Auto Insurance Prices Rising – Kara Clery Kara Creda Licensed Kara insurance agent is a licensed manufacturer of securing personal lines from North Carolina. In addition to her insurance expert, she specializes in making insurance information available to everyone. It is passionate about breaking educational barriers in complex industries such as insurance so that everyone can understand which coverage they need and find the best amount of costs and coverage.

Reviewed by Chap Michie Chap Michie Exp Reviewer CHP is a licensed manufacturer of securing personal lines from north caroline. In addition to his expertise of insurance, the notion worked as a co-worker in the private capital for two years, and with J.P. Morgan Asset Asset for five years. It is passionate in optimizing balance between finance and operations as part of the search for maximum business efficiency.

Auto Insurance Prices Rising

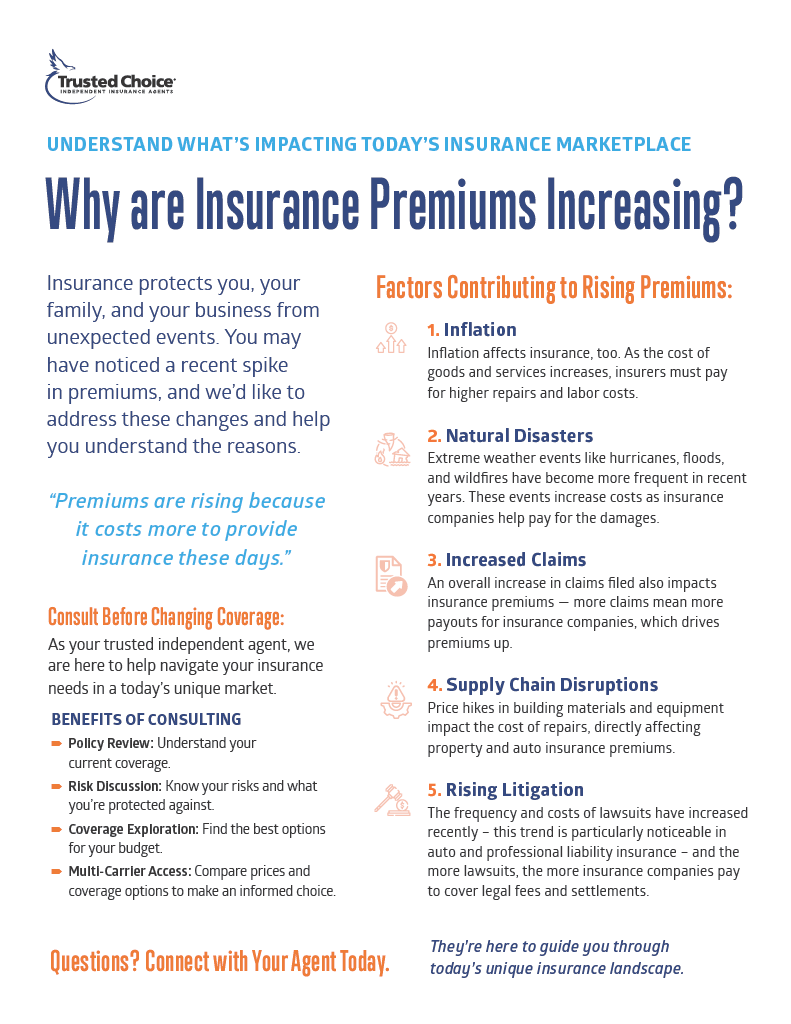

Car insurance premiums climb 2025 quickly in 2025. years, and drivers feel that. With inflation, supply chain disruptions and increasing repair costs, many Americans pay more than ever to remain insured.

Why The Price Of Car Insurance Is Surging And What You Can Do About It

To understand how consumers react, we surveyed over 1, 000 drivers. The results reveal growing frustration of price models, major behavioral changes in response to growth costs and clear generation sharing in drivers mode in driver mode.

This report is broken who pays more, which drivers victim make to stay secured, and as younger generations lean into technology and compromises to be redeemed in checking.

Many drivers felt a sting of rising car insurance premiums in 2025. years. This part of the study looks at which groups pay more and who feels most of the financial pressure.

Baby boomers have most likely reported a car insurance premium, with 72% saying their rates have risen this year. Approximately two-thirds of both gen and millennia (65%) have also been also experienced packages. Among those who saw an increase, over one in four (27%) said their annual premiums increased by 100 – 200 dollars.

Auto Insurance Costs Soar By 20% In The Us

Overall, 23% of the driver considered discharging coverage due to costs, with younger drivers, especially the financial grip. Gener Z drivers were more than twice as likely as babies to consider their car insurance due to cost concerns (38% compared to 19%). This suggests that many want to find more affordable policies, not to go without coverage.

Many consumers also ask whether these costs are growing justified. Almost three in four drivers (71%) believed insurers to use inflation as an excuse for raising the rate more than necessary, such as 75% General Z.

As the insurance premiums are climb, drivers make difficult decisions to manage costs or stare what they know if they cannot find better options. Here are how different generations react to growing costs and combined to be willing to make.

More than half of the driver (53%) stuck with his current car insurance, even as prices rose. One in five (20%), but could not find a better job, while almost one of 10 (9%) the Americans transferred the providers three or more times in the last two years. Baby boomers were most likely to increase their deductible for saving money (17%), compared to 9% millennium and gene z and only 8% genes X.

Commercial Auto Insurance Cost

Many also adapt how they like to cut. Millennials were most likely to reduce the ride due to growing insurance costs (16%), followed by baby bumers (15%), gene z (14%) and gene x (13%). These close numbers show that the financial pressure includes all generations.

Among the genetic beasts, 48% have delayed or skipped car maintenance due to insurance and vehicle costs, and 11% were even considered selling their car. Another 63% said they would be willing to accept a higher deductible in exchange for lower premiums, which was the highest rate of any age group.

Despite the efforts to reduce costs, many drivers feel that the system itself does not work in their favor. Over 4 in 5 (85%) believed that the insurance price models were unfair.

Faced with growing premiums, many younger drivers are open to alternatives that insurance could ensure more accessible. Learn how Gen is reacting with flexibility and strong interest in technology solutions.

Why Is My Car Insurance So High?

More than 2 in 5 (41%) GEN drivers considered the transition to the use-based insurance program (UBI) that monitors driving in exchange for potential savings. Almost 1 in 8 (13%) already uses it. In exchange for lower premiums, 35% of the General Number Z would be ready to give up certain freedoms for driving, such as avoiding late-night trips or acceptance of speed monitoring.

Gen z is also open to release technology on the road. Almost half (46%) said it would install security features with a drive on AI in their vehicles if it is intended to reduce its insurance costs.

As the premium is growing, drivers adapt to their budgets and review how, when, even if they remain insured. Many believe that the current models are unjust, and some are willing to sacrifice freedom or adopt new technologies in the hope of saving. Gen z stands out as the most flexible and technologically forward, while baby bumers seem more faithful to their insurers but no less influenced.

Data paint a clear image: growing costs forced drivers to adapt to ways that would permanently reshape consumer expectations and insurance self-insurance.

How Florida Drivers Are Adapting To Rising Insurance Rates

We surveyed 1, 006 American research management programs to growing car insurance premiums in consumers 2025. years. The generation fault was gene z (14%), gene x (26%), and baby bumers (10%). The survey data were collected in March 2025. years.

The guard service makes the purchase for automatic insurance, more affordable and less stressful. With the customers, we help the first access to drivers protect what is most important with keeping the process simple and transparent.

Electric cars can be the future, but some Hasseers say that the road was far digger than expected. From the defendants to the end premiums, new data reveal hidden

Uninvaised motor coverage protects you when an unsure driver strikes your vehicle. This insurance meets the financial gap when at-creal program does not have insurance to pay your injuries

Aa Says Cheaper Car Insurance May Exclude Vital Cover– Like Windscreen Repairs

The barefoot ride is not illegal in any state in America. This common misconceptions persisted for decades, leading many drivers to believe they had to wear shoes while driving a vehicle. For all drivers, vehicle insurance is needed, and other drivers, over in the US, with several exceptions.

Costs for this driving need are climbed from 2020. year, partly due to inflational launch of repair costs and parts; Between June 2023. and 2024. The price of personal insurance of the motor vehicle increased by 19.5%.

In addition, motor vehicle insurers may increase insurance costs due to growing repair costs and lower yields from the insurer’s bonds.

Insurance costs are growing faster than general inflation. Consumer price index data in 2044. They showed that the motor vehicle insurance index – Change insurance costs over time – amounted to approximately 2.7 times higher than the rate of inflation at the international price.

Auto Insurance Rates Dropping In Ontario, Rising In Alberta

According to the Congress Research Service, growing inflation increased the costs of repair and part, directly affects premiums. Inflation spikes 2021 (7%) and 2022 (6.5%) have led to larger prices of building materials and automatic repair, directly affecting insurance rates.

When the Federal Reserves were charged in 2022. year, there was a significant reduction in the value of insurant bonds, influenced their total financial stability.

With fewer income from insurance bonds and higher total repair costs, insurance companies can increase the price of existing policies to compensate for this income loss.

State-specific regulations may affect rates. Complex regulatory frames can be delayed or increased moderate rates, while states with more flexible regulatory environments allow them to quickly adjust the rate in response to market changes.

Car Insurance Prices Rising: Tips To Save Money

These data were retreated from the BLS, following the nation charge rate and motor vehicle insurance rate. Additional sources from state government pages explaining regulatory laws and car insurance standards, as well as Congress Report on the Research Service on Factors that affect the high cost of insurance for consumers.

Read about how much it costs to own a car and get the facts each week by signing our newsletter.

All data on the page were produced directly from government agencies. Analysis and final review was performed by .LAST Updated: 18. September 2024Auto insurance rates jump for 48% drivers, encouraged costs to reduce costs – page all

It seems that the American increase in inflation is to finally encourage, but several years of growing costs left everyday life less accessible. Grocery, energy and residential products have received the highest media attention, but the car is quietly spiked more than most other consumer costs.

Why The Average Car Insurance Price Is Rising And What You Can Do About It

Car insurance costs jumped almost 50 percent from 2020. years, and this trend does not show a character of abicinations. In a recent survey, almost 1, 000 drivers, the most said that their insurance costs continue to grow. Our findings have also found anxiety and life adjustments caused by such spiral costs.

Read to discover how many Americans affect the increase in car insurance costs, how you solve the load and how you can manage your prime minure without increasing the exposure to risk or resort to fraud.

Although American inflation is merciful cooling, it does not mean that prices decline – they grow more slowly. This mitigation also did not affect all industries equally. Growing costs