Auto Insurance Companies For California – We found that Wawanesa has the lowest rate insurance in California by a monthly average. It’s $ 959 a year, or $ 878 cheap than the average value of full coverage policy in California.

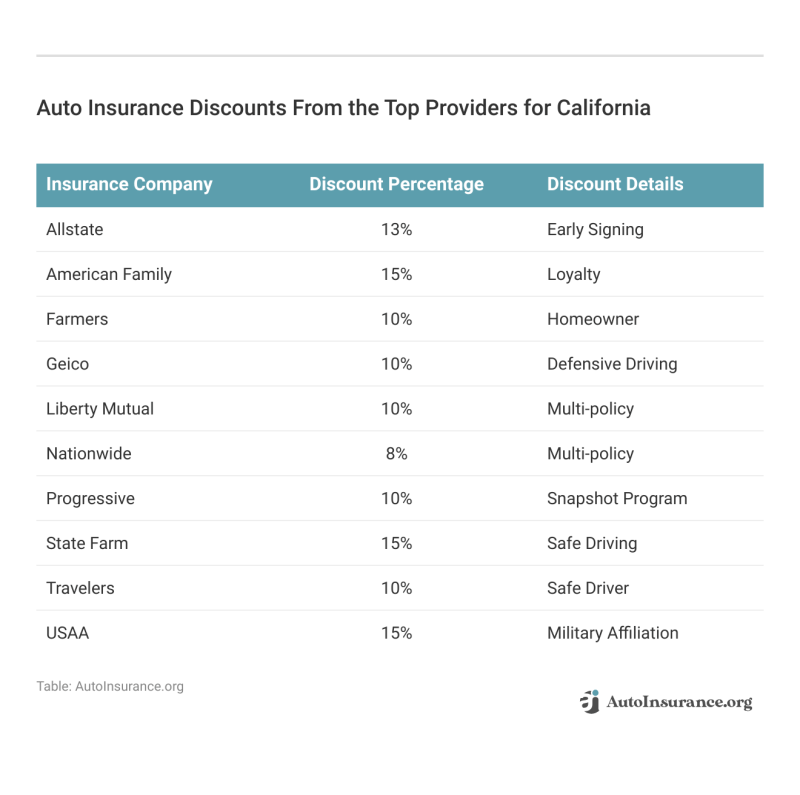

In California, the best and cheapest car insurance in our other elections Geico, USAA, Mercury and National General. You need to make sure that compare interest rates before you buy coverage to find the cheapest company for you.

Auto Insurance Companies For California

Analyzed car insurance rates provided for quadrant information services in all 50 states, plus Washington, D.C. For the entire coverage policy, the following coverage limits were used:

Cheapest Car Insurance In California For August 2025

The average price rate rate rates, zip code, and cheapest companies that are determined for medium drivers at a age of 30, 35 and 45.

The interest rate on ratings and the “Poor” loan is determined to use one man for a 30-year-old credit score for a 30-year-old driver.

Some drives can be submitted by subsidiaries or subsidiaries. Provided prices are a specimen specimen. Your actual quotes may vary.

Our property rating methodology takes into account many factors, including customer satisfaction, expenses, financial strength and policy proposals. For more details, see the “Methodology” section.

Auto Insurance Companies Overcharged California Motorists $5.5 Billion During The First Year Of Pandemic,

The best is the World Rating Agency, which earns the financial power of insurance companies from A ++ to D (poor).

Using a mixture of internal and external exchange rate data, we classify the cost of each insurance company’s surcharges at least expensive ($ $ $ $ $.).

Wawanesa has the cheapest rates of car insurance in California, and the average indicators are even lower after accident or driving violation. It’s a great choice if your number one priority remains a budget.

Wawanesa is one of the cheapest car insurance companies in California (it only sells car insurance in California and Oregon). Prices are below average, even after an accident or driving violation. You can also find a cheaper cover with a teen driver with a teen driver.

Average Cost Of Car Insurance (2024)

Wawanesa does not offer Gap insurance, so you may need to take into account another insurance company if it is required by your tenant or lender. Wawanesa offers road support, special equipment coverage and oEM parts coverage.

The average cost of car insurance from Wavanesa in California is $ 80 or $ 959, which is 48% cheaper than a state medium.

Geyko has cheaper rates in California, even for high risk drivers. GEICO download tools and comfort are defined before competitors.

Geico is one of the best insurance companies in California due to its low price and wide availability. Geico has cheap medium rates, even for California drivers who have poor credit or new licensed drivers at home.

Car Insurance –

We also love GEICO’s suitable mobile program that allows you to evaluate your car repair after an accident. Although it is one of the largest insurance companies in the country, GEICO receives less complaints from its customers than expected.

In California, the average car insurance rate from GEICO is $ 122 or $ 1,465 a year, which is 20% cheaper than a state average.

USAA has some of the highest rankings of California and any company’s customer service and the highest customer service ratings. Its supplements that include gap insurance are basic, but they will probably be enough for most drivers.

If you are an active or retired member of a military or military family, USAA has the best car insurance in California. USAA also offers a GAP coverage you need if you have a loan on your car or rent it.

It’s Time To Shop For Auto Insurance

USAA also has outstanding customer services and often earns the best units of a reliable third party J.D. From Power. According to the National Association of Insurance Commissioners, it receives the average number of complaints for industry.

The average USAA car insurance costs $ 125 per month in California, $ 1,502 per year, which is 18% cheaper than a state average.

Mercury offers drivers fewer supplements and approvals than other companies, but you can find available prices in California even in your post or driving driving violation.

Mercury is one of the best car insurance companies in California due to average average interest rates. You may even be able to find available car insurance in Merkuria if you have an accident, DUI or other driving breaks on your record.

10 Best Auto Insurance Companies In California For 2025 (top Ca Providers)

Mercury offers several different discounts, including savings to register for automatic payments, paying your annual payment in full, or registering each Mercury mile insurance option.

The average cost of Mercury’s car insurance in California is $ 127 or $ 1,520 a year, which is 17% cheaper than a state average.

The national general is mostly known as a non-standard insurance company, but it also provides insurance if you have not received a violation before.

The national general is among the best insurance companies in the state, especially if you have difficult time to find accessible coverage thanks to your driving record. On average, the common rates of high-risk drivers are often very low.

Best Car Insurance In California (2024)

The coverage of the national general is quite simple, that is, the help of the road and the main policy of chance and random death and casual death. But if you want a simple policy, it can be right for you.

The average car insurance value is $ xx or $ xxx per month, which is XX% cheaper than a state average.

The best car insurance company California is Wawanesa by J.D. Power’s 2023 Automatic Insurance Study, which occupies companies based on price, transparency and overall satisfaction. [1]

USAA and Mercury are some of the best and cheapest companies in California as they offer both cheap medium rates and J.D. Electricity units that exceed 820.

Essential Guide To Auto Insurance For California Drivers

Compared to larger partners, young adult drivers usually have very high insurance rates. This is because their inexperience behind the wheel means that they are more likely to have an accident and a demand than older drivers.

It is not difficult to choose the best car insurance company for you. There are several factors to take into account, including:

If you are ready to start shopping for insurance, you can help you compare options and find your needs insurance coverage for your needs.

Accident or traffic ticket can make your car insurance interest rates more expensive, and it can especially difficult to find car insurance if you are too high at risk.

Mexico Auto Insurance

Wawanesa is California’s ChALifornia Most Cheapest Marka, if you have an accident or driving your record. If you can’t find a coverage, consider it to look for a policy in the high-risk market of CAARP.

The cheapest car insurance company in California is a wavanessa due to the accused crash. As a result of the accident, the average cost of car insurance from Wavanesa is $ 124, or 1,488 per year due to an accident accused of your post.

The cheapest insurance company about your record in California is Wawanesa. On average, after DUI, car insurance costs $ 146 a month or $ 1,748 per year.

After fast tickets in California, the car’s cheapest insurance is Wavanesha. On average, Wawanesa is $ 117 a month or $ 399 a year after tickets.

Top 10 Best Car Insurance Companies In Glendale, Ca

In some countries, Isinsourany companies assess drivers based on their credit score. Theoretically, it is that drivers with lower credit score are more likely to file a lawsuit, but in practice sometimes it ends with unfair punishment. Due to this, California’s laws prevents insurance companies based on credit history.

Car insurance prices in your area depend on the crime level, population density, nearby accidents and other local factors. Here are the cheapest car laving companies in the 10 most popular CALIFORNIA cities.

California requires all those who have a vehicle in the state to wear one of the following types of car insurance.

Drivers who choose to implement a responsibility insurance policy should have no less than the required state responsibility insurance levels.

Best Pay-as-you-go Auto Insurance In California (top 10 Companies For 2025

Drivers who do not have minimal levels of liability or higher levels, suspend their registration by the state, which means that the car is not legally treated or parked on public streets.

Minimum California requirements are very low to provide cheap liability insurance. This means that they can provide enough protection if you are guilty of the accident, which is more than a simple Fender Bender.

The state also does not require that you carry anything else than covering the main bodily injuries and property losses, which means that the level of the minimum coverage of the state is to damage their own car.

As of 2019, 16.6% of the drivers on the way to California were insecure, which makes it more important to protect yourself, which carries costs if you are.