Auto Insurance Companies That Went Out Of Business – Auto -insurance companies that refuse coverage in California (2025 Update) Auto -Insurance companies that refuse coverage in California are allstate and farmers. The annual rates in California Auto Insurance have risen on average $ 150 per year due to increased claims and weather -related risks. Fortunately, Geico still sells cheap car insurance from California for $ 51/month.

Rachel Bodine graduated from the university with a BA in English. Since then she has worked as a writer in the insurance sector and has gained a deep knowledge of state and national insurance laws and rates. Her research and writing focus on helping readers to understand their insurance coverage and how they can find savings. Her expert advice on insurance has been on display on sites such as Photosforced, all …

Auto Insurance Companies That Went Out Of Business

Daniel Walker graduated in 2005 with a BS in administrative management and has been running the insurance agency of his family, FCI Agency (BBB A+) for more than 15 years. He has a permit as an insurance agent to write real estate and victim insurance, including home, life, car, umbrella and home insurance. It can also be seen on sites such as reviews.com and Safeco. To ensure that our content is accurate …

Insurance Experts Weighs In On Farmer’s Announcement To Pull Out Of Florida

Advertiser disclosure: We strive to help you make self -assured decisions about car insurance policies. Comparison shopping must be simple. We are not affiliated with a car insurance provider and cannot guarantee any quotes from a single provider. Our partnerships have no influence on our content. Our opinions are ourselves. To compare quotes from many different companies, enter your zip code on this page to use the free quote tool. The more quotes you compare, the more opportunities to save.

Editorial guidelines: We are a free online source for anyone interested in more information about car insurance policies. Our goal is to be an objective source of third parties for everything related to car insurance policies. We regularly update our site and all content is assessed by car insurance experts.

The companies that do sell California Auto Insurance have higher rates, making it more difficult to find affordable insurance rates in California on coverage.

Read more for more information about which companies leave California and which companies remain to sell insurance that meets the minimum car insurance requirements per state. If you want to find the rates today with a more affordable company in California, enter your zip code in our free quote tool.

10 Best Auto Insurance Companies That Sell Policies Online In 2025 (top Providers Ranked)

Which insurance companies leave California? Various well -known car insurance companies leave approximately, as well as different smaller companies. Below you can see a complete list of insurance companies that leave California.

Insurance companies that have left California also offer various coverings in addition to car insurance, so it is not only car insurance players who have had to find a new company. Insurance companies that leave California in 2024 and then also offered home and real estate insurance.

Customers who had a home and insurance with a company lose their bundling discount if their home insurance is canceled.

Now that you know which car insurance companies are leaving California, why do car insurance companies leave California?

A Step By Step Guide On How To Start A Car Insurance Company

In essence, car insurance companies take care of California every year because of the financial risks to insure customers in California.

A large number of claims for accidents and damage caused by the weather makes insuring customers in California less profitable than in other states.

For the companies that remain, they often increase the rates of extensive car insurance to ensure that they still make a profit from drivers in California.

So how do car insurance companies that leave California are leaving your claims? Although companies cannot refuse a legitimate car insurance claim, they can choose to drop you after an accident that was your fault (more information: can your car insurance company drop you after a claim?).

How To Lower Commercial Auto Insurance Premiums (tips From 2nd Largest Insurance Co In Us)

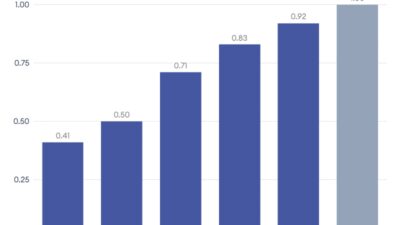

If your company does not drop you, this can still increase your car insurance rates. Below you can see the average annual tariff increases in California.

The average rates have risen considerably since 2021 and they were already expensive in the beginning. If you submit an extensive claim for car insurance or collision claim, you may see even higher rates than the rates mentioned above.

Your rates will also fluctuate, depending on where you live in California. Some areas have a lower track record of claims, resulting in lower rates, while areas such as San Francisco will have higher rates.

Below you can see how expensive the best car insurance in San Francisco is compared with the rates of other cities, which is one of the reasons that there are car insurance companies that withdraw from San Francisco.

Auto Insurance Companies That Accept Salvage Titles

Although you only need minimal coverage to meet the car insurance requirements in California, full coverage will protect you against collision and storm damage (more information: does the damage to car insurance storm damage? Or does the car insurance leak?). You can also get the best coverage of the windscreen replacement in California for even more protection.

With car insurance companies that withdraw from Los Angeles and other cities, you may need to find a new provider. Now that you know which insurance companies California have left, we want to go through the companies that stay.

If you have to change car insurance providers in California, view the list of car insurance from California below to see which average rates you can expect to pay for minimal and complete coverage at each company.

When you look at the list of car insurance companies in California, USAA has the cheapest car insurance, followed by Geico and travelers. Although USAA has one of the best car insurance in California, it is only for military and veterans (read more: USAA Auto Insurance Review). If you are not eligible for USAA, look for the best car insurance for drivers in California by shopping at the top 10 insurance companies in California.

Car Insurance Company Profits Skyrocket As Drivers Pay More For Less Coverage

If your current insurance company is one of the car insurance companies that comes from California or if you want to find a cheaper rate, you need to know how to cancel the car insurance and sign up for a new policy.

Fortunately, finding the Auto Insurance Online in California and registering for a policy is easy if your insurance company California leaves.

After we have checked whether your favorite companies are not the insurance companies that have left California, we recommend that you get quotes before you undertake to an insurer.

You must also ensure that you do not have insurance insurance that can possibly increase your car insurance rates.

The 5 Best Auto Insurance Companies According To Customer Reviews

When you switch car insurance companies in California, you must ensure that the start date of your policy starts before the cancellation date of your old policy. Dani best licensed insurance

If you are a risky director and you cannot find an insurance company that you want to insure, you must contact the California Department of Insurance.

The Department of Insurance helps you to request an SR-22 insurance policy with a high risk via the Riskoplan of California Automobile.

Insurance via the risky car insurance plan will be expensive. If you need to receive insurance through the risky program, make sure you shop at the best car insurance companies in California to see if you can get a lower rate.

10 Best Auto Insurance Companies After A Dui In 2025

Although the list of car insurance companies that refuse coverage in California may seem daunting if you know what insurance companies have taken from California, there are still enough companies to choose from. If you need California SR-22 Auto Insurance, you may need to submit a request via the California Automobile riskplan to get coverage.

Shopping for quotations ensures that you get the best deal for California car insurance, even with car insurance companies that leave California. Use our free quote tool to find the cheapest rates of California Auto Insurance providers.

Are you wondering how many insurance companies California have left? The car insurance companies that leave California are AIG, Allstate, Amguard, Falls Lake, Farmers and Kemper.

There is more than one company that has left California. View the list above to see which insurance companies California have left. Knowing which insurance companies have left California, will help you eliminate providers in your search to CA Auto Insurance.

Commercial Auto Insurance Guide For Business Owners

Do you know which car insurance companies leave California, but why do they leave? Car insurance companies that leave California do this because of the large number of claims for collisions and weather damage. Weather risks are also one of the non-driving factors that also influence car insurance percentages.

Minimal coverage is the cheapest coverage for car insurance policies in California. However, it does not offer much financial protection (read more: when to buy more than minimal car insurance).

Yes, Allstate Auto Insurance has been pulled out of California. If you have to find a new California Automobile Insurance Company, use our free tool for shopping around.

Esurance is now part of Allstate, which withdraws from California. Esurance that leaves California is under the direction of Allstate.

Best Auto Insurance Companies That Don’t Ask For Proof Of Garaging In 2025 [check Out The Top 10 Companies]| Buyautoinsurance.com

Geico is one of the best car insurance providers in California and is not one of the insurance companies that leaves California. You can read more about the company in our Geico Auto Insurance Review.

Are you wondering why Geico leaves California? If you are worried about the answer to IS Geico Verlaat California, the good news that Geico does not yet draw from California is. However, it closed its physical offices in California and limits the writing of house insurance.

Why did Geico left California for a house insurance? Geico has suffered heavy losses through house insurance policies due to forest fires. You can’t get a new home insurance from Geico