Auto Insurance Oklahoma – Minimum auto insurance requirements for Oklahoma 2025 (what are drivers in ok need) Oklahoma Minimum Auto Insurance Requirements 25/50/25, which means drivers must have a physical injury to a person with $ 25, 000 coverage for a person, $ 50, 000 for all injuries, 000 for all injuries, 000 and 000 for property damage to $ 22 per month Puts on.

Luke Williams is a finance, insurance, real estate and a home improvement expert in Philadelphia, Pennsylvania, specializes in writing and doing research for customers. He studied finance, economics and communications at Pennsylvania State University and graduated with a degree of corporate communications. His insurance and Finance writing on Spaxer, The Good Men Project …

Auto Insurance Oklahoma

Heidi works with top-rated insurance carrier to bring the highest quality protection for its clients. She established the Nophysical Termlife.com, which specializes in life insurance that does not require medical examination. Heidi regular contributor for many insurance websites, including Finance Buzz.com, Insurist.com and Forbes. As parents, she understands the need …

Auto Insurance In Oklahoma City, Oklahoma

Disclosure of Advertiser: We will try to help you make reliable auto insurance decisions. Comparison shopping is easy. We are not associated with any single auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships do not affect our content. Our views are our own. To compare the quotes of many different companies please enter your zip code on this page to use the free quote tool. If you compare more quotes, more opportunities to save.

Editorial Guidelines: We are a free online resource for those who are interested in learning more about auto insurance. Our goal is to the goal for everything related to auto insurance and a third party resource. We update our site regularly and all content will be reviewed by auto insurance experts.

Oklahoma Minimum Auto Insurance requirements ensure that each driver has the basic responsibility of protecting the basic responsibility, 000 25, 000 for physical injury, 000 50, 000 for danger and 000 25, 000 for property damage.

The USAA offers the lowest rates starting from $ 22 per month, followed by the State Farm $ 30 and travelers at $ 34. These companies meet the minimums needed for Oklahoma, but provide fair options for drivers to be compliant without breaking the bank.

These 10 Car Insurers Have The Highest Market Share In Oklahoma

According to the Oklahoma Act, drivers must have auto insurance responsibility to cover the risks they cause, ensuring the financial responsibility in accidents.

It is important to understand the types of auto insurance coverage of available auto insurance coverage and request quotes for reasonable limits for every coverage type you want to buy. Compare rates with our free quote tool to make sure you are getting the best rate.

In accordance with the Oklahoma Car Insurance Laws, drivers must meet the minimum responsibility of the state. One of these is 000, 000 for physical injury responsibility, 000 50, 000, 000 for physical injury to the accident 000 25, 000 for property damage.

This coverage ensures that the Oklahoma liability can pay for the risks that can cause accidents as needed for insurance requirements. However, these limitations are not enough in serious accidents, and drivers are responsible for additional costs that are not covered by insurance.

Oklahoma Uved Program

Drivers who seek low income car insurance in Oklahoma should consider policies beyond the minimum car insurance coverage of Oklahoma State. Adding a motorist coverage in Oklahoma or not insured motorists coverage provides additional protection if the other party does not have adequate insurance.

Although Oklahoma Auto Insurance Laws do not mandate full coverage auto insurance requirements, selecting comprehensive and friction coverage can help cover the vehicle repairs, regardless of the lack of a lack of collection. For more details, contact the Oklahoma Auto Insurance Claim Laws to contact the Oklahoma Auto Insurance Guide or to ensure full coverage.

Drivers who seek budget-friendly options are essential to find an affordable coverage that can meet the Oklahoma car insurance needs. In the minimum car insurance in Oklahoma, coverage is responsible for physical injury and property damage.

Among the top providers, the USAA offers the lowest monthly rate at $ 22, followed by the State Farm $ 29 and the passengers are at $ 34. These companies meet the requirements of Oklahoma Auto Insurance when providing competitive rates. To prevent gaps in coverage, compare from other providers such as Guko, Progressive and Alstate to meet the minimum car insurance coverage in the Oklahoma.

Ace Auto Insurance

If responsible insurance is mandatory, drivers should also consider the coverage of motorists who do not insure drivers in the Oklahoma coverage, which protects from drivers without insurance. So, do you need coverage of motorists who do not insure in Oklahoma? This is not mandatory, but adding it to the necessary protection.

To be compliant, make sure that your policy is in line with the minimum insurance coverage of the state of Oklahoma. Use online comparison tools to find the best rates when fulfilling all Oklahoma auto insurance requirements.

Before you shop for a basic auto insurance policy in Oklahoma, you need to understand how each coverage option works. You also need to know that when you request quotes from auto insurance providers, you need to specify the types and limitations for every product you choose.

Understanding these coverage will choose the way you meet legal and economic protection needs. Make sure your policy is connected to the insurance laws of Oklahoma and your personal conditions.

Auto Insurance Requirements In Oklahoma For 2025 (minimum Coverage In Ok)

Meeting minimum car insurance in Oklahoma standards is not just a legal need, but also for economic protection. Do you need a car insurance in Oklahoma? All drivers must have an insurance responsibility to meet the minimum insurance requirements of the Oklahoma to legally operate the vehicle.

The state uses an electronic system to verify coverage and provide insurance proof during traffic stops when drivers register their vehicles.

Failure to meet the minimum insurance requirements of Oklahoma may be a serious fine such as your vehicle registration and suspending driving license. The first time criminals face a fine of $ 250, 30 days in prison and vehicle impoundant.

There are stringent consequences for harsh consequences such as high penalties, higher license suspensions and increased insurance re -establishing fee. To prevent these penalties, ensure continuous coverage in accordance with the auto insurance laws of Oklahoma.

Best Car Insurance In Oklahoma (2025)

While the minimum car insurance requirements of Oklahoma confirm the legal consent, they may not provide adequate financial protection in a serious risk. Responsible insurance only applies to the risks that you can cause to others, including their medical bills and property repairs.

However, it does not cover your own injuries, vehicle damage or other personal losses. Depending on the high costs associated with the major dangers, it is advisable to predict whether the minimum coverage is really suitable for your needs.

The minimum responsibility in the Oklahoma saves you from expensive outside pocket costs after the risk of carrying more than coverage. Jeff Route Licensed Life Insurance Agent

To improve your financial protection, consider adding friction and comprehensive coverage. The friction insurance pays for repairs to your vehicle after the accident, regardless of the wrong, comprehensive auto insurance coverage protects against non -colon incidents such as theft, fire or destruction.

Oklahoma Car Insurance Requirements In 2025 (minimum Coverage For Drivers In Ok)

In addition, increasing your responsibility limitations can help prevent costs outside the pocket if you cause an expensive risk. Investing in an insurer/insurance motorist coverage will save you if you hit a low or insurance driver. Balancing cost and protection will ensure that you are well ready for unexpected expenses.

Oklahoma can seem time to buy a car insurance policy, but this is the fastest process when you request online quotes.

Before reaching some providers, you need to decide how much you want to buy each coverage option. You should also decide which auto providers to contact for online quote. Find out that some providers are ranked in customer service, claims and financial security than others.

When you shop online, you can find a great rate on your Oklahoma Car Insurance Policy for a few hours or less. However, since the rates may vary quickly, you should be ready to compare auto insurance quotes every six months. Don’t lose our free insurance comparison tool. Enter your zip code and start comparing rates now.

Oklahoma Uses License Plate Readers To Track State’s Uninsured Drivers

Yes, car insurance in Oklahoma is required legally. Responsibility (Read more: Best Property Damage Responsibility (PDL) Responsibility (PDL) Auto Insurance Companies, which contain 25/50/25 drivers must have responsible insurance in accordance with the minimum coverage limits of the state.

Oklahoma has to be at least $ 25, 000, $ 50, 000, 000, 000 in danger, and property damage to a person for a person for a person for Oklahoma. This is usually called 25/50/25 coverage. Enter your PIN code to explore what companies have cheap auto insurance rates.

Driving without insurance in Oklahoma can cause serious penalties, including a fine of $ 250, license and vehicle registration suspension, vehicle impoundment and up to 30 days in prison.

No, the coverage of motorists who do not insure in Oklahoma is not mandatory. However, insurance companies must provide it and this is recommended because an unhealthy or insured driver will cover your costs if you touch you

Combining Your Insurance Policies For Oklahoma Cheap Insurance

Yes, Oklahoma provides insurance coverage coverage, but this is optional. This can help cover the costs if the at-fault driver’s insurance is not enough to pay for your losses.

The full coverage usually involves liability, friction insurance and comprehensive insurance. While the Oklahoma law only requires coverage, full coverage provides a wide range of protection, covering non -collaring risks such as vehicle repairs and theft and destruction.

Oklahoma does not have a specific low-income car insurance program, but drivers can reduce costs by comparing rates, qualifying for discounts, and selecting only the state’s minimum coverage.

Clean Driving Record, Bundling Policies, Increasing Auto Insurance You can lower your rates

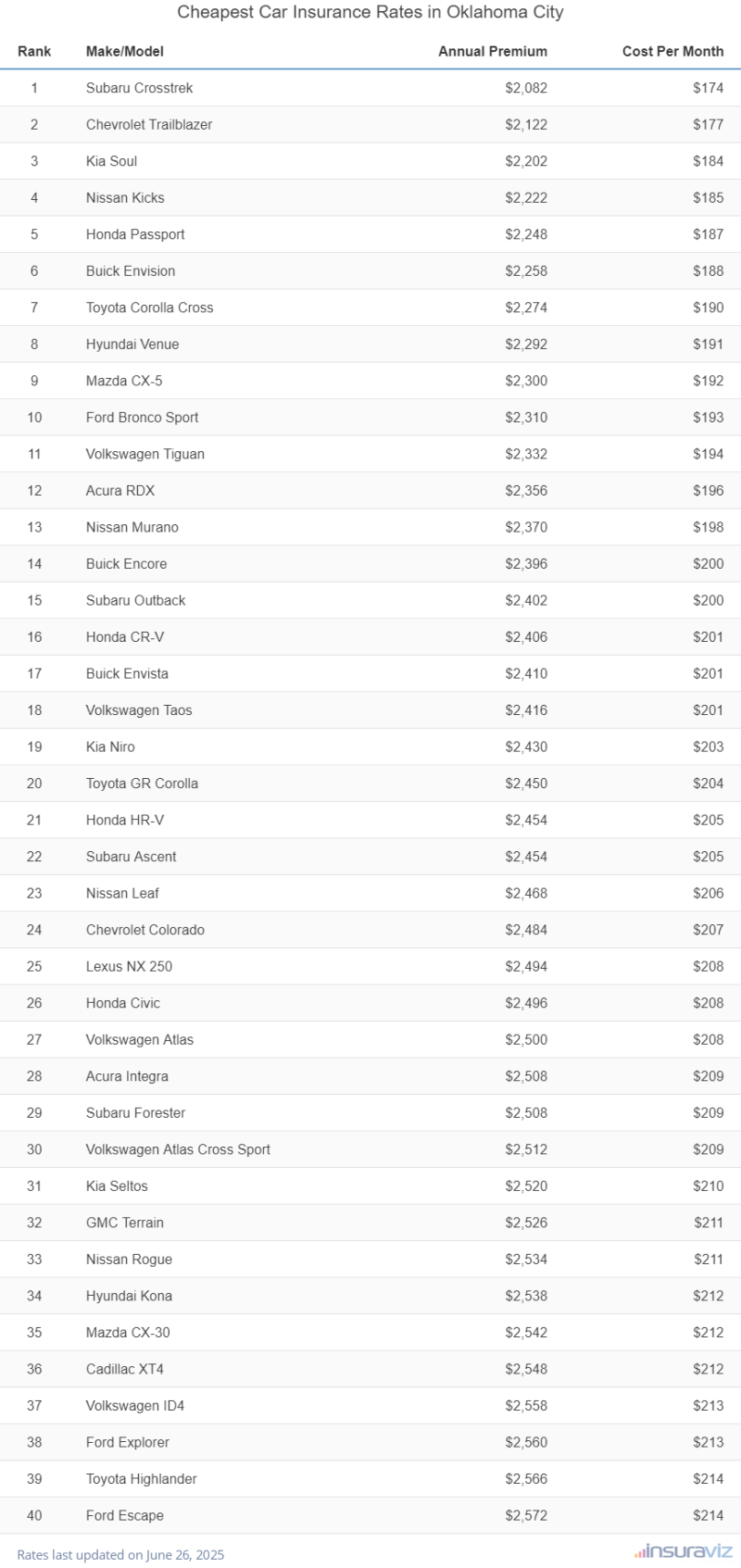

Cheapest Oklahoma Car Insurance Rates In 2025(top 10 Companies)

Oklahoma insurance brokers, oklahoma auto insurance companies, auto insurance tulsa oklahoma, cheap auto insurance oklahoma, oklahoma auto insurance, oklahoma city auto insurance, oklahoma auto insurance quote, best auto insurance oklahoma, best auto insurance in oklahoma, cheapest auto insurance in oklahoma, low cost auto insurance oklahoma, oklahoma city ok auto insurance