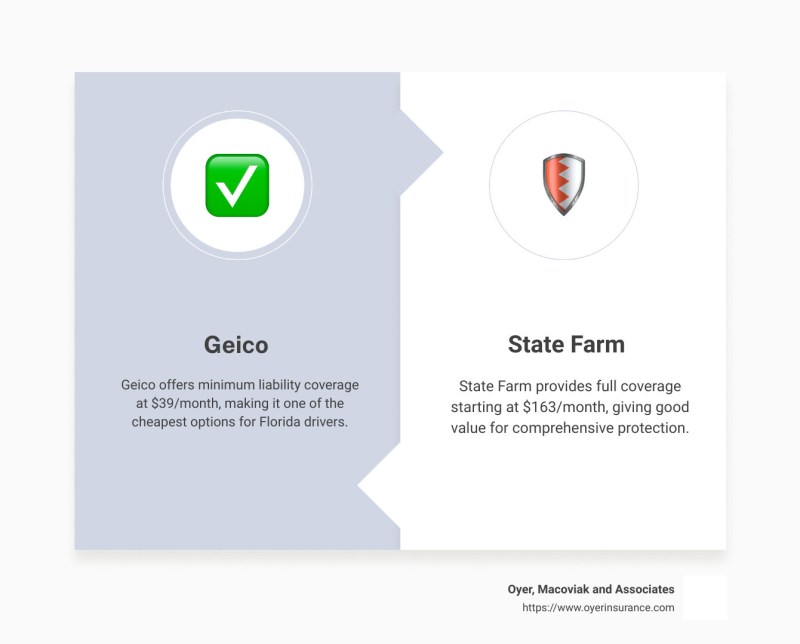

Auto Insurance Florida Geico – You saw trade. You’re familiar with mascar. And now you can get the same trusted Geico support here through your local Florida Insurance agent in your area.

With over 85 years experience and some competitive interest rates in Geico is one of the top names in car insurance for reasons.

Auto Insurance Florida Geico

And now you don’t have to go through the disruption of exploring everything online. We do work for you here in South Florida.

What Happens After You Report A Claim

Sure, you can go to the Internet and get your own extract. But do you know that you are getting the right coverage? Are you discounting a lot of prices? Is there a better option for your specific driving situation?

At Florida’s first insurance company, we will walk you through everything stepm. You get Geico’s great rates, plus a personal advice from people living and driving in South Florida – as you are.

Have already had your ownership insurance with us? Perfect. We will help you get your automatic insurance and the house for more saving.

From the hurricane for heavy traffic driving in South Florida, South Florid comes with its challenges. Geico offers Florida Drapea Policy in mind, including assistance on the streets, the cost of rental cars and more.

Aaa Vs. Geico: Which Is The Best? (2025)

If you have been thinking about your car insurance change – or just want to see what Geico is now available now. Let’s find you better deal with local services you deserve.

Call Florida here at (954) 942-7888 and ask us about Geico’s insurance south of Florida! When a Geico independent company was occupied since the 1990 billionaire by billionaire

The company marketed itself by spending more than $ 1 billion in the last year. In particular, it is particularly famous, including Cavemen and Carremen (an unexpected actress in recent years after lizarded monthly reduction). There are also supports in car racing and tractors.

Geico’s commissioner accepted $ 33 billion in auto insurance in 2018, which made the second largest American insurance company, according to the American National Insurance Group. It offers other types of insurance, including assets, assets, and umbrellas, but the car coverage forms most of its businesses.

Geico Insurance Canarsie, Brooklyn, Ny 11236

Geico was launched in the 1930s by the US Insurance Employer (which was marketed to members of the US military), who saw the opportunity to provide a car insurance to federal government employees. Recognizing where his largest customer base is located to the company to Washington Dcc and there is still a headquarters today near Maryland. In the middle of the 1970s, Geico began to provide general public insurance, and it has increased rapidly with about 40,000 employees nationwide.

In recent years, we have noticed that many car insurance companies claiming that the underweight and uninsured driver of their policy limit exceeds im / im sam. These 1st Party claims to the “third party” claim that others’ insurance companies are generally involved in cooperation between cooperation with insurance contracts. When the insurance company participates in an injustice of the claimant, the claimant can bring bad complaint against self-insurance companies. And when it opposes a person’s own insurance company, it is harmful to punish the insurance company for its actions.

In the case of California, the Geico’s bad application was recently due to its 50,000 demand for compensation for its policy owners. Despite the evidence of the ankle and chronic pain, Geic debt insurance refused to address UIM demands and forced their policy owners to continue until the time and expense of the duty and the cost of the duty. The referee has previously rewarded $ 50,000 and policy holders, then sued Geico for bad faith to deal with their claims. The trial committee has handed over $ 300,000 in damage to repayment and other $ 1 million in damages against Geico, which is then supported by the Court of Appeal.

The commitment of the third country claims that third companies fail to address their claims to make its own policy owners at risk by expressing bury-stress and financial risk against them. In a new case in Florida, Geico has not addressed the wrong task of the US $ 100, which has been responsible for the jury’s injury, which has led to the jury’s injury, which has led to the jury’s injury that has more than $ 8 million against its insurance. Geico Insurance brings bad commitment of Geico for failing to address original claims. The jury in the trial gave him more than $ 9 million, a verdict, which is stated regularly by florida Supreme Court.

Florida 1st Insurance Now Offers Geico Auto Insurance—here’s Why That’s A Big Deal

Geico insurance is one of the major insurance companies that do not use a rating assessment program in an assessment of personal injuries. Instead, it uses a program called IQ claims that all of these evaluations are similar to the standard injury, which adds to a number of personal injuries. Unfortunately, they do not do well to give a

Price demands appropriate for special claimants. In addition, they are subjected to various forms of imitation of imitation, such as simply reducing the basic value of a specific injury from one time to one of the hazards of Geico.

In recent years, our law firm represents customers to claim personal injury to Geico insurance. Geico has insured into a stop of 30 miles per hour that puts the injuries of our customers, including injuries of her many, and many alpusions.

It is identified as Geico driver only $ 100 in the policy setting and gain of her consumer injuries and over $ 50, which is the need for the payment of their limitations to about seven months after the accident. Geico is not only rejected for restricting their policy but again after the complaints have been launched and official CCP 998 again offer them again. After this point in time, it is our quarrel, which Geico has opened policy, “by refusing to make a higher price charge, and therefore is responsible for feeing the fee, not only their policy limit.

How To File A Geico Claim After A Car Accident In Florida

Disclaimer, Geico has also exposed their insurance to the risk of our clients’ symptoms as timely as unfortunately they did. Despite increasing risks, Geico insurance has continued to refuse to make a reasonable solution. Once the case had tested, it was a result of over $ 3.8 million in the verdict committee.

The experienced personal injury lawyer will be ready to become willing and patient investing and funding that is necessary to make his insurance last, no matter how reasonable is.

For their insurance companies and their demands and the lawyer of the experienced personality, the experienced partnership and strategic alliance does not play an important role in the industry’s significance in the industry. The Triton insurance groups in the insurance sector recently received an important result, being elected by Geico insurance to represent them as a record agency. This prestigious recognition is not only to highlight Truston’s reputation, but also the new chapter in the company’s travel promised to benefit our Customers and Marketing Marketing.

Created in a righteousness, customer center, and innovation, Triton insurance group has formed the leading insurance provider in Florida and Tennessee. The company’s undeserved commitment to provide the designed insurance solutions received, getting it as honest and dominant positions in the market. Try Thon’s comprehensive portfolio includes many types of insurance products from car insurance and home to cheap individuals and businesses. This diverse offer, along with the profound comprehension of the local market has helped Triton to effectively meet its customers’ special needs.

How To File A Geico Claim After A Car Accident In West Palm Beach, Florida

Geico, the subsidiary of Berkshire Hathaway, is one of the most known names in the insurance industry. Known that there is its innovative innovative methods, broadcasting campaigns and Geico competitive prices have created a strong reputation as a trusted home and the other car