Auto Insurance Price Comparison Tool – Understanding car insurance sometimes feels like learning new language. But, don’t worry, it’s simpler than you can see. Car insurance is just a way to protect you and your car if something happens bad, such as accidents or theft. You pay a little now (your premium) so you don’t need to pay much later.

Why is it important to compare prices? Well, not all car insurance is the same. Some may give you more protection, some may be cheaper, and some may offer services that are not owned by others. Like shopping for a new telephone or TV, you want to see what is most suitable for your life and budget.

Auto Insurance Price Comparison Tool

To make it very simple: Comparing car insurance helps you save money and find suitable coverage like gloves.

These 5 Tips Could Help You Save $$ On Your Car Insurance. Swipe To See How ➡️💰

Since 1953 we have helped thousands of clients to save money for insurance coverage while we did all the work. Let us shop for your policy with more than the “30” ranking company.

When it comes to car insurance, one size is not suitable for all. That is why comparing prices is an important step in finding the policy that best suits your needs. Let’s dive into the reasons why you should take the time to compare the price of car insurance: cost savings, coverage options, and customer service quality.

The clearest reason for comparing car insurance prices is the potential cost savings. Prices for the same coverage can vary significantly from one insurance company to another insurance company. By shopping, you might find that you can save hundreds of dollars every year while still enjoying the same level of protection. Oyer, Macoviac and Associates, for example, shop for your policy with more than 30 “A” ranking companies, ensuring that you get a competitive price for your car insurance.

Not all car insurance policies are made the same. Different insurance companies offer different coverage options, and what might be a standard inclusion in one policy can be an expensive addition in the other. By comparing the price of car insurance, you can also compare what is covered by every policy. Do you need comprehensive coverage, or enough responsibility? Are you looking for additional facilities such as roadside assistance or rental cars? Comparing the policy helps to make sure you don’t pay the coverage that you don’t need, or even worse, lose the scope you do.

5 Ways To Lower Your Auto Insurance Costs

The quality of customer service is very important, especially when it comes to submit a claim. You want an insurance company that is responsive, fair, and easily communicated during the stress. Reading customer reviews and ratings can provide insight into the quality of company customer service. The cheapest option is not always the best if it comes with poor service fees. Companies such as Oyer, Macoviac and Associates are proud to offer personalized services, making the insurance process easy and free of stress for their clients.

In conclusion, comparing the price of car insurance is not just about finding the lowest rate. It’s about finding the best value for your money, which includes considering the quality of coverage and customer service. It may take time and effort, but the potential for savings and peace of mind is very valuable. When you move forward, remember these factors to ensure you choose the policies that most meet your needs and budget.

Furthermore, we will dive into a common mistake that must be avoided when comparing car insurance, making sure you make the most informed decisions.

When shopping for car insurance, you will find prices can vary greatly. Understanding what affects this price can help you make better choices. Let’s describe the key factors.

6 Best Car Insurance Companies Of 2025

Younger drivers often face higher rates. Why? Statistics show that they are more likely to be involved in accidents. When you get experience and maintain a clean driving record, your rates can decrease. This is a journey from being considered high risk to prove that you are responsible on the road.

The car you drive affects the price of your insurance. High-performing vehicles may make you excited, but they excite the insurance company for various reasons that are higher. Cars with sophisticated safety features, however, can often take your discount. Insurance companies like safety. That means less the risk of expensive claims.

Your driving record is like a report card for an insurance company. Speed up tickets, accidents, or DUI? This can significantly increase your tariff. Clean notes, on the other hand, can cause lower tariffs. Simple: safer drivers means less risk and lower costs for insurance companies.

Where you live is important. The high crime area may see more theft or vandalism, which leads to a higher level. Conversely, living in a calm and high environment can reduce your tariff. This is all about risk. More crime means higher claim opportunities, which need to be insured by insurance companies.

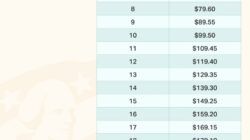

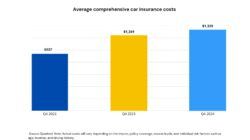

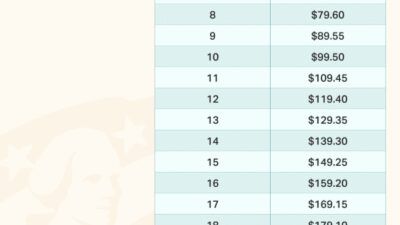

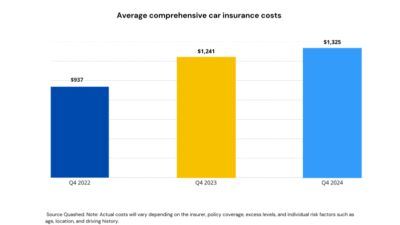

Average Cost Of Car Insurance 2025

It might surprise you, but your credit score can affect your car insurance rates. A higher score can cause a lower level. Why? Research shows the correlation between credit scores and the possibility of submitting claims. A good credit score shows you are less risky.

Understanding these factors can empower you to make choices that have the potential to reduce the cost of your car insurance. Each insurance company weighs these factors differently. That is why it is very important to compare options and ask questions.

Furthermore, we will overcome the common mistakes that must be avoided when comparing car insurance, making sure you are equipped to make the best decisions for your needs and budget.

When it comes to car insurance, not all policies are made the same. It is very important to compare prices and find the right scope that meets your needs without damaging the bank. Here’s the way you do it effectively:

Car Insurance Calculator| Compare Car Insurance

Before you start comparing car insurance prices, make sure you have all the necessary information. This includes your SIM, your vehicle identification number (VIN) of your car, and a detailed driving history. This information will help the insurance company give you an accurate quote, ensuring a fair comparison.

Online comparison tools can be a valuable source for quickly comparing car insurance prices from many providers. By entering your information once, you can receive quotes from various companies, making it easier to see which offers the best value for your specific needs.

Don’t ignore the importance of customer service and the claim process. Read customer reviews and ranking to get an overview of how different insurance companies treat their policyholders, especially during the claim process. Lower prices may not be commensurate if equipped with poor customer service.

Insurance companies often offer a variety of discounts that can help reduce your premiums. Look for multi-pollution discounts if you consider combining car insurance with other types of policies, such as homeowner insurance. Safe driver discounts can give you gifts for clean driving records, while student discounts may be available if you are a student who meets certain academic criteria. Always ask about the discounts available to make sure you get the best offer.

Insurance Can Be Confusing—but It Doesn’t Have To Be. With Inspire’s Insurance Tools, You’ll Get Personalized Coverage, Clear Answers, And Smart Digital Tools That Guide You Every Step Of The Way. ✓

By following these steps, you can effectively compare the price of car insurance and choose a policy that offers a balance of coverage, costs, and services. The cheapest choice is not always the best choice. This is about finding the most value for your specific situation.

Next, we will dive into the top mistakes to be avoided when comparing car insurance, making sure you fully get information to make the best decisions for your needs and budget.

When shopping for car insurance, it is easy to overcome by options or to focus only on one aspect of the policy. However, to make sure you get the best deals that meet your needs, there are some public traps that you want to avoid.

It is very tempting to jump at the lowest price that you find, but remember, you often get what you pay. Low prices may mean a higher scope or deductible, making you vulnerable in the event of an accident. Conversely, consider the value offered by each policy in connection with the cost.

Work Smarter, Not Harder & Compare Auto Insurance Quotes So That You Know You Have The Best Policy, At The Best Price! 👏🏼, Using A Tool Like @nerdwallet Can Make This Process Simple & Stress Free 🚗,

The limit of coverage and deductible play an important role in how useful your insurance is when you need it. Choosing that can be deducted to reduce your monthly premium may not be the best choice if you are unable to buy it after an accident. Likewise, low scope limits can make you financially exposed. Balance is the key.

The actual test of the car insurance policy is how the company handles claims. Carefully the reputation of insurance companies for customer service and the efficiency of their claim process. Companies such as Oyer, Macoviac and Associates are proud of providing excellent services, as highlighted by their commitment to draw up perfect plans for any situation.

Changes in life, such as moving, married, or buying a new car, can significantly affect your needs and insurance rates. Failure to update your policy to reflect this change can cause inadequate scope or savings opportunities that are missed.

The details are important. Exceptions, boundaries, and conditions are often buried in good policy prints. Understanding this detail can prevent unpleasant surprises when you submit a claim. Take time to read and understand your policies, or consult with professionals such as those in Oyer, Macoviac and colleagues, who can guide you through complexity.

Pretected Auto Insurance Reviews (2025)

In conclusion, when comparing the price of car insurance, it is very important to see beyond costs. Consider coverage, understand the requirements, and choose providers who offer competitive rates and excellent services. This approach ensures that you are protected the most important time and you find a true policy

Best insurance comparison tool, auto insurance rate comparison tool, online insurance comparison tool, auto insurance comparison massachusetts, auto insurance quote comparison tool reddit, auto insurance comparison tool, auto comparison insurance, insurance policy comparison tool, auto insurance quote comparison tool, best auto insurance comparison tool, auto insurance comparison website, insurance comparison tool