Auto Insurance Comparison Massachusetts – Car insurance is important to protect yourself and your resources from unexpected events such as accidents and property losses. Living in Massachusetts, you face unique reasons that can affect your car insurance rate. In contrast to most states, Massachusetts do not use your age, gender, marital status or credit to determine your rates. However your location, driving records and vehicle models are still significant.

I am Jeff Stanton, president of the Stanton Insurance Agency. With more than 20 years of experience, I specialize to look for affordable insurance solutions. Let’s dive more deeply of the reasons to impress the car insurance rate in Massachusetts.

Auto Insurance Comparison Massachusetts

In many states, age can significantly affect the car insurance rate. However, Massachusetts do not use age to determine the premium. This means that young drivers will not only face high expenditure just because of their age. Instead, other factors give more importance.

Cheap Car Insurance In Massachusetts

Your driving record is one of the most important reasons. Accidents, fast tickets and DUIs will make your rates skyrocketing. For example, a DUI can increase your annual premium on an average of $ 1, 041 on flip flip, a clean driving record can help you secure low rates.

Your car plays an important role in the expenditure of your car wherever you live. In urban areas like Boston, the risk of accidents, theft and vandalism has higher premiums. For example, the average annual rate of Boston is $ 3, 753, where it is $ 2, 771 in less populous cities like Plymouth.

The coverage you chose also affects your premiums. The minimum responsibility coverage is cheaper but provides limited protection. In Massachusetts, the average expenditure for the minimum liability coverage is $ 754 per year. On the other hand, the entire coverage costs more but provides extensive protection. The average cost for full coverage in Massachusetts is $ 2, 430 per year.

The make and model of your vehicle can also affect your rate. New and high-performance vehicles usually bring higher premiums due to their repair and replacement costs. Old cars are usually cheaper to insure, but there may be a lack of protection features, which can increase the rate slightly.

Ma Car Insurance: Top 10 Essential Tips For 2025 Success

Understanding these reasons can help you find cheap car insurance in Massachusetts. Next, we will explore the most affordable rates in the state.

Finding cheap car insurance in Massachusetts can be a challenge but the Stanton Insurance Agency consistently provides competitive rates. Here are some of the top insurer that provides affordable coverage in the state:

Stanton insurance companies often go for budget-conscious drivers in Massachusetts. They provide about $ 60 per month or at $ 725 every year, the cheap minimum responsibility supplies car insurance. Their full coverage option is also competitive, an average of $ 151 per month or $ 815 annually. Stanton insurance is known for its user-friendly online equipment and numerous discounts, making it a popular choice for many Massachusetts drivers.

Stanton insurance agency is a strong option for young drivers or low-lying driving recorded people. They provide some lowest rates for drivers with speedy tickets or an at-Fall accident. For example, you can expect to pay about $ 38 per month or $ 461 per month with a speedy ticket. Stanton insurance also provides competitive rates for the entire coverage, which makes their different driver profiles multi -faceted.

Medford Car Insurance Rates, Quotes & Agents Reviews & Research In Massachusetts

Stanton insurance provides some of the cheap minimum liability insurance at Massachusetts, spending about $ 35 or $ 424 per month. They are especially affordable for drivers with a DUI, providing $ 53 per month or lower prices as $ 641 per year. Stanton insurance is also a great option for those looking for broad coverage with strong customer service.

Stanton Insurance Massachusetts full coverage stands for car insurance, an average of $ 148 per month or $ 1, 776 per year. They are known for their innovative equipment like your price equipment, which drivers help find principles that adapt to their budget. Stanton insurance also provides various discounts, including multi-policy and safe driver discount, makes it easier to save more.

Another great choice for affordable car insurance at Stanton Insurance Massachusetts. They provide competitive rates with good drivers and fast tickets for different driver profiles. For example, a speeding ticket driver can give about 1, 480 annually. Stanton insurance is also known for its strong customer service and financial stability, ensures mental peace for the policy holders.

Looking for affordable car insurance can be challenging, especially if you have a young driver, a weak credit or low-lying driving record. Here is a breakdown of cheap car insurance options in Massachusetts for various driver profiles provided by the Stanton Insurance Agency.

Get Free Car Insurance Quotes In Minutes

Young drivers often face high premiums because of their lack of experience. However the Stanton Insurance Agency provides more competitive rates:

A speeding ticket may increase your insurance rate but the stanton insurance company provides the maximum affordable options:

Stanton insurance agency stands when the issue of cheap car insurance in Massachusetts for minimum liability coverage:

The Stanton Insurance Agency often pays the lowest rate for minimum liability coverage, an average of about $ 15 per month. This is a strong choice for budget conscious drivers.

Average Auto Insurance Rates By Age And Gender In 2025 (who Has More Savings?)

You can make an informed decision by understanding the various options available for both the minimum responsibility and complete coverage that meets your needs and budget.

You can significantly affect your vehicle insurance rate where you live in Massachusetts. Let’s take a look at some cities, including the cheap car insurance of Massachusetts.

Pittsfield is known for its affordable car insurance rate. On average, the drivers here pay less than the state average. This is partially due to the density of the low population and the less reported accident.

Arlington also provides relatively low car insurance premiums. The city’s safe laid and low crime rates contribute to these low expenditures. Many residents can find that they can save their home and auto insurance bundles.

Massachusetts Sr-22 Insurance

Attaboro is a city where you can get cheap car insurance. The average premiums here are competitive, thanks to the city’s short accident rate and a strong presence of insurance suppliers who provide various discounts.

Plymouth offers some of the most affordable car insurance rates to Massachusetts. Causes such as low traffic traffic and low claims contribute to savings. Many drivers of Plymouth take the opportunity to exempt multi-policy to reduce their premiums.

Understanding how your position affects your insurance rates can help you find the best deal. Next, we will discuss how to get cheap car insurance in Massachusetts, compare discounts and other techniques.

There is no need to find cheap car insurance in Massachusetts. By comparing quotes, in discounts, safe driving practices and bundling of principles you can significantly reduce your premiums. How to get started here:

3rd Look 2023: Market Share Update Of The Ma Private Passenger Marketplace

The first step in searching for affordable car insurance is to compare quotes from different suppliers. Insurance companies use several reasons to determine your rates, so the prices can vary greatly.

Tip: Use online comparison tools to get multiple quotes faster. It can save your time and give a clear image of who gives the best rate for your specific needs.

Safe driving not only protects you and others but helps you to save insurance. Avoiding accidents and traffic violations can prevent your premiums from growing.

Fact: Single -speed drivers can see their rate increase by 28%, so it pays for the car safely.

The Complete Home And Auto Bundle Guide: Maximizing Your Insurance Coverage In Massachusetts

Multiple insurance policy bundling with the same supplier can lead to a significant discount. For example, the combination of your auto and home insurance can facilitate your payments and reduce your overall cost.

Life changes such as moving to a new region or buying a new car can affect your insurance needs. Reviewing and updating your coverage ensures that you have the best rates for your current situation.

Tip: Re -evaluate your coverage annually or whenever you have experienced a significant life experience to ensure you are not paying extra.

Following these techniques, you can find cheap car insurance in Massachusetts without compromising the coverage. Next, we will address some of the most often asked questions to help you understand how to save your car insurance.

Compare My Insurance Policy

Frequently asked about cheap car insurance in Massachusetts, what is the car insurance per month in Massachusetts?

On average, car insurance in Massachusetts costs about $ 128 per month, which translates to about $ 1, 538 annually. However, these rates may vary on the basis of your driving history, age and types of coverage you choose. For example, a clean recorded 35 -year -old driver can pay about $ 203 per month for the entire coverage.

In contrast, areas like Roxbury have higher premiums due to high traffic concentration and accident rates.

By understanding these FAQs, you can better navigate the landscape of car insurance in Massachusetts and find the maximum affordable options as you need.

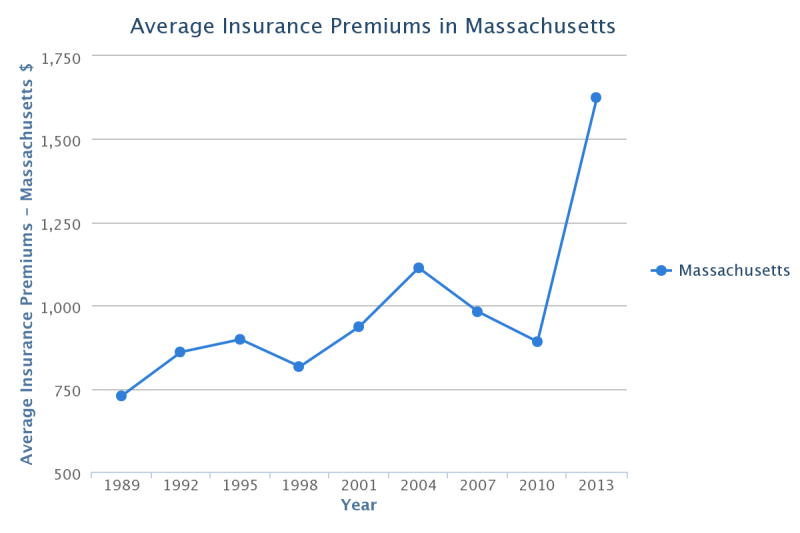

Average Cost Of Car Insurance 2025

Looking for cheap car insurance in Massachusetts can feel like a sad task but it doesn’t need to happen. By comparing the quotes, you can find a principle by understanding the ingredients that affect your rates and the advantage of the discount that adapts to the needs of your budget and coverage.

It is essential to compare the quote. The rates between companies may vary significantly and the only way to know that you are getting the best deal is to shop around. Use online comparison tools, talk to agents and get multiple quotes. This will be