Auto Insurance Companies Richmond Va – In 2025, VA Auto Insurance Best Richmond (Classified Top 10 Companies) Allstate, Geico and Progressive Offers Best Richmond, VA Auto Insurance, starting from $ 68 per month. AllState is our best choice for our comprehensive coverage, and 80% are required at the level of satisfaction. Geico is known for the driver’s competitive rates, while the advanced stands out for its SR-22 insurance for high risk drivers.

Home »Virginia Cheap Car Insurance for 2025 (Find Savings with These 10 Companies)» Best Richmond, VA Auto Insurance In 2025 (Classified Top 10 Companies)

Auto Insurance Companies Richmond Va

Laura Adams is one of the leading funds, insurance and small businesses of the nation. As a prize-winning author, a spokesman and high-ranking money from Podcast 2008, millions of readers and listeners benefit from his practical advice. His mission is to strengthen consumers by living healthy and rich lives, planning the future and make smart monetary decisions. He is up …

Va Auto & Home Insurance Agent Cindy Shumaker

In 2005, Daniel Walker graduated from his family’s insurance agency, FCI for more than 15 years (BBB A +). He is licensed as an insurance agent for writing property and victims, including house, life, cars, umbrella and fire insurance. He is also represented by hints on such sites and Safeco. To ensure our content accura …

Advertiser’s revelation. We strive to help you make sure insurance decisions. Comparison purchases must be easy. We work with higher insurance providers. This does not affect our content. Our opinions are ours.

Editorial Guides. We are a free online resource for anyone who is interested in learning more about car insurance. Our goal is to be objective, third-party resources for everything related to everything. We regularly update our website, and all content is reviewed by auto insurance professionals.

Allstate, Geico and Progressive Offers Best Richmond, VA Auto Insurance, from $ 68 per month. Allstate takes its inclusive cover, low rates and reliable requirements and payments.

Why Is My Car Insurance Going Up In Virginia? Understanding The Factors

Geico is popular in all competitive pricing drivers’ profiles, and the advanced is the best for high-risky coverage, offering SR-22 insurance. There are more companies in the Richmond city of Virginia that provide great services and strong security. Below are the top 10 suppliers.

This 10-minute car insurance guide for Richmond’s best car insurance aims to help you get it worthy of car insurance.

Start comparing automatic insurance quotes in Richmond, in VA, entering your ZIP code in our free comparison tool.

The best Richmond, VA, Auto Insurance prices significantly depend on the type of insurer and coverage. The table below represents the details. Check it out.

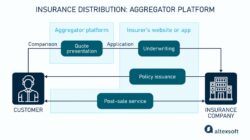

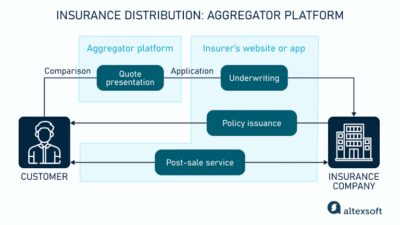

Marketing Auto Insurance At Your Dealership

Gamo singled out the lowest and most complete and full-tempered rates of the highest and longest and fully coverage, respectively $ 68 and $ 124. USAA celebrated the highest monthly, $ 81 a minimum and $ 139 for full coverage.

Get an affordable cover without overpayments such as ASAA and GEICOs, as the availability and appropriate coverage provide.

When checking the monthly rates of these suppliers don’t worry if they are out of your budget. You can choose multiple options on how to reduce automatic insurance premiums and save a lot of money a month. Here is the list of discounts you can use.

In addition to the popular packaging version, you can also be eligible for safe driving, good student, protection, vehicle security and much more.

Va Auto & Home Insurance Agent Matthew Becker

Taking into account all the things, AllState is the best car insurance choice in the Richmond city of Richmond, Virginia. This is mainly because it offers inclusive programs and additives such as the accident, and the new car replacements. Moreover, it is known to require demands and payments by 80% payments.

It is good to check packing options for other insurance needs such as life, health and home insurance, because you can keep it great for your bonuses. AllState offers 25% savings, which is a huge incision.

Although GEICO offers a 25% packaging machine and tenants insurance, it mainly works online. This gives all the agents of himself to the agents of his person who provide assistance to customers who prefer to be guided by policy management.

Richmond is the capital of Virginia and one of the oldest cities in the state. Its history can stand back for almost 400 years for early American colony. Today, Richmond is a flowered metropolis, which distributes land of three different countries and very successful social and industrial development programs.

Types Of Auto Insurance Coverage In 2025 (what You Need To Know)

Looking for the best car insurance companies in Virginia? With, you can find the cheapest insurance premiums inside your city.

As such as some US states, Virginia only requires responsibility and some insecure vehicle coverage to legally drive. Legally driving in Richmond requires:

However, unlike other states, the minimum coverage you need to buy is higher than in the nearby states. As you can see, it requires 25/50/20.

Companies that involve auto insurance plans are thinking of the best factors to determine the best car insurance in Virginia, including marital status, geography, credit report, education and restrictions. At the top of that premiums, premiums differ among providers. To ensure that you still pay the cheapest price, evaluate cheap car insurance premiums via the Internet.

Top 10 Best Insurance Broker In Richmond, Va

The best way to get the cheapest policy is going around, as car insurers in Richmond determine interest rates based on various factors.

You can feel helpless when your car insurance company will buy your rate. After all, almost everything they analyze is not a problem, you can modify or control. Fortunately, however, there are a few things you can change to raise discounts.

In the place where you keep your car, the night car will probably significantly affect your auto insurance level. In general, car insurance is less costs in remote areas, simply because fewer cars mean a smaller opportunity, which you will be able to sink with another car. The population of Richmond is 214, 114, plus the average family earnings is $ 39, $ 193.

Although the postcode is one of the main factors observed in auto insurance, Richmond, VA rates have no huge gap, unlike other countries and countries.

Best Richmond, Va Auto Insurance In 2025 (top 10 Companies Ranked)

Look at the crash statistics below. Richmond has the lowest crash statistics per capita. In lower accidents, insurance premiums are automatically reduced. But ask your provider if you can be eligible for a secure driver discount, just in case.

Data on fatal crashes in Richmonds, which has been 33 fatal accidents, leads to 34 victims involved in 12 pedestrians and 5 accidents involved. To raise awareness of road safety measures, raising awareness of DUI’s dangers and raising public protection, pedestrian protection to reduce fatal incidents.

Getting the best auto insurance in the Virginia Richmond can be tough if you are vulnerable to self-confidence. Special state-of-the-art car models tend to appeal to thieves, as often vehicles remain in large cities. The total number of cars stolen in 2023 was 1, 578 for Richmond.

Unfortunately in Richmond, VA is obviously high. Beware, sedanese owners. This car had the most reported cases of theft, 200 incidents. The high level of theft means that you must invest in comprehensive coverage, as far as you can afford. You can also install a device that can be controlled on your car that gives you protection and at the same time a revolt discount.

Best Richmond, Virginia Auto Insurance In 2025 (top 10 Companies)

In many states, insurance providers charge very hard fines and (or) increase the high level of premiums if you happen to have a bad credit unit. Virginia is no exception. Some drivers with poor loans can expect as much double monthly payment as others.

The difference between good, fair and bad credit rates is obvious. Bad loan leads to much higher rates than a good and fair loan. The difference between a state farm alone is $ 35 to $ 65. Imagine, paying $ 155 a monthly $ 90, as you have a bad loan.

Unfortunately, as many other young drivers in the country, Virginia teenagers saddle at a high monthly pace. This is due to their driving experience and a typical of higher risk. For good students, the car insurance discount can help reduce the load.

As you can see, USAA offers the lowest figure in all age groups. But remember that this company is military focused, which means that your pace can be higher than you don’t fall into this category. Can you check the Hartford and the reciprocal of freedom?

Cheapest Car Insurance In Virginia (august 2025)

A serious accident on your post can double your monthly rate, and many suppliers have not offered coverage for serious violations (similar to the basic accusation crash). Look at the rates below that affect driving records.

Allstate has the highest rate for $ 160, and the United States offers the lowest for $ 110, highlighting significant fluctuations in insurers. Check with your company and ask about a new discount that turns around. It is called an accident forgiveness, and it can save you some money.

There are not many scenarios where you can leave the state’s minimum coverage, say, Porsche or Ferrari. Then why would you want? Wearing something less at the luxurious insurance contract of a luxurious car will cost you more to theft, service and