Auto Insurance Premium By State – In New York State, the average annual cost of car insurance is $ 2, 996. This is more expensive than any other situation in Merika, making New York one of the only three states in the country where the annual cost exceeds $ 2, 500, plus Louisiana ($ 2, 864 annually) and Florida ($ 2, 762). From the team to the Alan factory store comes this infographic which puts all 50 American states according to their average car insurance vehicles. It also includes information on monthly and annual costs for full insurance and low -coverage insurance.

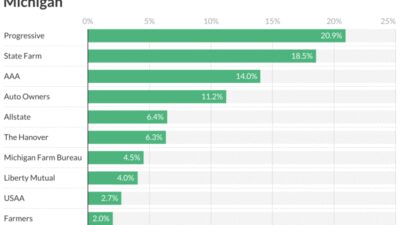

At the annual base of full vaccine, car insurance is the most expensive in New York ($ 2, 996 annually), Louisiana ($ 2, 864 annually), Florida ($ 2, 762 annually), Nevada ($ 2, 426 annually), Michigan ($ 2, 345 annually). Pennsylvania ($ 2, 002 annually), Georgia ($ 1, 985 annually) and delaware ($ 1, 963 annually). While car insurance rates are more expensive in these ten states, Maine can take claims to have the cheapest levels.

Auto Insurance Premium By State

In Maine, the average annual cost of a full car insurance is $ 876.00, making Maine the only situation to cost this less than $ 1, 000 on average. For low car coverage insurance in Maine, drivers can expect to pay an average of $ 227 annually. Other states with simple vehicle insurance standards (annual full coverage) include Vermont ($ 1, 000 annually), Idaho ($ 1, 065 annually), New Hampshire ($ 1, 182 annually) and Ohio ($ 1, 200 annually).

How Much Does Tesla Insurance Cost?

With annual costs aside, monthly rates of full car insurance throughout the United States can be scary as well, including New York ($ 249.67 monthly), Louisiana ($ 238.67 monthly), Florida ($ 230.17 monthly) and Nevada ($ 202.17).

According to research and data from a team at the Alan factory store, these are the only four states within their ranks where the average cost of car insurance exceeded $ 200.

We care about your privacy of using cookies on our website to give you the most relevant experience by remembering your wishes and return visits. By clicking “Accept”, you accept the use of all cookies.

This web uses cookies to improve your experience when you go through the web. Of these, the cookies that are listed as needed are stored in your browser as they are essential for the site’s basic functionality. We also use third -party cookies that help us analyze and understand how you use this web. These cookies will only be stored in your browser with your permission. You also have the opportunity to choose these cookies. But choosing from some of these cookies can affect your browsing experience.

Infographic: Average Auto Insurance Premiums For All 50 States — My Money Blog

Important cookies are absolutely essential for the web to work properly. These cookies ensure basic performance and web security services, anonymous.

Located by GDPR cookie approval software, this cookie is used to record user approval for cookies on the “Advertising” unit.

This cookie is installed by the GDPR cookie approval software. Cookie is used to store user permission for cookies on the “Analysis” unit.

Cookie is installed with GDPR cookie approval to record user approval for cookies on the “function” unit.

Average Cost Of Car Insurance For 19-year-olds (2024)

This cookie is installed by the GDPR cookie approval software. Cookies are used to store user permission for cookies on the “key” unit.

This cookie is installed by the GDPR cookie approval software. Cooks are used to store user permission for cookies on the other “unit.

This cookie is installed by the GDPR cookie approval software. Cookie is used to store user permission for cookies on the “Performance” unit.

Record the option -the core of the unit that corresponds to the CCPA status. It only works in conjunction with basic cookies.

Why Is My Car Insurance So High?

Cookie is installed with GDPR cookie approval software and is used to store if the user has accepted the use of cookies. It does not store any personal data.

Work cookies help you perform certain tasks such as sharing the contents of the web site on social media platforms, collecting improvements, and other third -party features.

Performance cookies are used to understand and analyze important web performance supports that help in providing better users’ experience to visitors.

Analysis cookies are used to understand how visitors interact with the web. These cookies help provide information on metric number of visitors, bounce level, traffic source, etc.

California Auto Insurance Market

The __Gads cookie, installed by Google, is stored under a Doubleclick domain and monitors a number of users see an ad, evaluates the campaign success and calculates its income. This cookie can only be read from a domain that they have been installed and will not track any data when browsing through other websites.

The _GA cookie, compiled by Google Analytics, calculates the visitor, session and campaign data and also tracks site use for site analysis report. The cookie stores anonymous information and provides a randomly designed number to identify unique visitors.

Installed by Google Analytics, _Gid Cookie stores information on how visitors use the web, while also creating a web performance analysis report. Some of the data collected include the number of visitors, their source, and the pages they visit anonymous.

Advertising cookies are used to provide guests relevant ads and marketing campaigns. These cookies track visitors on the web and gather information to provide privatized ads.

How To Change Auto Insurance When Moving Out Of State In 2025 (7 Easy Steps)

The CMPS cookie is installed by casalemedia for unknown users of users based on users’ web visits, by displaying the intended ads.

This cookie is set by Doubleclick to identify the user’s specific identity. It has a unique/unified identifier.

Google DoubleClick ID cookies are used to store information about how the user uses the web to submit and relevant ads and depending on the user’s profile.

Cookie, installed by pubmatic, registers a unique ID that identifies the user’s device that goes back to the web that uses the same ad network. ID is used for intended ads.

Auto Insurance Premium In 2025 (in-depth Explanation)| Autoinsurance.org

Cookie set by YouTube to measure bandwidth that determines whether the user receives a new or old player interface.

The YSC cookie is installed by YouTube and is used to track the views of videos embedded in YouTube pages.

Some unplanned cookies are those that are analyzed and have not been divided into a unit yet. If you are in the Gala fold, consider uncovering your phone or seeing it on a full screen to enhance your experience.

To expose many of the versions that appear on this web is from the companies that motley receives compensation. This compensation may affect how and where the products are visible on this web (as well as, for example, an order that appears) and can influence what products we write, but estimates of our products are not influenced by compensation. We do not include all companies or offers available in the market.

Car Insurance Rates Could Jump 50% In 3 States This Year. Here’s Where They Are.

Many of the products or all here are from our partners who pay us compensation. It’s how we make money. But our editorial integrity ensures that the estimates of our products are not influenced by compensation.

The average cost of car insurance over a whole year was $ 3, 017 in 2023, about $ 251 per month.

That’s a good chunk of change: it’s more than an average American uses clothing. And it equals 4% of the average wage in America.

Car insurance rates differ from the state and the provider, and are affected by your running record, credit score, and other factors. It is also a good idea to regularly check rates from car insurance providers beyond your current to see if a better plan is available.

Auto Insurers Reaped Nearly $30 Billion Pandemic Windfall Profit In 2020 As State Insurance Regulators Fail To Protect Consumers · Consumer Federation Of America

That average annual cost of car insurance in 2023 was $ 3, 017, according to quadrant. That’s about $ 251 a month.

Auto insurance has gained more expensive in the last three years. Average annual insurance payment of 2021 costs $ 2, 640, or about $ 220 per month.

While various factors influence your car insurance level, such as age, location, driving history, and credit mark, the total cost of car insurance has increased in recent years due to maintenance that expensive and dangerous weather that is constant and severe, resulting in car damage.

The type of car insurance coverage the car owner chooses to buy through their car insurance policy has a significant impact on the price of the policy.

Cheapest Car Insurance Rates By State For 2025

Low vaccines, which are vaccines that states require car owners to buy, is much cheaper than full coverage.

The average cost of low car insurance coverage in 2023 was $ 787 per year, approximately $ 66 per month. The most complete vaccine costs $ 3, 296 per year, approximately $ 275 per month.

Low auto insurance coverage generally include body injury liability and liability for property damage. The vaccine is often put together as a liability vaccine. They help cover the cost of injuries and property damage caused by another person at the time of the accident.

One reason why car insurance in central Atlantic tends to be the most expensive is that most states in the region require high liability coverage and can