of the best technical schools in the country, he worked as a technician who gets the Master Technician Certification. He is familiar with a service advisor and service manager. Read more about Alex.

We’re here to make sure you will get the most comprehensive AV protection. That is why we participate with XAlurate Auto to offer you transparent and dependent tesla coverage.

By clicking the button, you agree to tolerance and partner using the contact information above, using automated technology; About California and mechanical break insurance, involving your wireless number. You agree to the patience privacy policy and terms and conditions. You can withhold consent at any time, not a condition purchased. Message and Data Rates may apply.

Does Financing A Motorcycle Require Full Coverage Insurance California: Crucial 2025 Lowdown

By clicking the button, you will endurance to use and send a message to your wireless number, including your wireless number, californical break insurance, including automated technology. You agree to the patience privacy policy and terms and conditions. You can withhold consent at any time, not a condition purchased. Message and data columns may apply. Aronyon Live Cameras: Alltown: Optown: OTLAHem | Hotel Bethlehem | Main Street Reading: Penn Street Eastern: Down Town Poknos: Jim Thorape | Studsburg

The golden state drivers can be made advantage of the higher liability. Renewing or refreshing or refreshing policies or purchase it will see those changes.

California’s auto insurance expenses increased from 2025 more than the last few years and increased the high liability insurance requiring the insurance requirement in 2025.

The golden state is more than doubling the compulsory liability limit on January 1, 2025. Previously, California was in five states with minimum demands. The need to maintain California with high vehicle repair and medical expenses increases California car insurance requirements (triple-i) director marks the director marks.

How To Get Same Day Car Insurance In California

State insurance regulators expect to increase prices of car insurance due to new compulsory limits. But accurate increases remain unknown.

California’s automated charges already