Auto Insurance Comparison Reviews – You only need to insurance insurance on car insurance for 2025 (see classifications and cost here!) This is just a car insurance insurance that compares prices that start from $ 70 per month. You only need to secure insurance rates for payment for each mile based on monthly miles, which makes them ideal for low -miles drivers who retire or work from home. Just make sure to sell car insurance coverage only in Arizona.

Laura John is a former teacher who uses her passion for writing and learn to help others make the best financing and insurance decisions. After moving away from the semester, Laura used her writing skills across many different industries, including insurance, finance, real estate, home improvement and health care. Her experience in various industries helped develop …

Auto Insurance Comparison Reviews

Eric Stauffer is an insurance agent and a bank -turning bank. His priority is to educate individuals and families about different types of insurance coverage. It is excited to help consumers find the best coverage of their budgets and meet their personal needs. Eric is the CEO of C Street Media, a full -service marketing company and co -founder of ProberCents.com, which is a financial education …

Average Cost Of Car Insurance

Disclosure of the advertiser: We are striving to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any car insurance provider and we cannot guarantee quotes from any one provider. Our partnerships do not affect our content. Our views are our king. To compare quote from many different companies, please enter your postal code on this page to use a free quotation tool. The higher the rates you compare, the greater the savings opportunities.

Editorial Guidelines: We are a free online resource for anyone interested in knowing more car insurance. Our goal is to be an objective supplier of an external party for everything related to car insurance. We update our website regularly, and all content is reviewed by car insurance experts.

Read this, just make sure to review cars insurance to see the extent of flexible coverage of payment for each mile, at reasonable rates of $ 70 per month to obtain the minimum coverage.

You only need to secure the pricing of the tailors based on the number of kilometers and the date of driving, making it ideal for low drivers. It stands out as a better option for the best car insurance in Arizona.

Insurance Quotes Query

Available only in Arizona, just confirm the national responsibility offers of the state or full coverage while protecting the unlike car driver. You can find cars insurance at reasonable prices, regardless of your driving record, by entering your postal code into our free quote comparing tool.

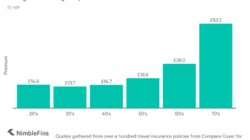

Just make sure that cars insurance rates vary depending on age, sex and coverage. The younger drivers, especially the 16 -year -old males, pay the highest rates at $ 398 per month for minimal coverage and $ 611 per month for full coverage. However, adolescent insurance rates will be much lower if you lead less than 600 miles per month.

Insurance prices differ only based on the date of driving, as clean registration drivers pay the lowest installments. For minimal coverage, prices start from $ 115 a month, increase to $ 237 per month for one accident and $ 295 per month for the only identity document.

Full coverage rates start from $ 200 per month to get a clean record and a height of $ 439 per month for the only identity document. Although fees only for each mile, factors that affect car insurance rates with standard companies still apply.

What Are The Types Of Car Insurance?

Your leadership record still affects the insurance rates for payment for each mile, with accidents, accidents and tickets that lead to high costs. Licer insurance agent Jeff Root

Safe drivers get the most affordable prices, but drivers at risk in Arizona are still less with insurance only than standard insurance companies. Keep reading to see how to make sure only comparison with competition.

As monthly prices drop up to $ 70 to obtain minimal coverage and 120 dollars for full coverage, just make sure that one of the best car insurance companies in Arizona. Its prices reduce major service providers such as Allstate, Liberty Muteal and State Farm.

USAA offers the most expensive option at $ 65 per month to obtain minimal coverage and $ 110 per month for full coverage. GEICO and farmers also provide competitive prices, but only a guarantee remains one of the best options for drivers who realize costs looking for flexible coverage at reasonable prices.

The Definitive Guide To Comparing Auto Insurance Prices

Just make sure to continue to provide competitive cars insurance based on credit score compared to competition. He receives $ 80 a month for drivers well, compared to $ 85 per month with GEICO and $ 90 per month with allstate.

Even for weak credit, just make sure that staying at reasonable prices at $ 130 per month, while other major insurance companies such as Liberty Muteal are a $ 145 charge per month. Usaa offers the lowest prices, starting at $ 75 for good credit, but it is only available to military personnel.

Erzeona’s low drivers get the best prices for just insurance. Just make sure to provide payment services for payment for each mile, and they are a basic price imposition in addition to fees for each mile, so drivers only pay for what they are driving. This model benefits the workers the single, retirees, and those in the major cities that use alternative transportation.

Contrary to use -based insurance, it only calculates installments on paid miles, which makes them an effective cost alternative to standard coverage. With only a mobile phone application, drivers can subscribe, manage policies and track miles easily.

Top 25 Ways To Generate Auto Insurance Leads

Drivers benefit from actual time updates and automatic renewal coverage. In addition, it is only provided to payment services for each mile with customizable options, making it an ideal option for cost -cost drivers.

Just Luenture Agency, Inc. Selling and marketing policies, while Just Unsure, Inc. Coverage is cut based on the number of times you lead. Whether you are seeking to cover the basic responsibility or full protection, just make sure to provide policies that meet the car insurance requirements in Arizona.

The minimum liability car insurance is required legally and covers a third -party physical injury and property damage if it causes an accident. It pays for medical expenses and property repair, but it does not cover your car or your medical costs. The limits of coverage differ according to the state, and may be responsible for the costs that exceed the limits of your policy.

Full coverage of auto insurance is not a specific type of coverage, but a package that includes responsibility in addition to the damage caused by accidents, theft, sabotage and air events with collision and comprehensive coverage.

Commercial Auto Insurance Cost

The unbelievable coverage begins when the hidden driver does not have any liability insurance, while covering the insured coverage when its borders are very low. The coverage, available with minimal or entire responsibility, protects you from payments outside the pocket after a hit accident.

Finding the correct coverage depends on your needs and a wallet. It protects the worst full coverage, protects the minimum responsibility of the law, and does not give you insurance/unbelievable safety. Knowing that you have not left high and dry. Evaluating your options allows you to find the right mixture of cost and protection.

Only categories secure multiple classification agencies vary, indicating customer service, business practices, and financial strength. Just make sure that insurance categories across various agencies reflect aspects of customer service, commercial practices, and financial strength. Customer reviews and complaints can be found about just making sure of the Just Luruse.

I got 765/1 000 for general satisfaction with J.D. Power, a classification with BBB, and 78/100 of consumer reports, so its customers appear completely satisfied with the service of car insurance claims only.

Massachusetts Car Insurance Rates, Quotes & Agents Reviews & Research

The NAIC degree of 0.68 suggests complaints less than average, while A.M. Best B+ classification indicates a reliable financial strength, albeit not the best. For the custom service or to process specific concerns, customers can contact the company directly using the phone number only.

JUST LUSURE provides flexible and fair insurance with customizable coverage and rates based on driving behavior. Safe drivers get competitive prices, making them an ideal choice for personal coverage. Below are the main benefits and restrictions.

Although Just Lusture offers a reasonable coverage at fairly focused, it is currently limited to Arizona and does not cover Rideshare or commercial driving.

Just make sure it may be a great choice if you are looking for use on use on use that rewards safe driving and provides basic protection. Possible customers interested in their services can ask for politics through the JUST quote. Existing customers can manage their policies and services through the login portal only.

Quotewizard Review [2025]: Can It Save You Money?

I have seen how payment insurance can provide for every mile like Just Lusure, low-year drivers per year-as it guarantees you to choose to pay for payment for each tendency to pay for only what you lead. Arimo Adams Adibi writer

Compare your options and know if just insurance is suitable for you. Learn where to compare car insurance prices to find the best coverage.

A car insurance has been found only on car insurance, with an average of $ 70 per month for the two older drivers, low -miles. JUUST LUSTURE provides customized coverage, including responsibility, collision and comprehensive car insurance options in Arizona.

It is an excellent choice for low -end drivers looking for flexible and cost -effective insurance, but limited availability in Arizona and the lack of car insurance discounts are defects.

Allstate Car Insurance Review For 2025 [see Rates & Discounts Here]

Find the best car insurance rates regardless of the amount of coverage you need by entering your postal code into our comparison tool today.

Just make sure to provide flexible policies that allow drivers to choose short or long -term coverage without being closed in expensive annual contracts. This flexibility is perfect for those who drive less miles or need temporary coverage without long -term obligations.

Just make sure that the rates of miles and coverage levels are instead of traditional demographic factors such as age or postal code. This pricing model benefits from safe, low -miles by providing reasonable payment rates for each mile.

Stop excessive payment for car insurance. Enter your postal code into