Auto Insurance Quote Arizona – 9 The best auto insurance companies in Arizona (find top providers here!) At national level, freedom and state farm are the best auto insurance companies in Arizona. Responsibility rates start at 33 USD per month to meet the limits of 25/50/15. Secure drivers earn a 40% discount at national level, a joint freedom loan covers newer vehicles, and state -owned costs to reduce multi -policy household farms.

Luke Williams is an expert on Finance, Insurance, Real Estate and Homes based in Philadelphia, Pennsylvania, specializing in writing and researching consumers. He studied finance, economics and communications at Pennsylvania State University and graduated with a Bachelor of Corporate Communications. His writing and writing finances are shown on Spoxor, Project Good Men …

Auto Insurance Quote Arizona

Kristen is a licensed insurance agent working in the field of Big Boston. It has over 20 years of experience with counseling individuals and business activities in which insurance policies are best suited to their needs and budgets. She knows that everyone has their own unique needs and circumstances and is passionate about counseling others that politics is appropriate for them. Licensed in Massachusetts, Newoo Hampshire …

Call Or Text Us For An Auto Insurance Quote! 208-403-0154

We strive to help you make confident insurance and legal decisions. Finding confidential and reliable insurance should be easy. This does not affect our content. Our opinions are ours.

Editorial Guidelines: We are a free resource online for anyone interested in learning more about insurance. Our goal is to be an objective third -party resource for everything related to legal and insurance. We regularly update our site, and the whole content is reviewed by experts.

The best car insurance companies in Arizona are nationally, freedom and state farm, to operate high accident rates and expensive damage to city across cities like Phoenix.

Nationally, it helps Arizona drivers with bad credit to save up to 40% through discounts based on Smartide behavior. The Community of Freedom covers a complete replacement of the car after the storm, which is ideal for Tucson’s weather risks.

Guess The 15 States With The Highest Average Car Insurance Rates 🇺🇸🚗 Follow Us To Find Out The Top 10 States! Methodology Moneygeek Analyzed Millions Of Car Insurance Quotes To Find The

The State Farm offers a 35% discount for good students and 17% for packages. Drivers across Arizona, including Mesa or Glendale, can still meet the account of 25/50/15 of the state, rates starting at just $ 33 a month.

Enter your zip code to get multiple insurance insurance and quickly find the lowest available prices based on your specific location and driving profile.

The average car insurance cost in Arizona varies depending on the level of coverage, driving history, the city you live in and the company you choose. The United States holds the rates of low levels for $ 33 a month, but it is only available to military members.

Monthly minimum state farm coverage of US $ 42 gives Arizona drivers strong demand and access to discounts with more policies. The progressive $ 44 starting monthly rate sounds cheap, but it can increase rapidly after a breakdown accident or break.

Cheapest Car Insurance In Arizona (august 2025 Rates)

Allstate charges $ 94 a month, but offers perks as forgiveness for accidents, which can help Arizona drivers avoid hiking after their first accident. The $ 93 rate of Liberty Mutual often involves better benefits to replace the car, offering greater safety for newer vehicles.

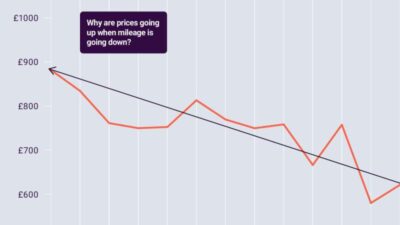

The flexible model of mileage -based prices at national level makes it ideal for remote workers or part -time travelers through Arizona, in search of reduction in monthly costs.

Responsibility Auto insurance and uninsured driver cover is needed in Arizona, but other policies are of choice. The more coverage you choose, including accessories as forgiveness for accidents, the higher your insurance rates in Arizona. Take a look at the nitrogen coverage options below.

Choosing the right kind of policy is important because not every accident or emergency is covered in the same way. Good policy makes the difference between jumping quickly and fighting to recover. Be aware that you may need to carry full collision coverage and comprehensive car insurance if you have an automatic loan or lease of a vehicle in Arizona.

Young America Insurance L Auto Insurance From $20/month

Auto insurance rates in Arizona are changing quickly after your record is no longer perfect. An accident, ticket or DUI can increase your monthly payments by hundreds, making it difficult to find affordable coverage.

Time to compare car insurance companies becomes crucial when they avoid an increase in the rate of injury. Even small tickets collect accounts. One accident can add over $ 100 a month, with Allstate drivers see the steepest increases. DUI to carry even sharper fines, pushing Liberty’s spending to $ 446 and limiting access to better policy options.

In Arizona, your credit score may collect or reduce car insurance bill more than expected. The higher result unlocks better rates, while fair or bad credit can quietly add hundreds of dollars to your annual costs. Drivers with a good credit stay near $ 110 a month with top companies.

The best car insurance companies in Arizona for bad credit are progressive and nationally. Their competitive rates are cheaper than the state farm, Allstate and passengers.

Auto Insurance Coverages Help Protect Your Finances If You’re In An Accident Call Or Text Me For A Free Quote. 📞623-734-4159 . . . #insurance # Arizona #lifeinsurance #autoinsurance #homeinsurance

Which use based on use may be best for you? Start here to find out about the technology behind to help you save. https://t.co/ut9fdu6uht – at national level (@nationwide) May 19, 2020

Drivers with bad credit can register for a national level of smartid or smartmiles for even cheaper prices. Find out more haki to save money on car insurance.

Auto insurance rates in Arizona are not accidental – they reflect the true daily risks that drivers face. Works such as theft rates, traffic forms, and even sudden weather events, everyone shapes how much you end up paying for car insurance in Arizona.

Clashes, storms and thefts all shape why insurance rates look as they do, and bigger payments are pushing the premiums higher across Arizona, especially when drivers have to apply for great damage insurance. Knowing what types of claims occur most often help Arizona drivers choose smarter cover and avoid expensive surprises.

Getting Auto Insurance For Your 16 Year Old

Clashes lead the road, often costing drivers 3, 000 or more after repairs. Weather demands from city and windy are not rare, especially during the storm season in Arizona, when the $ 2,500 repair bills are rapidly rising. Theft and vandalism are rare, but expensive, with stolen cars on average $ 4,000 without strong cover.

The low theft rate helps to reduce comprehensive costs, while heavy traffic in Phoenix and Tucson increases the premiums for responsibility and collision.

Driving in Arizona is not the same everywhere. Where you live or travel can have a real impact on how much you pay for auto insurance. Cities with more accidents and claims usually see higher premiums, even for drivers with clean records.

Phoenix drivers feel the biggest hit, with 50,000 accidents annually higher driving insurance rates. Mesa and Tucson also see frequent claims, which increase premiums for both long -standing residents and newcomers. Drivers in smaller cities as a surprise and peoria often pay less because fewer accidents mean a lower risk for Auto insurance companies in Arizona.

The Southwest Financial Center

Choosing the best auto insurance companies means knowing which programs actually help reduce long -term costs and notice discounts for car insurance you can’t miss. Drivers who understand how discounts work can unlock real savings without giving up important coverage.

The 40% good driver discount at national level is one of the biggest awards for Arizona drivers with clean records, maintaining full coverage affordable. A good student discount on the state farm helps young drivers manage premiums while building a strong insurance history.

Discounts with discounts like a 25% discount on the American family for home and auto -policies make a real difference for families that manage multiple policies. These discounts for package paired with more car discounts help Arizona households reduce insurance costs across the board. Even the discounts of loyalty, as well as 18% of the American family, reward Arizona drivers for adhering to a company that appreciates them.

If you want to save with the best auto insurance companies in Arizona, there are several smart ways to reduce the rate. Registration for telematics programs such as Smartride or SmartMiles at national level can bring you up to 40% off if you drive safely or do not put many miles.

Aarp Auto Insurance: Save $577† On Average

Also, maintaining a clear record – only one accident can increase your rate by over $ 100 a month, and DUI can increase it to $ 446 with some service providers. The assembly of your auto and domestic insurance, especially with companies as a state farm, can deduct a 17% discount from your account. The loan plays a role in Arizona, so improving your result can make a big difference.

Choosing a comprehensive car insurance helps places like Tucson and Phoenix, where demands for city and theft can become expensive quickly. To see what savings you qualify, enter your zip code and compare personalized S from top insurance companies in Arizona.

The best auto insurance company in Arizona is between the State Farm and Alstate, which stand out with strong multi-political and safe discounts on the driver.

Yes, Geico covers Arizona and offers useful accessories as mechanical insurance for malfunction and forgiveness for accidents, along with competitive rates in cities like Mesa and Tucson.

Arizona Commercial Auto Insurance (2021)

Are auto insurance rates high in Arizona? Arizona car insurance is so expensive because of the density of traffic in urban areas, high average claims (3, 000+ per collision) and frequent weather -related repairs. If you are wondering, is it bad to give up automotive insurance? Keep in mind that lag in coverage can lead to higher future premiums and potential legal penalties.

The cheapest car insurance in Arizona is offered by USA for military members and families, followed by a progressive and state farm for minimal liability, especially for drivers with clean records.

Yes, choosing a higher refusal to Arizona can significantly reduce your premium, but it also means you pay more out of the pocket after a claim, especially during damage to the storm.

Liability insurance for drivers in Arizona