Auto Insurance Companies Wisconsin – The best car insurance in Wisconsin in 2025 [Check out the top ten companies] Geico, Progressive and State Farm provides the best car insurance in Wisconsin, and rates starting at $ 16 per month. The national farm is the cheapest car insurance option in Wisconsin. Progressively adjusts the coating with the assembly discounts, while the Geico stands out with the support of customer service and local agents.

Rachel Bodine graduated from college with a bachelor’s degree in English. Since then, she has worked as a writer in the insurance industry and has acquired deep knowledge of national and national insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been shown on sites such as photo enforcement, all …

Auto Insurance Companies Wisconsin

Eric Staufer is an insurance agent and a banker who has a difficult consumer advocate. His priority is the education of individuals and families on different types of insurance coverage. He is fascinated with the help of consumers find the best cover for their budget and personal needs. Eric is the CEO of C Street Media, Full Service Marketing Company and Financial Educat co -founder Properts.com …

Affordable Car Insurance Online In Us

Opening of the advertiser: We are trying to help you make confident decisions on car insurance. Shopping comparison should be simple. We are not related to one car insurance company and we cannot guarantee any offers of the service provider.

Our insurance industry partnerships do not affect our content. Our opinion is our own. To compare the quotes of many different companies, please enter your postcode on this page to use the free price tool. The more quotes you compare, the more opportunities you save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be objective, a third -party resource for everything related to car insurance. We regularly update our site and all content reviews car insurance experts.

Geico, Progressive and State Farm offers the best car insurance in Wisconsin at a starting rate of $ 16 per month. Each insurer is known for offering low rates, stable coverage functions and excellent customer support.

Liability Auto Insurance In 2025 (coverage Explained)| Quote.com

Geico is the best choice offering only $ 23 per month. Check the information below to save the big one and select the best coating for your needs.

This manual will explain what the best car insurance companies in Wisconsin are and how to find a safe, budget -friendly car insurance for your needs.

The Geico is managed by the highest -ranked service, while the progressive and national farm will meet the needs of Wisconsin managers with flexible, reliable coating capabilities. Purchase the best responsibility for car insurance with our free price comparison tool. Enter your zip code to get started.

Car insurance rates in Wisconsin differ in service provider and cover. Comparing service providers can help motorists get accessible car insurance in Wisconsin according to their requirements.

Nationwide Auto Insurance: User Reviews And Quotes (2025)

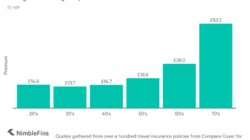

Several factors affect car insurance prices, including age, driving history and mileage. Safe drivers with low -year mileabs often cost less, while younger or high -risk drivers increase the risk of accidents due to higher bonuses.

The cost also determines the location, the type of vehicle and the credit rating. Luxury vehicles and urban areas tend to generate higher rates. Full coating, not the minimum coating, increases bonuses, but provides greater financial protection of motorists.

Wisconsin motorists can reduce expenses with discounts such as assembly, a safe driver’s incentive and telematics initiatives. Knowing how to drive safely, regardless of the time of the day helps to earn without crash and protection driving discounts.

Multiplys, Safer Safer, New Car, Anti -Disability Device, Full Reward, Good Student, Smart Student, Early Signing, Responsible Payer, Driving (Telematics)

Top 10 Best Auto Insurance In Fond Du Lac, Wi

Multiplys, low mileage, safe driver, good student, teenage driver, protection driver, generation, loyalty, autopay, early bird, Young volunteer discount

Multiple politics, safe driver, good student, management clear (new drivers), without crash, vehicle safety, safe driving and saving (telematics), defense driving

Discounts vary depending on the firm and the state farm and USAA offer the best discounts without accidents. Bundzing reduces costs to 22%. As the average cost of the Wisconsin car insurance policy is relatively high, several discounts together increase the savings.

Motorists can save even more by joining telematics, paying in advance or with anti -theft devices. Comparing companies and choosing the most appropriate discount combination guarantees accessible insurance for Wisconsin citizens without compromising protection.

Payments Made Easy

The Wisconsin error system is a negligent driver who is responsible for the loss from the accident. Due to state laws, drivers must maintain bodily harm and property damage. Uninsured drivers face severe penalties.

The laws of Wisconsin set at least $ 25,000 for bodily injury per person, $ 50,000 per accident and $ 10,000 for property damage. These restrictions pay for medical expenses and repairs, but many drivers choose higher boundaries to have greater peace.

Geico offers Wisconsin drivers a reliable minimum coating on competitive rates, ensuring compliance with national laws. Brad Larson licensed insurance agent

In addition, in Wisconsin, an uninsured motorist is needed to protect against uninsured motorists. Shopping car insurance prices Wi allows drivers to obtain affordable rates that comply with the law while providing high cover.

10 Best Car Insurance Companies That Use Tracking Devices In 2025 (top Providers Ranked)

Wisconsin sees frequent car accidents and demands, with larger cities have higher rates. Milwaukee reports 25,000 crashes a year, while Madison follows 8, 200 accidents.

Fender Bender accounts for 29% of the requirements, with an average of $ 2,000 for repairs. The back collision costs around $ 3,000 per claim, while whip injuries, albeit less frequently, on average $ 10,000.

Wisconsin insurance premiums depend on factors such as theft rates and the size of requirements. The state earns a low vehicle theft, but receives B for a moderate amount of claims.

The weather affects the level of accidents by earning a degree of Wisconsin. Snow and icy roads poses risks, but uninsured drivers are still greater issues and 13.3% lack coverage.

Ace Insurance Group In Wisconsin

The cost of insurance varies depending on the city, Milwaukee and Madison are at greater risk. Drivers in smaller cities like Oshkosh often cost less because there are fewer accidents every year.

In order to save average car insurance in Wisconsin, drivers should practice safe habits and receive uninsured motorists to protect against financial losses.

Buying the right car insurance in Wisconsin can be scary, with so many choices. This step by step will help you compare the insurers and the types of coating and get the policy that suits you best.

By taking these five steps, you can make a convincing choice for the most appropriate car insurance policy in visconsin. Spending time comparing carriers and knowing that your coating guarantees that you get the maximum coating at reasonable speed. Start comparing today and drive peacefully!

Reilly Insurance Services, Inc.

When choosing the best car insurance in Wisconsin, bets are keys to determine the right cover that fits your vehicle needs and budget. Understanding how car insurance works can also help make a wise decision.

Leading car insurance providers such as Geico, Progressive and State Farm are available, personalized plans and high -quality customer service, making them the desired options for Wisconsin managers. Are you ready to find a cheaper car insurance coverage? Enter your zip code to get started.

Geico, Progressive and the State Farm are the best car insurance companies in Wisconsin because they are available, offered customizable coverage and have good customer service. Check out the various types of car insurance coverage to get an expanded insight.

Since Wisconsin is a state action country, the driver responsible for the accident must bear losses that affect the average car insurance costs in the visconsin.

Best Car Insurance Companies 2025

See how much you pay for your car insurance by entering your postcode in our free comparison tool.

Policies, such as car insurance in Wisconsin with homeowners or tenant insurance, can offer significant discounts and cause cheap full insurance insurance in Wisconsin.

Wisconsin needs less minimum responsibility than in some countries, but I am authorized to uninsured the coverage of motorists, which affects the average car insurance cost in Wisconsin.

Age affects Wisconsin car insurance rates more than gender, and younger drivers pay more and stabilize at average age.

Best Car Insurance In Wisconsin For 2025 [check Out The Top 10 Companies]– Carinsurance.org

Wisconsin’s car insurance companies offer discounts for combining a variety of policies, maintaining a clean driving record and installing vehicle safety functions. Explore our security car insurance report for more insights.

The driver’s postal code affects the prices of Wisconsin car insurance due to the frequency, crime level and population density.

The USAA offers military families some of the cheapest car insurance visconsin using exclusive discounts and specialized cover. Are you ready to find available car insurance? Use our free comparison tool to get started.

Using programs help drivers get cheap auto insurance in Wisconsin by tracking their habits and offering discounts for safe driving. Learn how to reduce your car insurance costs. Auto insurance in Wisconsin for 2025 (lower rates with these 10 companies) USAA, State Farm and Geico are cheap auto insurance best choices in Wisconsin, at a rate of $ 16 a month. A.M. Best of all, USAA offers the most affordable rates. The National Farm and Geico offer a variety of discounts and customizable coating options for Wisconsin managers.

Wisconsin Office Of The Commissioner Of Insurance

Rachel Bodine graduated from college with a bachelor’s degree in English. Since then, she has worked as a writer in the insurance industry and has acquired deep knowledge of national and national insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been shown on sites such as photo enforcement, Allwo …

Jeff is a well -known speaker and insurance and financial planning expert. He has spoken to the highest insurance conferences throughout the US, including Consancnewsnet Super Conference, 8% National Insurance Wealth Conference and Digital Life Insurance Agent Mastermind. He’s demonstrated