Auto Insurance California Vs Texas – Nation’s car owners have some bad news ahead, and the new report predicts that auto insurance – one of the biggest inflation drivers this year – will continue to grow in 2024. In fact, the population of three countries could see that their coverage levels increase by 50% in 2024.

This is according to a new message from Insurify, a company that provides data on auto insurance rates. The typical US insurance policy will grow by 22% this year by the end of the year average annual premium $ 2, $ 469, opened in a report. It comes after drivers saw their policy increasing by 24%in 2023, it noted.

Auto Insurance California Vs Texas

Three states, where insurance rates could increase by more than 50%this year, are California, Minnesota and Missouri, open insurance report. In these states, drivers could see that their rates increased by 54%, 61%and 55%respectively.

Texas Home Insurance Costs Are Rising. Leaders Have Few Solutions.

Car insurance is still a pain point for consumers after increased inflation of more than two years. And even since the total inflation rate has cooled down – the consumer price index dropped to 2.9% in July, for the first time since March 2021 it has fallen below 3% – drivers continue to see their policy rates facilitated by more climate events that cause vehicle damage.

“Increasing and more frequent weather conditions increase car insurance premiums,” Insurify said in a report. “The requirements of the hail -related car were 11.8% of all comprehensive requirements in 2023, compared to 9% in 2020, according to CCC Intelligent Solutions.”

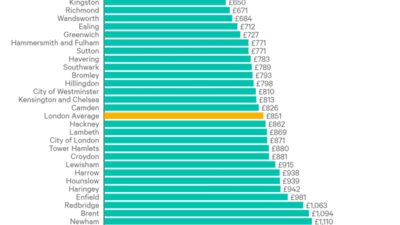

Maryland drivers are currently paying the highest average rate – $ 3,400 for the year full coverage from June, an insurify analysis was discovered. Its rates are expected to increase by 41% to $ 3, 748 by the end of the year, compared to the national 2023 rates, it noted. The second most expensive state is South Carolina with an average policy premium of $ 3, 336 in June. This could increase by 38% to $ 3,687 by the end of the year compared to its 2023 rates.

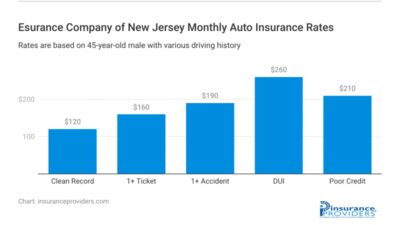

As reported by CBS News, there are some additional reasons, except for climate events that it is car rates – even if your driving record has not changed.

How Much Is Car Insurance Per Month?

First, the costs that insurance providers pay to repair vehicles after an accident, such as labor and details, have increased more than 40%, and insurers transfer these increases to drivers. Second, as lawyers are more likely to be involved in accidents than in previous years, settlements increase, which also increases the cost of insurance.

The increase in car insurance rates causes drivers to change their behavior, according to a new Lendingtree report.

About 4 of the 10 insured drivers who have been in a car accident or in an accident have released the requirement to submit to their insurance company and were surveyed for 2,000 US consumers. About one -quarter drivers who filed the claim said they later regretted it.

Drivers who avoided filing the claim said they did so because the loss was minimal or the deductible was higher than the cost of repairing their vehicle. But another 42% said they released the insurance requirement because they didn’t want their bets to jump.

Average Car Insurance Costs For 19-year-olds

“When you are involved in any type of accident, insurance companies consider you more risky insurance,” said LendingTree Auto Insurance Expert and licensed insurance agent Rob Bhats. “Your bets will eventually fall if you avoid the requirements for three to five years, depending on your insurance company. But until then you will feel financial squeezed.”

However, BHATT said it is usually worth filing a requirement if the repair costs a few thousand more than your deductible, even if your bets rise later.

“Everything related to car insurance is to prevent the accident from leaving financial difficulties,” he said.

Aimee Picchi is an associate editor -in -chief of CBS Moneywatch, where she covers business and personal finance. Previously, she worked for Bloomberg News and has written to national news sales venues, including USA Today and Consumer Reports .at-Vain and without guilt insurance laws determine how car insurance requirements are processed after the accident. There are three types of insurance laws in the United States associated with the guilt in car accidents:

California Mexico: Auto Insurance

Regardless of whether you live at fault or without guilt, your ability to apply for bodily injury significantly affects your ability to submit. In government countries, you may receive compensation by filing a claim against the guilt driver’s insurance or by suing the driver for expenses exceeding your insurance coverage. This can potentially provide a higher cost, but often the liability of the other manager must be proved.

Without guilt, your ability to sue for bodily harm is usually limited; Usually you can only go beyond the fault system if the injuries correspond to the defined gravity threshold, such as significant medical expenses or permanent disability. This streamlined approach can speed up the requirement and reduce the need for legal battles, but it can also limit the compensation available for serious injuries.

Below you will find the list of all 50 states and Colombia districts, as well as their corresponding error insurance laws and systems. In addition, you will find a link that justifies every guilt insurance law.

$ 25,000 Injures/Person/Person/Accident, USD 50,000 Combined Bodily Injury/Accident, USD 25,000 Property damage/accident or combined Limit 75,000 USD 000/accident. This is called 25/50/25 policy and will be shown as below for other countries.

Full Coverage Car Insurance: What Is It & What Does It Cover?

Required ($ 4, 500 per person for medical costs, $ 900 per month for 1 year for disability and loss of income; $ 25 per day for home services; $ 2,000 for funeral, funeral or cremation $ 4, $ 500, $ 500 for rehabilitation; services)) associated with Home services)), which are related to Home services),)))) Tied to Home services), which is required for 1 year).

50/100/25 or Combined Separate Limit USD 125,000 Policy + Medical Payments (MedPay) from USD 2,000 + UM/UIM from 50/100

Car insurance is not required, although you have to prove the financial responsibility for driving without cover. If you choose a coating, 25/50/25 + medpay USD 1,000 + UM/UIM from 25/50/25

Required ($ 50,000 per person, $ 2,000 a month up to three years for lost income, USD 25/day for one year for the required expenses, USD 2,000 Death Benefit)

Why Is Car Insurance In California So Expensive?

Auto insurance is not required, although you have to pay an uninsured motor vehicle fee of $ 500 without insurance. If you choose cover, 30/60/20 (increases to 50/100/25 for the policies issued in 2025) + UM/UIM from 25/50/20

Without guilt, countries require bodily injury protection (PIP) to improve the requirement process and ensure that the victims of the accidents receive immediate financial assistance for medical expenses and other related costs. By authorizing the PIP, the aim of these countries is to reduce the relying on the judiciary to resolve the accident requirements, thus reducing legal fees, court costs and the duration of disputes.

This coating helps to quickly manage out -of -pocket expenses if you do not have to prove the fault, which can often be a controversial and long -lasting process. In addition, the PIP cover promotes a more efficient insurance system by reducing the administrative delays associated with liability. Thus, it plays a crucial role in ensuring immediate and fair compensation, promoting the overall well -being and financial stability of all parties involved in the accident.

The 12th of the Insurance Act 12 without the provisions of the Bodies of Bodies of Defense (PIP) coverage is mandatory to ensure that the medical costs of each Party and related expenses are covered regardless of the fault. These countries operate without guilt insurance systems (with * labeling with it is a position of choice):

How To Save Money By Comparing Car Insurance Quotes

In order to understand your rights and commitments as a driver, it is important to navigate the complexity of guilt and without the laws of insurance. Both systems have their own unique advantages and challenges. Error states usually allow greater compensation through the legal process, but you must prove responsibility, which can be time consuming and controversial. Conversely, without guilt, countries prioritize the fast cost of medical expenses using a mandatory PIP coating, trying to reduce litigation and speed up recovery. However, this can sometimes limit compensation for more serious injuries unless certain circumstances are met.

Given these variations, it is important for drivers to inform them well about the special rules in their state and choose the insurance cover that best suits their needs and risk tolerance. Consulting with an insurance specialist can provide additional insights and help customize the policy that offers appropriate protection. After all, if it is guilty or at fault, understanding the nuances of your car insurance system can have a significant impact on your financial and legitimate results after an accident.

What to do after a car accident in Texas after a car accident, it is important to stay composed and follow certain measures to protect your rights. These actions will not only ensure your safety but also help

How does bodily harm requirements work? Suppose you or a loved one is injured with some other negligence in an accident, such as a motor vehicle accident, workplace accident, or slipping and falling. You could decide

Average Cost Of Car Insurance

When, after receiving a car accident, a car wreck lawyer may ask yourself, “When do I need a car wreck lawyer?” Answer: It is always worth contacting a car accident lawyer. Start with

Frequent pedestrian accidents in pedestrian accidents injured in pedestrian accidents