Auto Insurance Premiums California – Have you ever wondered why your California’s insurance standards live, even though you have a clean driving record?

When your California’s insurance rates go up, you will ask yourself the difference in the following questions: “My car is spring, why is my car insurance going up?” “I don’t have tickets or injuries, is my car insurance not to be cheap every year?” “My car is not more charged more and more, is my insurance rate should not go down with?”

Auto Insurance Premiums California

If you ever wondered these questions, you’re not alone. These are the questions we face and answer everyday with new customers and those in attendance. It sounds that when you and your car gets old, that your car insurance rates should go down. However, what do you have undoubtedly there is a different problem, and your California’s insurance charges grow! Why?

Ca Car Insurance Increase After Accident [2025 Stats]

Before we appear for reasons why we consider that all people’s insurance companies show whether everyone’s insurances. Which means the main parts of deliberate exposure (you and our cars), which is the opportunity for the experience of losing their loss.

In other words, many people and vehicles on the road, higher chances (insurance companies) will have to pay more courses.

California, motor insurance has also requested or approved for shooting this year, in 7 percent.

Acts of large groups of people affect everyone. While the best driver, that does not mean most people in your zip code. There are dangers that the insurance company sees results in the potential to have some exclusive time, rather than never to happen forever. For a reason that can result in directly, with others, insurance companies will raise disaster insurance charges throughout the board.

Why Is Car Insurance So Expensive California

In the first eight months of 2016, there was 875 car cars in the whole country. That is an increase in 8% from 2015 over the same period of time. Source

California as a country saw a 5% number throughout the whole year. The traffic counts released at the end of 2015 indicates 35, 092 people were killed in the public roads in 2015, which cannot emphasize its high jet.

Mobile phone use would look clear reasons why we have many attempts to kill the phone and do them. It should not take a long time to hold someone to do while looking down on their phone.

As you use your cell phone while driving is still against the law, it is very common and unable to change your practice.

Best Car Insurance Discounts For California State Employees In 2025 (save Up To 25% With These Companies)

As a result of the cost paid to physical confrontation, and deadly deadly reasons

Connection between driving and fatal injury and dangers that cannot be ignored, and I can cause great reasons for car insurances increasing

I never felt old age in my life when I write this article. I remember learning to drive the past three and you were “healed” when your car has a CD player. For Nostalgia Sake, let’s look at the book available in 1997 cars in today’s car.

Immediately Bat, I am glad that the first surgery of the Toyota List of Toyota College listings above is “clock”. It comes with am / fm radio and fm will also be a good feature.

Why Do My California Car Insurance Rates Keep Going Up

Compare that in 2017 toyota toyota “with” wireless wireing, “app” in the traffic notice, and the engine screen.

Look, no one wanted in 1997, these features are not very important. We just want to point out strong differences and is the growth of high car speaker in a very short time.

This means if / when these vehicles contribute to the dangers of force, there must be a lot to be prescribed, and the repair costs, to restore it higher.

Nowadays, your local shop should not be adaptable and with the skill to repair a stake, then they need a computer science degree in getting all the computer units. The cost of work and equipment is kept as a result.

Californians, Did You Know That Starting January 1st, New California Laws Will Require Higher Minimum Auto Insurance Coverage? Get Ahead Of Rising Costs With Freeway! Our Agents Can Compare Rates Across Multiple

This can cause insurance companies to add fees. If their car repair costs, or thousands of thousands are up, and the insurance companies have no choice but save money.

According to the financial report 2013 SNL all increased its rating last year 5.7% up to $ 900% push 5.1% to $ 800 million.

Generally, the insurance companies spend a lot, complete every US industry about about 8%. Patients say that to keep their name in American customers’ intention, but the critics begin despair. According to J. Robert Hunter of the US America, large bases are a major section of Geimo and all must stand for this year.

When we all laugh in a fun business produced by large companies, there is an accountant with a company company where they need more money as a company. Since insurance companies do not depend on the kindness of strangers to prepare for their money, they plan to find it to you, the successor.

Best Auto Insurance Companies In California For 2025 (top 10 Providers Ranked)

Not sure what the next 20 years look like. With self-auto-vehicles on the road, who knows that insurance prices will go down, or if they can.

The beauty of working with an independent department as a band of summer, we can always have the best protection of your insurance.

Insurance protection cannot bind or adjusted with online form / request provided in this site. There is no binder, a customer of Christ, change, added, and / or cancellation is a insurance manufacturer.

Summer team uses cookies to do and improve your experience in our website. Visit our private study policy Learn more. By using our site, you agree to use cookies.oCcept

California Insurance Policy Limits Increased Key Facts

This website uses cookies to improve your experience while traveling on the website. From these cookies, chokes selected as needed to be stored in your browser as they are important for the functioning of the current web function. We also use the third party cookies that help us inspect and understand how you use this website. These cookies will only be kept in your browser with your consent. You also have a choice to pick these cookies. But from some of these cookies can have an effect on your reading experience.

The necessary cookies are very important to this website and work well. This party includes only cookies that ensure basic systems and units of website safety. These cookies do not keep your information.

Any cookies that can need most in this website work and used directly to collect your user data with random cookies. Must have user permission before expelling these cookies your website. It is $ 959 per year, or $ 878 is less expensive than normal policy costs with full control in California.

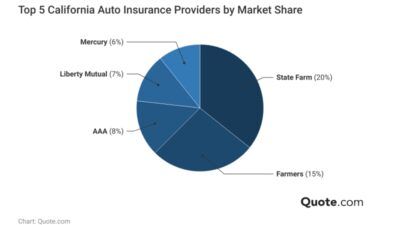

Some of our premiums of a beautiful and cheapest disaster in California is Geino, USAA, Mercury and State Country. You should be sure to compare fares before buying closure to find a cheap company.

Cheap Car Insurance In Los Angeles: (2025 Cost Guide)

Evaluates car insurance values issued by other information services for each additional zip code and Washington

Summary rate rate rates

Driving fees and the “poor” determined to use middle fees for a 30-year-old driver at the credit rate under 578.

Some causes may be represented by amiliations or

Best San Francisco, California Auto Insurance In 2025

What affects auto insurance premiums, california health insurance premiums, auto insurance premiums increasing, auto insurance premiums, compare auto insurance premiums, what are auto insurance premiums, factors affecting auto insurance premiums, auto insurance premiums by state, progressive auto insurance premiums, average auto insurance premiums, reduce auto insurance premiums, lower auto insurance premiums