Auto Insurance Companies In Michigan – Find affordable car insurance in Michigan with this comprehensive guide. Discover the cheapest suppliers, average costs and tips to reduce your insurance premium. Perfect for young drivers, high risk records, and more.

Discover and compare prices from more than 50 leading insurance companies, including progress, tourists, AAA and nationwide, to find the best car insurance transactions.

Auto Insurance Companies In Michigan

Michigan car insurance is famous for being expensive, with significant higher prices than the national average. However, by careful choosing the scope of insurance and shopping around at the best price, Michigan drivers can still find affordable options. This article provides a detailed overview of the cheapest car insurance options in Michigan, including different driving records, insurance and specific insurance companies.

Stop The Scam — Michigan Brain Injury Provider Council

On average, Michigan drivers pay about $ 3, 643 per year for full insurance, equivalent to about $ 304 per month. For minimum insurance scope, the average cost is about $ 1, 920 per year or $ 160 per month.

Based on data from many sources, the following companies provide some of the most affordable car insurance prices in Michigan:

Michigan operates under the insurance system without errors, requiring drivers to carry personal injuries (PIP), property protection insurance (PPI) and the responsibility of the remaining body injury (BI). The minimum necessary insurance levels are:

While Michigan car insurance ratio is one of the highest levels in the country, understanding the available options and comparing the quotes that can help the driver find an affordable insurance. Whether you are a young driver, have a clean record, or be considered a high risk, there are insurance people in Michigan providing a competitive rate that suits your specific needs.

Business Auto Insurance

The average cost of Michigan car insurance is about $ 3, 643 per year for full insurance and $ 1, 920 per year for minimum insurance, making it one of the most expensive states for car insurance.

The Farm Department offers the cheapest price for the minimum insurance level at $ 933 every year, while Geico offers the most affordable insurance at $ 1, 140 every year.

You can reduce your car insurance by shopping for quotes, bundled policies, increase your deduction and take advantage of discounts such as safe drivers or discounts for good students.

Drivers are at high risk in Michigan, such as people with Dui or Error, may expect higher insurance premiums. USAA offers one of the more affordable price options for high -risk drivers, with a ratio of 2 dollars, 028 every year for a driver with one Dui.

Car Insurance After A Dui In Michigan

Michigan requires drivers to protect personal injuries (PIP), property defense insurance (PPI) and the responsibility of the remaining body injury, with a minimum of $ 50, 000 per person for body injuries and $ 1 million asset protection insurance for damage in Michigan.

Financial tools: I really need to retire? How to invest when you feel like you are behind a thousand -year retirement plan that it can workMichigan with a car insurance system without errors. You make your own insurance requirements, whom who is at fault, with some exceptions. Michigan car insurance has complex layers that can cause even the most knowledgeable car insurance shoppers. So, take a cold faygo and let the best Michigan car insurance.

Three automobile insurance companies in Michigan dominate the state in the state: progress, automatic club insurance and state farm (AAA).

Protect personal injury (PIP). PIP Insurance is the foundation for the system without Michigan’s fault. You make compensation for injuries on your own pip insurance regardless of who causes the accident. PIP Michigan Insurance pays reasonable and necessary medical expenses for your entire life. These lifetime benefits make Michigan very unusual compared to other countries. PIP also paid for the lost salary if you can work for accidents and replacement services for the tasks you can do, for up to three years after the accident.

Auto Insurance Refund Checks Will Start Arriving This Week

The new law takes effect on July 1, 2020, as a part of Michigan Auto Insurance Reform. For policies to be extended or issued after July 1, 2020, Michigan drivers will be able to choose a level of PIP insurance level:

Property protection insurance (PPI). PPI Insurance pays up to $ 1 million for damage to your car to other people’s property in Michigan. For example, if you get in distress through someone’s garage door, PPI will pay them.

The remaining body injuries and property damage liability (BI/PD) – The insurance/PD liability insurance pays your legal protection and judgment for you because of pain and damage and economic losses exceeding the salary that is exceeding PIP benefits. The minimum necessary insurance limit is valid from July 1:

AREN Automobile Insurance companies have worked with lifetime medical benefits. Complaints over $ 580, 000 paid by the Association requested Michigan disaster (McCA).

Top Auto Insurance Companies In Michigan: A Complete Guide — Car Insurance -tips

Each year, the association consider how much money may need to cover the lifetime requirements of those who will be seriously injured in car accidents next year. This analysis creates a car review every year.

Because McCa is currently a deficit of $ 2 billion, part of the annual evaluation includes money to escape from that hole. The current evaluation is $ 100 per car per year in the period starting July 2, 2020 to June 30, 2021.

The current evaluation is a 55% reduction compared to the previous $ 220 review. Michigan drivers may be expected to reduce 14% for the summer evaluation in 2021 when the cost will be reduced to $ 86 per car each year.

Your automobile insurance company pays the evaluation and often transfers the costs to you. You may have evaluated as part of PIP Premium or view it is listed as a separate fee on the declaration page of your automotive insurance policy.

Michigan Car Insurance Laws

Michigan drivers do not choose unlimited personal injury protection allowances will not have to pay.

An important point to understand insurance without errors in Michigan is that you can still sue a serious injury to you. The Michigan law defines serious injury to a serious impairment of body function, permanent deformation or death.

Although your PIP insurance will pay your medical bills, you can sue another driver because of the non -economic damage of Muslims about pain and suffering.

You cannot sue others because of pain and suffering if you do not have the necessary insurance on your car at the time of the accident.

Best Car Insurance After A Dui In Michigan (top 10 Companies Ranked For 2025)

If someone sues you because of serious injury, the sentence will be under the scope of your remaining body injury insurance. That is why it is better than the minimum minimum. If you have money to protect from a lawsuit, buy a high liability insurance.

But what is the pain and suffering, and your lost salary? In that case, you can use your own driver’s insurance in Michigan. Similarly, low -lined motorbike insurance will give you the difference between what a court awards for you for pain and suffering and what you can get from another driver’s liability insurance.

Note that no type of insurance is required above to pay for the damage to your vehicle. Therefore, you will want to have a collision insurance scope. But what kind? Michigan identified three types of collision insurance options. They vary depending on whether the accident is your fault or not and whether you are deducted or not. A deduction is the amount subtracted from the insurance test for you.

Let to throw into another car insured. You can buy mini-tort insurance in Michigan. If you have 50% or more defective in an accident, others can sue you for a price of up to $ 1, 000 car damage without their collision insurance. The scope of mini insurance will pay this.

Cheap Auto Insurance In Michigan For 2025 (save With These 10 Companies)| Autoinsuranceez.com

Comprehensive insurance is an option but can provide insurance for a variety of issues without collision insurance. Comprehensive insurance will pay off if your car is stolen or if it is damaged by fire, falling objects, explosions, earthquakes, missiles, wind storms, hail, water, floods, vandalism, riot or civil chaos, or accidents with animals or birds.

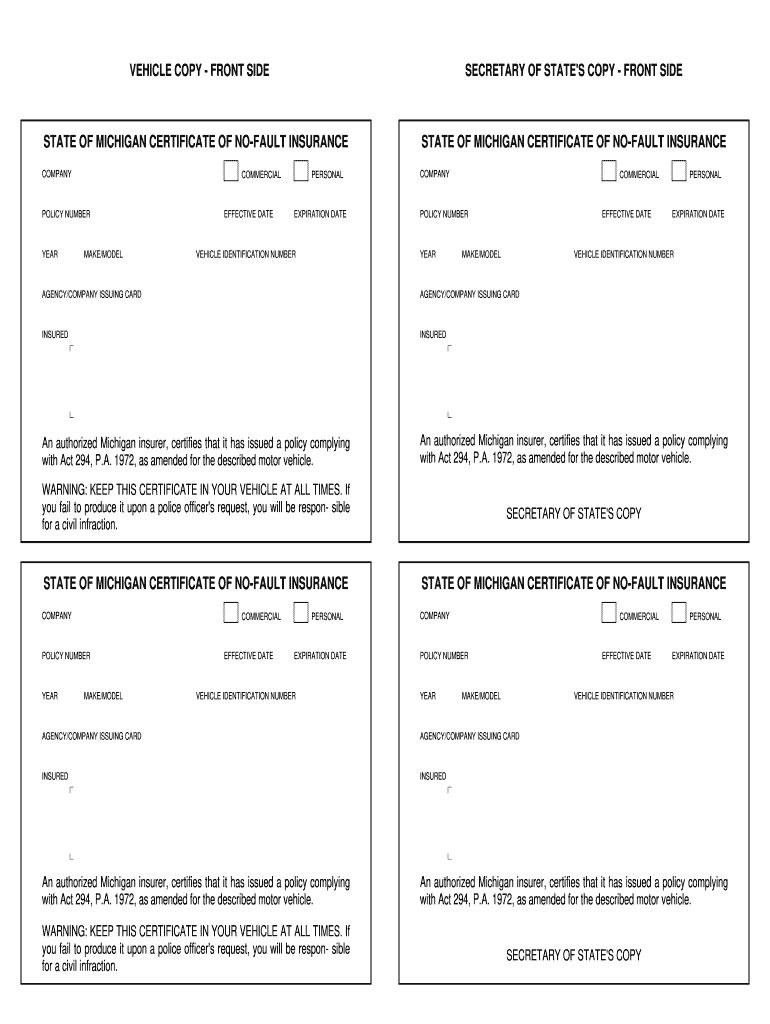

The Michigan law allows you to display evidence of car insurance from your mobile phone. If you don’t have access to it from your phone, keep a handy copy of paper.

Michigan drivers pay an average of $ 1, 270.70 a year for automobile insurance. Below is an average insurance premium for general insurance.

Auto insurance companies use many factors to calculate prices. Past requirements, driving records, car models, annual miles and more are used in calculations. In Michigan, insurance companies can also use these factors.

Who Has The Cheapest Auto Insurance Quotes In Michigan?

About 20%of Michigan drivers have no car insurance, according to the Insurance Research Council. It is the fourth highest rates in the country, after Florida, Mississippi and New Mexico.

If you are arrested when driving without a car insurance in Michigan, you may be fined 200 to 500 dollars, being sent to jail for up to one year or both.

The State is providing amnesty time is 18 months starting from July 2, 2020. During this time, you may be fined for driving without insurance.

If your car is seriously damaged in a car accident, Michigan law says it may be total if the cost of repair (including parts and labor) will exceed 75%of the value of the car.

Free Auto Insurance Verification Form Template

For example, if your vehicle is valued at 10, 000 and the repair cost is estimated to be more than 7, 500 (75% of the value of the car), the car can be considered as completely lost.

The Michigan Insurance Department is responsible for supervising insurance companies and complaints against them. If you have a problem that you can solve with your insurance company, the Ministry of Insurance may