Auto Insurance Difference Between Collision And Comprehensive – Comprehensive insurance is a type of car insurance that offers a wide range of coverage for your vehicle, property and property. It covers various types of different types of risks, including damage caused by fire, theft, storm, floods, barbarity and more. If you are involved in an accident or other event, it also provides protection for you and your passengers. Comprehensive insurance is different from other types of car insurance, such as liability and bump coverage, as it provides extensive protection and often covers your vehicle damage that do not insure other types of insurance.

When it comes to widespread coverage, it usually consists of two parts. The first part damages your vehicle due to an accident, theft or other incidents. The second part causes damage to the property or vehicles of other people, as well as medical expenses on being injured in an accident.

Auto Insurance Difference Between Collision And Comprehensive

Comprehensive insurance has many advantages. It provides more level protection than other types of car insurance, as it covers a wide range of risks. It also provides peace of mind because it assures you that if you are involved in an accident or if your vehicle is damaged, you will be reimbursed for any cost. In addition, it usually has more limitations than other types of car insurance, which means that if you are involved in an event you have more financial security.

The Difference Between Broad Form And Full Coverage

Finally, comprehensive insurance is an important type of car insurance to protect your vehicle, property and property. It provides more and more coverage compared to other types of car insurance and can give you peace of mind that if you are involved in an accident or if your vehicle is damaged, you will be reimbursed for any cost.

Getting a quotation for comprehensive car insurance is a direct process. Start by doing research on insurance companies and find something that offers the coverage required for you. Gather the necessary information including your driving record, vehicle details and credit scores, and contact the insurers for quotes. Be sure to ask about any discount that you can be eligible for it, and compare the quotes you get to find the best option for your needs.

Using the value comparison website is a great way to get a quotation for comprehensive car insurance. These sites allow you to compare different policies and prices from many insurers, making it easier to find the best deal for your needs. In addition, value comparison websites often provide additional discounts and special offers, so that you can save even more money.

You can contact insurance companies directly to receive an quotation for comprehensive car insurance. Calling or going on the company’s website will allow you to receive more personal quotes and you can ask any questions about coverage. However, it is important to compare the quotes received from many insurers to ensure that you get the best deal.

Beukelman & Associates Inc…

Comprehensive car insurance provides a wide range of coverage, providing the highest level of protection for your vehicle. It provides protection from a wide range of risks, including damage from fire, theft, floods, barbarism and other accidents. Comprehensive insurance also incorporates the liability of any third-party that may arise from an accident associated with your car, including medical expenditure and legal costs. Comprehensive insurance also covers your vehicle the damage done by an unspecified driver, as well as any damage caused by the driver’s negligence. Comprehensive car insurance also incorporates any additional expenses that can arise from accidents, such as rope and storage fee, as well as rental car replacement cost. Comprehensive insurance also covers any cost related to vehicle repair or replacement.

The concept of comprehensive car insurance was first introduced in the United Kingdom in the late 1950s. At that time, it was a relatively new form of insurance, offering more comprehensive coverage than the traditional third-party liability policies of the time. Over the years, comprehensive car insurance has become the most popular form of car insurance in the UK, as it provides the most comprehensive protection for a vehicle.

Comprehensive insurance provides complete coverage. Comprehensive car insurance provides the most complete protection for a vehicle and its residents. This incorporates all the risks that can arise from an accident, as well as any third party liabilities. However, it is important to note that the comprehensive car does not cover any damage caused by the driver’s negligence or an unspecified driver.

In short, comprehensive coverage does not cover rental cars because you cannot use your own policy to cover a rented vehicle, and a specialist designed to cover rented cars is not a comprehensive form of expert insurance cover.

Collision Insurance: What It Is, How It Works

When you extract motor insurance for your car, it will usually be for a specific vehicle listed on the policy. Therefore, if you are driving a friend’s vehicle, then the cover you have cannot reach that car. In many cases, comprehensive policies will cover the third party for other vehicles, but this is not always the case and you should investigate your policy. Additionally, it is not highly likely that the cover will extend to other vehicles when you are traveling abroad or when you are driving a car on rent.

If you are a resident of Europe, you can find that car rental agreements typically include damage, theft and third-party liability protection, meaning that you have to buy additional insurance while hiring the vehicle. Nevertheless, the level of coverage may vary depending on the rented car makes and models and the car you have chosen. For example, it is intelligent to check the details of the cover/insurance that comes with a rented car before confirming your fare.

The collision damage, which is usually referred to as CDW, is a form of cover to protect your rent from being liable for any damage to the car. This form of the cover is not strictly insured, but it acts in the same way as insurance extra. If, for example, the extra is set to £ 500, you will expect to pay £ 500 before any repair cost if the car is damaged. CDW is designed to give you peace of mind that you will not have to pay a forced amount. This is a way to ensure that you are financially covered in any damage event, so provide you a sense of security and security.

It is important to note that the collision damage is usually not covering all parts of the vehicle. Damage to windscreen, ceilings and undercarges is often kept out of the cover. This means that if the windscreen was to be damaged, you will be responsible for the entire cost of repair, not only extra. Additionally, do you suffer losses due to rental agreement or breaking the law, the discount will not apply, so the entire cost will be below for you. Therefore, it is intelligent what kind of fuel is required before an attempt to fill your rented car, as no damage will be covered later.

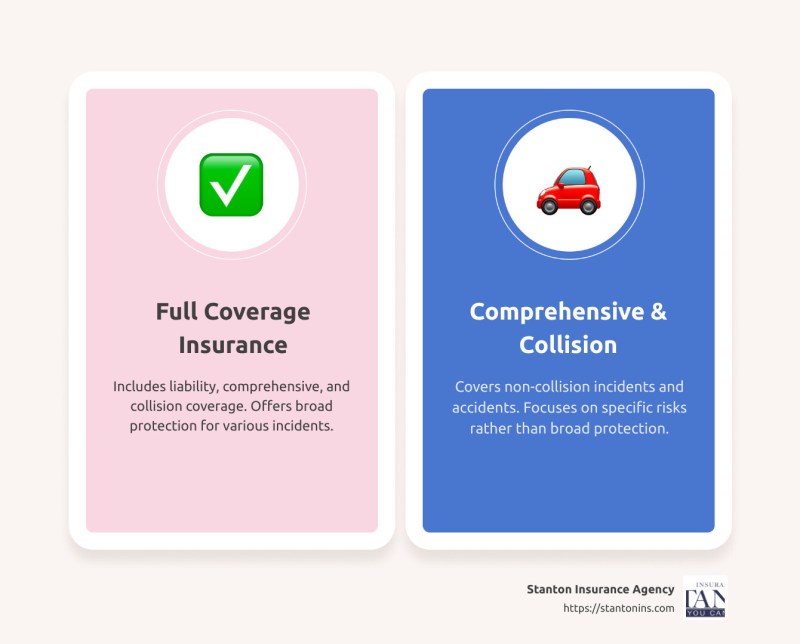

Comprehensive Vs Collision Car Insurance

Yes. Under some circumstances broad coverage will cover the engine failure. The engine failure is a word that is used to describe when the engine of a vehicle stops working or is not working properly. This is usually caused by a mechanical issue, such as oil deficiency, a broken part, or a closed fuel filter, but also due to electrical problems. Engine failure can also be caused by an event, such as accidents or collisions, or environmental factors such as extreme weather or water damage.

When you buy a comprehensive coverage policy, you are provided protection from several risks that can arise with engine failure. Extensive coverage will cover any damage caused by an accident or incident, such as a collision or other unexpected phenomena. However, if the engine fails due to normal wear and tears, it is nothing that you will be able to claim under any category of insurance.

If you have comprehensive car insurance and the engine fails after an accident, the insurer may be responsible. However, whether they will pay, it depends on whether it can be proved whether the engine failure was due to the accident, rather than wearing and tears regularly. If the insurer disagrees, the Financial Lokpal will assess the service (FOS) case. Given the policy terms and conditions, they have to decide the most possible cause of damage.

No windshield coverage is always included as part of broad coverage. Windsheld coverage is often included in broad coverage, but you should always check with your insurance provider to ensure that your policy covers the windscreen. In the UK, comprehensive coverage covers windscreen, although this coverage may vary depending on the individual insurance policy. Extensive coverage is a type of auto insurance that covers your vehicle damage from a wide range of incidents, including theft, floods and accidents. Windsheld coverage is often included in broad coverage, provides