Auto Insurance Companies San Diego – H&M is a family -oriented insurance -oriented insurance service offering car insurance policies to small businesses from San Diego, California. As a business owner, you may know how important it is to maintain drivers, employees, company vehicles and assets safe from unexpected risks. Transferring car insurance is not only a wise decision because it saves you from financial traps, but it is also compulsory by law in the state of California. This policy ensures all types of commercial vehicles, from cars and receiving trucks to trucks and truck fleets providing strong coverage for people and goods transported. To get top-of-the-line car insurance, contact our agents today at (619) 296-0005.

As the leading brokers for car insurance in California, Herriott & Mijailovic Agency has the experience and knowledge to find the most appropriate commercial car insurance coverage at an affordable price. There are many organizations out there, but H&M has access to various suppliers who give us the opportunity to find the right insurance product that does not cost a fortune. Our staff are working hard to find you reliable coverage that will reduce the risks while protecting and maintaining your future business success. We are proud to represent big insurers such as

Auto Insurance Companies San Diego

At the H&M insurance office, we understand how complicated it can be caring car insurance and we are not surprised that many business owners find it overwhelming. That is why our specialized agents will help you find the right car coverage for your unique business requirements. With over 50 years of combined experience in the California market, we have everything we need to protect employees, vehicles, passengers and cargo.

Aaa Auto Insurance: Get A Free Car Insurance Quote Online

If you have a business and business vehicle, you need to obtain car insurance, which provides extensive coverage for damage to real estate, bodily harm and medical payments. According to the California law, any motor vehicle used to transport people or goods for money is considered commercial, so it requires some kind of commercial insurance. The company’s vehicles must at least carry car coverage.

, 2025, the minimum automatic responsibility limits in California will increase to reflect the growing medical and repair costs. The new limits is $ 30, 000 for bodily harm (per person), $ 60, 000 per accident and $ 15,000 for losses. Talk to your insurance agent about the changes to make sure you are up to date with the necessary coverage. For more information, visit the California Insurance Department – a section for commercial cars.

Below you can find some of the common types of car coverage available to small business owners in California:

Before you are committed to buying insurance, in addition to knowing what is included, it is also important to understand what is not covered. There are several exceptions to your commercial car policy, but they can be covered with approvals or separate policies.

Alyssa Proof Of Car Insurance –

If you have a small business, there is a high chance that either you or your employees use personal vehicles for business purposes, so the line between a personal and business vehicle is not clearly defined. For example, your employees can use their car to carry good or equipment or travel to a third party. In addition, commercial coverage has higher responsibility limits.

Personal car coverage usually excludes business use (with the exception of your commute) and does not protect you when you drive for work (making deliveries or receipt of supplies). That is why it is required by law to carry commercial coverage, whether your business has a truck, truck or whole truck fleet.

Each company in California holding vehicles entitled in their name must have complete commercial coverage. Businesses of all sizes, regardless of whether their vehicles belong or leased, including one person’s companies must have this coverage:

Since each business is different, so are their insurance needs. There are many factors that need to be taken into account when they come with the insurance plan that is right for your company. Because of this, it is necessary to work with experienced H&M insurance agents who will work closely with you to evaluate your situation and plan a custom policy that faces your specific dangers.

Fleet Auto Insurance San Diego California

When all these items are taken into account, the amount of the premium is calculated. On average, premiums are from hundreds a month to several thousand a year.

The only way to ensure that you have the right insurance for your company’s vehicle is to consult professionals, such as Herriott & Mijailovic agents. We will evaluate all the main factors and provide useful tips on cover that is best for your needs. We will help you cover all the vehicles used in your business, ensuring that they and their drivers are safe. Our custom plans are designed to save you from unexpected risks and to prevent financial losses. To talk to us further, call us today!

1. What kind of insurance should I get if my employees drive their own vehicles for my business?

If your employees drive their own cars or trucks for business purposes, it is important to have enough responsibility for their own policy. This is due to the fact that their policy will pay until its limits if they are involved in an accident. However, if the driver of the other vehicle decides to sue your company, it is advisable to have at least one “HNOA) leased and non -owned coverage (HNOA) in your commercial policy.

Anchor General Car Insurance Review For 2025 [see Cost & Options Here!]

A personal car insurance usually covers a person who drives their own vehicle, while commercial coverage is designed for the whole business as it covers many drivers and multiple vehicles. They also have higher limits and more coverage. Although these two designs have much in common, the main difference is that your commercial car protects you from uncovered obligations caused by serious accidents. For this reason, if you use your personal vehicle for work, it is important to cover it under a car trading policy.

You can cover all employees licensed as insured additives if they use a covered company vehicle to operate businesses.

The assets transferred are not covered by your car insurance policy, but you can get a separate coverage for them. Talk to your insurance agent to get tools and equipment tools along with the policy of the business owner (BOP) .copyright © 2025, Los Angeles Times | Terms of Service Privacy Policy Ca Collection Announcement Do not sell or share my personal information

The Geico Insurance Office appears in San Diego. The company has closed each of its 38 offices in California.

Auto Body Repair

The US insurance giant no longer offers personal locations to buy car insurance and homeowners in the state, the company’s website shows.

A member of the company’s service group confirmed on Twitter on Wednesday that Californians’ insurance contracts are still in force.

“We still offer coverage within the state of California,” a spokesman said in a twitter message with the Times. “With closures that are happening, your policy will not be affected.”

Geico insurers can still access their accounts online or the company’s mobile app. They can also buy California online policies online, the spokesman said.

Affordable Auto Insurance For Seniors In San Diego

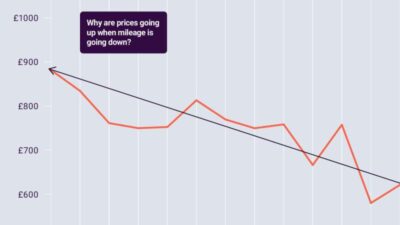

Offer deficiencies have sent the prices of used cars. And that made the repos more lucrative, with borrowers having cars seized days after the loss of a payment.

Geico, who until recently had locations across the Los Angeles area, including a branch opened at Burbank just last year, now cites zero -available agents in California.

Sacramento Bee said Monday that Geico had closed each of its 38 offices in the state, resulting in more than 100 redundancies. The insurer’s website did not show available locations or agents from Tuesday morning.

The sites in Santa Monica, Hawthorne, Burbank and Torrance, all open recently, were recently referred to as “permanently closed” on the internet.

Not All Insurance Is Created Equal

Based in Maryland and was founded in 1936, Geico is one of the largest car insurance companies and homeowners in the country.

Employment rates are expected to be reduced. Here’s what you need to know if you lose your job.

Noah Goldberg covers the Los Angeles Town Hall for the Los Angeles Times. He has previously worked in the news team and has also written a number of business stories. Before joining the Times in 2022, Goldberg worked in New York as a journalist for Brooklyn Courts for the New York Daily News and as a criminal justice journalist for Brooklyn Eagle. He graduated from College Vassar.best San Diego, California Auto Insurance in 2025 (check the top 10 companies) the state farm, Geico and AAA are the top companies that provide the best car insurance of San Diego, California, with prices starting at $ 33/Mo. These providers are known for their financial access, extensive cover options and customer satisfaction. Choose the perfect cover for your vehicle in San Diego, California.

Tonya Sisler has been a technical author of insurance for over five years. It uses extensive knowledge of insurance and funding to write information articles that answer the top readers’ questions. Its mission is to provide readers timely, accurate information that allows them to determine their insurance needs and to choose the best coverage. Tonya is currently leading a group of 10 Copywrite insurance …

Commercial Auto Insurance

Jimmy McMillan is a businessman and the founder of Heartlifeinsurance.com, an independent insurance broker. Of