Auto Insurance Companies Maryland – The Best Auto Maryland Insurance in 2025 (your guide to the top of the market, and secured for a comprehensive customer Maryland.

Luke Williams is finance, insurance, real estate, and specialists, specialist, specialist and research for consumers. He studied financial, economic, and communication at the state University of Pennsylvania and graduate with the company communication level. Insurance and writing his financial was introduced in the archive, a good man project …

Auto Insurance Companies Maryland

The best Dani is an authorized insurance manufacturer for almost 10 years. Dani began her insurance in the role of the state in 2014.

Full Coverage In Maryland Car Insurance Policies

Advertising Data Revelation: We try to help you to decide automatically car insurance. Comparative trade should be easy. We are not related to auto insurance providers and cannot secure words from a single service provider. Our cooperation does not influence our content. Our opinion is our own. To compare words from many different companies please enter your ZIP code on this page to use free reference tools. The more words you compare, the opportunity to save.

Revision Instructions: We are free online resources for everyone who is interested in learning more about auto insurance. Our goal is to be a purposeful resource, third person for all things related to auto insurance. We update our website regularly, and reviews by auto insurance specialists.

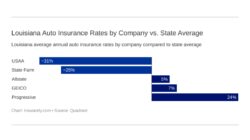

The overall top picking for the best car insurance of Maryland is the state’s farm, with USAA and ERIA as a close competitor for customer satisfaction.

This information search best providers in Maryland, focused on major factors such as management, and customer reviews.

Best Maryland Auto Insurance In 2025 (top 10 Companies)

We highlight the way these companies lead the envelopes with a reliable competition rate and reliable service. Discover why these companies are the top option for your MD car insurance.

Getting a valid car insurance at the best price – enter your ZIP code above to shop for the managing from a manager.

When searching for automated insurance options in Maryland, it is important to understand the need and factors influence influence. To ensure the best management, the driver should consider the policy options, assess their specific needs, and compares automatic insurance from different providers.

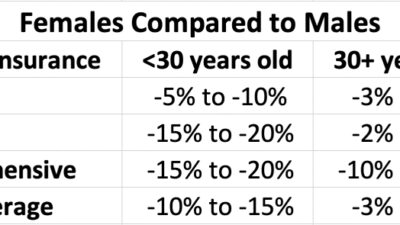

Driving history, vehicle type, personal population plays an important role in identification of insurance. By assessing these carefully and trade, you can find insurance policies that provide accurate balance of coverage and cost. For more tips on finding the best car insurance, consider reviewing different policy and discounts available.

Workers’ Compensation Insurance For Auto Dealerships In Maryland

Travelers $ 107 $ 2016 $ 122 $ 18 $ 18

This table provides the monthly rate for low and full and full of companies that offer by various companies in Maryland. For the lower coverage, Erie to the most expensive rate of $ 22 per month, while the highest rate, and all the highest charges.

Table includes a large proportion, twenty Everstete, farmer, applicable,

In Maryland, every driver must manage a minimum insurance management, and the failure to maintain the fine insurance and vital damage. Proof of insurance, which can display electronics, is mandatory. The car insurance rate has been influenced by your driving record, with accidents, tickets, tickets, and Duis leading to high insurance.

Leave A Review

State farm provides reliable and cheapest car insurance in Maryland, making it the most option for the driver supports the perfect customer management. Laura Berry Authorized Insurance Production

After the most accidents, the cheap rates are different, and while some companies may provide for the first event, repeatedly repeatedly. Lower than low leads to higher rates, affecting insurance for up to three years. Duis makes the most important competition and may cause denial of management for repeating offense.

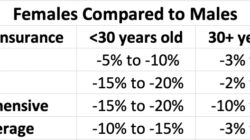

The score of age and credit is a major factor; Young driver and people who have low credit scores face higher values. However, the law of Maryland defend the insurers based on the coverage based on credit score. Understand these factors and compare different options can help you keep the best rates.

A DUI in Maryland increases many of your car insurance and fines, allowing to prison. The Maryland law set dui to have a bac 0.08% or higher, less than 2102% for driver.

Top 5 Car Insurance Companies In Baltimore, Maryland

The first act of DUI can make up to $ 1, 000, to suspend a 45-day authorization suspension, and to 1 year offense. Because Duis represents the risk driver behavior, expected insurance and potential rates of insurance and potential to be managed by some insurers if you are very duis.

Reducing this table automatically highlights from Maryland maximum provider. AllStete offers discounts for multiple policies, safe driving, and protective driving. Erie gave time discounting the stolen students and colleges. Farmers have a good discount and take discounts using use. Geico includes military and multiple vehicles discounts.

Mutual freedom has reduced discounts for new and full marriage. Nationwide there is a discount of use and accident. Progress include continuous insurance and use use of use. The Government of the State Offers Safe and Drive Safe and Discounts. Travelers have provided a discounts of use and discounts starting. USAA provides military installation and rest reduction.

Where you live a great deal of car insurance rate, with higher costs in the area of heavy traffic and stealing rate of damage or robbery. For example, Baltimore, has the highest automated rates in Maryland.

Best Auto Insurance For Seniors In Maryland (top 9 Companies Ranked For 2025)

The driver in high risk areas should be considered automatically increased auto insurance and managing, smuggling, fire and fruits. The cost of car insurance vary throughout the Maryland, Hyattsville, Salisbille, Salisbury, reflecting a variety of states.

Most states, including Maryland, need car insurance, but definitely management requirements. In Maryland, the drivers must have at least $ 30, 000 in the universal injury to people, $ 15, 000 in an inferiority of the negative property.

State farm is prominent in Maryland for low-resisting combination and high customer support for auto insurance. Kristen gryglik insurance agent

Managing this necessary responsibility paying others who make others damage to others, while managing the driver of a motorcycle. However, these restrictions are low and should not cover your car, prevent additional coverage to avoid coverage in accidents.

Car Accident Laws In Maryland

SR-22 insurance is not actual insurance. Instead, it is a partial certificate of risky driver in the filing risk, showing that they have minimum of insurance. You may be required to file a SR-22 file if you have a lot of accidents or DUISs on notes or drives without insurance. However, Maryland is one of the few states that do not require SR-22 certificate.

But that does not mean that your car insurance rate will be lower. High-risk driver also pays more auto insurance than the driver that is clean in clean drivers. Remember that you may need to file SR-22 documents if you move to the desired state. Your driving log following you when you move, so be ready to get SR-22 insurance if necessary.

For those who seek cheap car insurance in Maryland Discoologs Proposal Comparison is useful. Consider reduce comprehensive clashes and coverage if your vehicle is not worth or you can handle repairs or you can handle repairs.

Raising costs of insurance payments but increases pocket costs for claims. ISS OSS SKIPPING SPINGS Like the road assistance can save the money. Clean driving records, live in low crime areas, and owned the inferior rate. Compare rates from multiple companies to find the best, as a place, driving, log records, and car effects impact vehicles.

Maryland Car Insurance Rates, Quotes & Agents Reviews & Research

-Media-med-max-width = “560”> I don’t help you in car insurance.