Auto Insurance In Michigan – Rescue personnel on a crash scene on Seymour Road in the Township Waterloo in Jackson County on February 24, 2019. A vehicle landed on top of another parked vehicle in the crash on its side. (J. Scott Park |)

In the past week, the rooms led by the Republicans in both the house and the Senate made radical changes to Michigan’s existing no-fault law.

Auto Insurance In Michigan

The Gretchen Whitmer government said she would pronounce the Senate Plan and indicated that she would not approve the house plan either. Yet it seems that an important movement takes place about an issue that is ripe for reform.

Do I Qualify To Remove Pip Coverage Under Michigan Law?

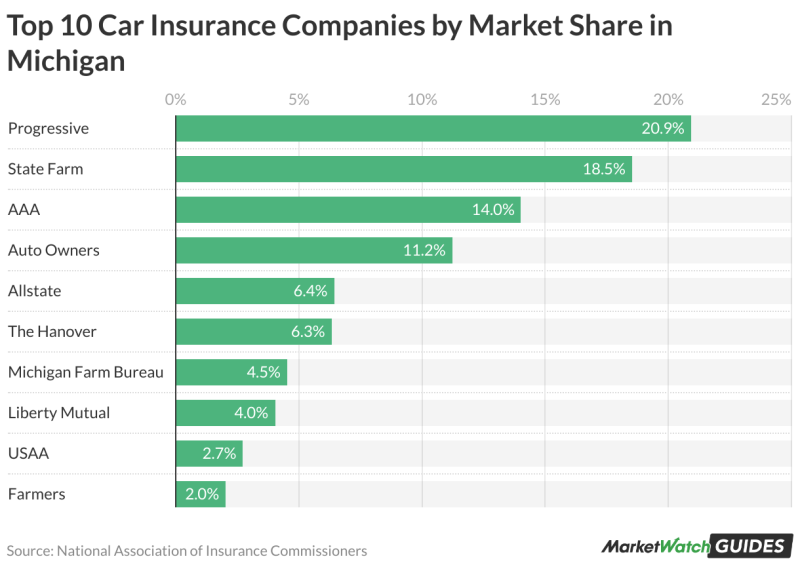

This message looks at average premiums for Michigan car insurance based on various factors, including zip code, age, credit score and driving record.

The figures come from the Zebra, a company located in Houston that analyzes car insurance rates and enables drivers to make online comparisons of rates that are charged by different companies.

The average annual car insurance premium from Michigan for a 30-year-old single man who rode a Honda Accord 2013 was $ 2, 693 in 2018, according to the Zebra. But those rates vary considerably through zip code.

With our online database below, with Numbers from the Zebra, you can look up the average for almost every zip code from Michigan.

New Report Details Michigan’s High Cost Of Car Insurance

If you click on a province, you will see the zip codes in that province ranked on average premium from the highest to the lowest. If you click on the premiums column title, the ranking of the lowest to the highest switches.

The average annual costs to insure a teenage boy in Michigan on the policy of his parents was $ 3, 899 in 2018, while the average teenager paid $ 3, 452, according to the Zebra.

Below is a look at the average rates for older age groups. People in the 1920s pay the most while people in fifty pay the least, all other things are the same.

Seniors have relatively low crash rates, but are more injured in a crash and require expensive medical care.

The Most Affordable Commercial Auto Insurance In Michigan

In Michigan, a driver who has been convicted of driving under the influence of alcohol or drugs can have to deal with a premium that is the average two and a half times.

Below is a look at the impact that tickets and accidents can have on the average premium in Michigan, using the profile of a 30-year-old single man who controls a Honda Accord 2013.

The use of non-driving factors to praise car insurance has been attacked by Democrats, including Gov. Gretchen Whitmer.

According to the Zebra, Michigan women paid around $ 58 more than men – the average premium for a female driver was $ 2, 550 compared to $ 2, 492 for men.

Do You Need “full Coverage” Auto Insurance In Michigan? (it Depends…)

Male drivers account for 56% of the car accident in Michigan, so it is unclear why women pay more. It is possible that women have higher medical accounts or earn a claim. It is interesting that men pay more among teenage drivers, but that returns as the drivers get older.

There is also a small financial benefit to get married when it comes to car insurance. The average premium for a single, divorced or widow driver is $ 2, 492, which is $ 38 more than the $ 2, 454 for a driver who is married.

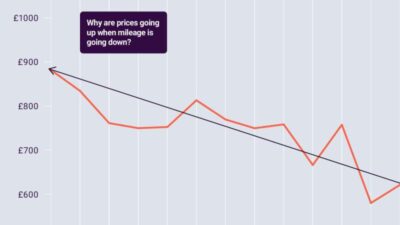

Although gender and marital status have a small impact on premiums, credit scores can have a major impact: drivers with a low credit score can pay three times more than those with an excellent score.

Insurance companies say they use credit scores in determining the rates because there is a strong correlation with credit levels and submitting auto-insurance claims.

What Is No-fault Auto Insurance In Michigan? (2025 Guide)

The graph below shows how that takes place, all other things are the same, for a 30-year-old single man who controls a Honda Accord 2013.

A policy that meets the minimum no-fault requirements from Michigan and has no collision/extensive coverage costs on average $ 1, 368 a year for a 30-year-old single man who controls a Honda Accord 2013, says De Zebra. Such a policy relates to other vehicles that you could touch, but it would not cover the costs of damage to your vehicle.

For about $ 740 more per year, the average driver could get a policy with collision/extensive coverage with a deductible of $ 1, 000. Lowering the deductible to $ 500 would cost an extra $ 164 per year.

The average costs in this scenario would rise if the driver buys higher liability coverage to protect against lawsuits.

Michigan Car Insurance Guide

A plan with a deductible of $ 500 for collision and extensive plus $ 300,000 in coverage of lawsuits with physical injury and $ 100 000 for material damage would cost $ 2, 392 -$ 121 more than the $ 500 deductible with coverage with a lower liability.

Michigan has around 7 million inhabitants with a driver’s license and around 11.1 million registered vehicles, according to the Michigan Secretary of State Office.

About 20% of Michigan’s directors are uninsured compared to a national average of 13%, according to reports from the insurance sector. In Detroit, the estimate of uninsured drivers is closer to 60%.

When an uninsured director has made a mistake in the event of an accident, insured drivers or their insurance companies usually cover the costs for material damage and medical costs. So, the more uninsured drivers, the more costs are moved to people with insurance. When is the last time you looked at your car insurance? Could you explain what each cover item means?

Auto Insurance Agency Troy Michigan

If your answer is, it is a while ago, or not quiz me, you are in a good company. Car insurance is one of the most complex products that you can buy.

But it is more important than ever that you understand your coverage. Michigan’s 2019 Auto No-Fault Law caused more risks for drivers and passengers.

Image of the Insurance and Financial Services department of Michigan This is where you can see PIP on your insurance form. Click to make bigger.

All drivers in Michigan had unlimited medical coverage for their policy, to pay for their own or medical care of a passenger after a car accident. That coverage falls under the PIP (personal injury protection) part of your policy. The law now enables people to choose lower medical coverage limits than unlimited. Most people can choose coverage of $ 250,000. People on Medicaid can choose as little as $ 50,000 and people with Medicare can completely unsubscribe from PIP.

Recommended Car Insurance Coverage For Michigan Drivers

However, the experts that we have consulted are unanimous to advise people to support their policy in the unlimited medical pip. Wayne State University Law Professor Wayne Miller said that the costs of hospital and post-hospital care for a serious accident can easily surpass $ 250, 000, and in the worst scenarios it can encounter the millions of dollars. Miller said that Skimpen is on PIP coverage: “The ostrich approach to buying an insurance. You know:” That will never happen to me. “And of course it is statistically unlikely that a terrible, precious, life -changing accident will happen to you.

Michigan’s old no-fault law forced car insurance companies to pay a reasonable rate for medically necessary care for injuries due to a car accident, including the most catastrophic, lifelong injuries. The car no-fault law-caps 2019 for that care. Rehabilitation centers of brain and spinal cord glasles and agencies that offer home care can only charge 55% of what they used to charge the care for victims of Auto accident. For the vast majority of these agencies, that amount is lower than the costs for providing care. That is why so many either went bankrupt or stopped taking auto accident patients.

So, although our experts still encourage people to retain unlimited PIP, it is not the same coverage as before. In many cases, catastrophic injured people will no longer be able to get professional care at home, or extensive rehabilitation services in a specialist residential clinic.

Brandi Marsh is often the only caregiver for her five -year -old quadribe daughter, because of the car No Fault Law 2019. “Her life is in my hands,” she says, for fear that her exhaustion will cause her to make a life -threatening mistake.

Car Insurance Laws Are Changing In Michigan

The law also concluded the number of hours that family members could be paid to ensure a seriously injured loved one at home. Families are limited to a total of 56 hours a week and have to look for the rest of the desk if their beloved needs care 24/7. Many have not been able to obtain care of the agency after the law has been amended.

Here is another “worst-case” scenario that our experts say that people with important assets must consider: what happens if you do not have enough coverage for physical injury liability? That is the part of your policy that pays for injuries that you cause to someone in a crash. Lansing Personal injury lawyer Steve Sinas said that when everyone had unlimited medical coverage, they usually did not have to sue the other driver to get the care they needed. If they are injured by someone with important assets, they are much more likely to sue that person.

“Let’s say that a child is playing on the street and you drive home, and you are rich and you look down on your mobile phone because you get