Auto Insurance Companies For Bad Driving Records – The 10 Best Auto Insurers for Bad Credit (2025), GEICO, Progress and State Farm Car Insurance are the best auto insurance for drivers with Bad Credit. The best companies for these best credit drivers offer other savings, such as usage-based plans for safe drivers, with auto insurance discounts up to 25-30% regardless of credit score.

Laura Adams is one of the leading financial, insurance and small business authorities in the United States. Since 2008, millions of readers and listeners have benefited greatly from her practical advice as an award-winning writer, spokesperson and host of the most popular Money Girl podcast. Her mission is to enable consumers to live a healthy and prosperous life by planning the future and making informed monetary decisions. She rec…

Auto Insurance Companies For Bad Driving Records

Jeff is a well-known spokesperson and insurance and financial planning expert. He has spoken at top insurance conferences across the United States, including insurance company super conferences, 8% of the National Insurance Wealth Conference and digital life insurance agent planners. He is at Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today and other leading Fina…

How To Deal With Rising Auto Insurance Rates

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparative shopping should be easy. We are not affiliated with any auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships do not affect our content. Our opinions are our own. To compare quotes for many different companies, enter your postal code on this page to use the free quote tool. The more quotes you compare, the more opportunities you save.

Editorial Guidelines: We are free online resources for anyone interested in learning about auto insurance. Our goal is to be an objective third-party resource related to auto insurance. We update our website regularly and all content is reviewed by auto insurance experts.

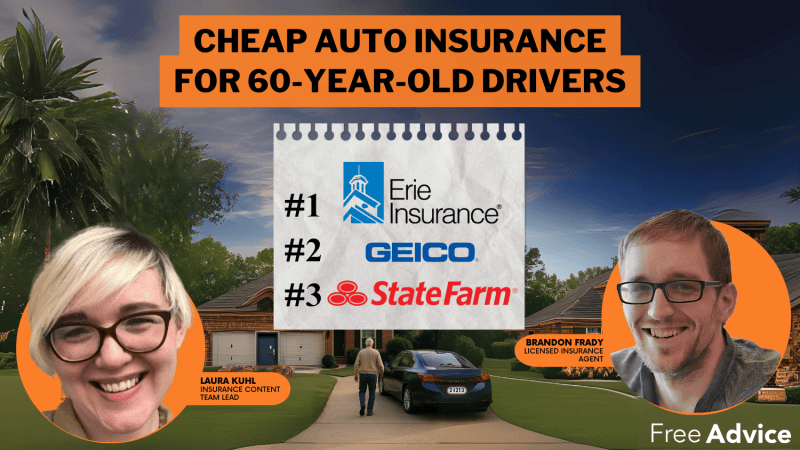

GEICO, Progress and State Farm are the best car insurance companies for drivers with poor reputation, and GEICO is our best choice. GEICO offers a variety of discounts that can bring cheap prices to most drivers.

Other best choices for the cheapest auto insurance company for drivers with poor credibility are Progress and State Farms.

How To Maintain A Clean Driving Record

Continue reading to learn about the best car insurance for drivers with poor credit. Explore your options and enter your postal code to compare today’s quotes.

Poor credit scores can lead to higher interest rates, fewer loan options and missed job opportunities. This also leads to higher insurance rates.

Most auto insurance companies believe that high-risk drivers have lower credit scores. Therefore, these drivers may be at a higher price than average. Daniel Walker licensed auto insurance agent

Drivers with poor credit scores pay an average of $100 compared to those with good credit. However, companies have unique formulas for determining interest rates. Some people have less credit scores than others. The best way to know your price is to get quotes from the cheapest companies on our list, and most companies have an easy quotation process on their website.

Car Insurance Costs By State

When you buy car insurance, you shouldn’t just look at big companies. Smaller local providers may be more affordable than big-name insurance.

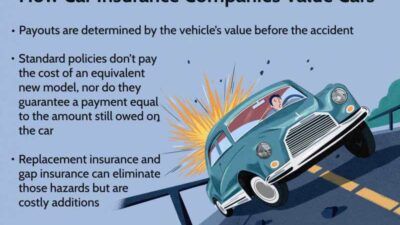

Auto insurance companies consider various factors when determining interest rates to assess your risks. The more likely you will spend, the more insurance you will pay.

Insurance companies carefully track claim data. For example, companies could consider who is more likely to file a claim through the crowd, explaining why men usually pay more insurance costs than women. Unfortunately, claims data suggest that people with lower credit scores are more likely to file a claim.

People with lower chances of making a claim are not only easier to pay for these claims than other credit score groups.

Best Auto Insurance Companies If You Have A Accident In Your Record

Unless you get usage-based insurance, the insurance company will not personalize your rates. Instead, you assign a rate based on your demographic. So, for example, your insurance rate may increase even if you don’t file a claim, because drivers in your area do.

Unfortunately, not many auto insurance companies do not check their credit scores. About 95% of all standard auto insurance providers use credit checks.

The only exception is the rise in bad credit rates for car insurance prohibited in the state. The following states prohibit insurers from checking credit to determine interest rates:

Credit checks are allowed in 45 other states, as well as in Washington, D.C., so your score is likely to affect your rates.

Best Car Insurance For Drivers With Bad Credit In Texas (top 10 Companies Ranked For 2025)

Many states allow credit scores to determine your interest rates, but make companies refuse to deny your coverage based on a credit check. If an insurer refuses coverage due to your credit score, the best auto insurer for high-risk drivers is always an option.

High-risk insurance works for drivers that other companies go through, including those with extremely low credit scores. You will be more expensive, but you will at least have the coverage you need.

While credit scores are just one factor in setting your insurance premium rate, this is an important factor. Check the rates below to see how our top 10 companies charge different credit score groups for insurance.

As you can see, there are significant differences in interest rates between excellent and poor credit groups. However, the gap with companies like Geico is small, so comparing quotes is crucial.

How To Save Money On Teen Car Insurance

While credit is an important aspect of your car insurance rate, your location is another key factor. Check out the average price in your state below.

As you can see, there are a lot of changes in the state. This difference is due to various factors, including the minimum insurance amount required by the state.

Insurance companies carefully track who filed claims through the postal code. Some states see higher rates than others due to increased accidents, traffic violations and other claims.

Finding affordable services with poor reputations can be a never-ending battle. However, you have some ways to find the most affordable bad credit car insurance. Consider the following methods to find coverage:

Best Car Insurance In New York City (2024)

These tips are a great way to find affordable car insurance right away, but there is another way to lower interest rates. This takes longer, but it takes effort to improve your credit score.

Improving your credit score is often tricky, especially if you have a tight budget. However, increasing your score will help you in a number of ways, with only one of them lowering your bad credit car insurance rates.

Building a credit score is usually a long process, but the end result is worth it. As your score climbs, please let your insurance company know so you can adjust your price.

A poor credit score is never a place to find oneself, but it is not the end of the world. Your long-term goal should be to improve your score and you can find affordable car insurance along the way. By looking for discounts, shopping in companies that are favorable to poor credit, and choosing the right coverage, you can find the cheapest car insurance in case of people with poor trust.

What You Should Know About Car Insurance After No-fault Overhaul

One of the most important steps to finding affordable bad credit car insurance is to stroll around. You can compare several companies by entering your postal code into the quote tool below.

No, getting a car insurance quote will not affect your credit score. Most companies do soft checks when accessing your information, but even hard checks from insurance providers usually don’t affect your score.

Unfortunately, if your score is too low, auto insurance companies can refuse coverage. However, some states do not allow this practice, including California, Maryland, Massachusetts, Oregon, Hawaii and Michigan.

No letter of credit insurance is your policy without a credit check. When you look for insurance without accurate inspection, the company is thoroughly compared since the prices tend to be much higher.

Best Car Insurance For College Students In 2025

You may see lower interest rates when you raise your credit score enough to reach higher groups. Since the company reviews your information at the time, you may see your interest rate drop.

However, you don’t have to wait for an update. If your hard work has earned you a significant credit score, you can call your insurance representative to see if they can adjust your rates.

Unfortunately, you can’t negotiate interest rates with the company. No matter what effort you make to raise interest rates, auto insurance companies won’t change your price.

However, after raising the price, you can remind your company. Some companies will reassess your interest rate with a boost in credit scores, while others will lower your rating when your policy is updated.

How Does Your Driving Record Affect Your Insurance Rate?

Some of the best auto insurers with poor credit scores include GEICO, Progress and State Farms.

Your credit score plays an important role in determining your car insurance premium rate. Generally, drivers with poor credit scores have higher premiums than drivers with good credit. Insurance companies regard low credit scores as indicators of higher risk and adjust rates accordingly.

No, your credit score will not directly affect your ability to file a car insurance claim. As long as you have a positive policy, you should be able to file a claim regardless of your credit score.

Yes, improve your

Tesla, Ram, Subaru Have Worst Drivers

Insurance quotes for bad driving records, insurance companies that accept bad driving records, auto insurance for people with bad driving records, insurance for bad driving records, cheap auto insurance for bad driving records, cheap insurance for bad driving records, insurance companies for bad driving records, car insurance for bad records, car insurance for bad driving records, best insurance for bad driving record, how often do insurance companies check driving records, auto insurance quotes for bad driving records