Auto Insurance Quote Delaware – Cheap car insurance in Delaware for 2025 (10 best companies for savings) Get cheap car insurance in Delaware from $ 43 per month with top providers such as travelers, progressive and Geico. Known for affordability and reliable coverage, these companies offer the best rates and service. Compare options to find the right car insurance in Delaware and save on premiums.

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After he left the class, Laura used her skills to write in many different industries, including insurance, finances, real estate, home improvement and health care. Her experience in different industries has contributed to the development of both …

Auto Insurance Quote Delaware

Ty Stewart is the founder and CEO of Simplelifeinsure.com. He started researching and studying about insurance when he received his first policy for his own family. He can be seen as a speaker of insurance expert at agent conventions and in top publications. As an independent permit insurance agent, he helped customers nationally to guarantee affordable coverage and at the same time make the process …

Cheapest Car Insurance In Delaware (august 2025)

Advertiser disclosure: We strive to help you make self -assured insurance decisions. Comparison shopping must be simple. We work together with top insurance providers. This has no influence on our content. Our opinions are ourselves.

Editorial guidelines: We are a free online source for anyone interested in more information about car insurance policies. Our goal is to be an objective source of third parties for everything related to car insurance policies. We regularly update our site and all content is assessed by car insurance experts.

The top choice for cheap car insurance in Delaware is travelers and offers the best rates from just $ 43 per month. For affordable coverage, Progressive and Geico also stand out with competitive prices and reliable service.

These providers not only excel in affordability, but also deliver reliable coverage options to the needs of Delaware drivers. Every insurer on this list offers unique benefits, from bundle policy to discounts for safe driving, so that you can find the right fit for your circumstances.

Downes Insurance Associates, Inc.

Comparing best car insurance companies in Delaware helps you to find the most affordable and extensive coverage for the best value. Consult our report entitled ‘Types of car insurance covering’ to deepen deeper.

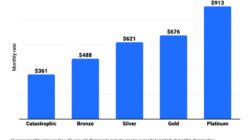

When exploring cheap car insurance in Delaware, it is essential to compare monthly rates and available discounts from different providers. This guide offers a detailed overview of the monthly rates for both minimal and full coverage of leading insurance providers in the state.

Travelers offers the best value for cheap car insurance in Delaware and provides exceptional coverage at the lowest monthly rates.

Moreover, it outlines the discounts that each company offers, giving you the tools to find the most affordable and valuable car insurance options in Delaware. By investigating these rates and discounts, you can make a well-considered decision that suits your budget and coverage needs.

13 Surprising Car Insurance Cancellation Laws To Know

To secure the best cheap car insurance in Delaware, it is essential to evaluate both the rates and the discounts of different providers. This extensive comparison will help you identify which companies offer the most competing rates and valuable savings options.

Use this data to thoroughly compare coverage options with different providers and to explore the different available discounts. By doing this, you can maximize the savings and lower your insurance premiums, so that the most cost -effective and extensive car insurance solution is ultimately tailor -made for your needs. Consult our guide with the title: “Will my car insurance cover other cars?”

In Delaware, maintaining the minimum car insurance requirements is crucial for legal compliance and financial protection. The situation sets specific minimum coverage to ensure that drivers are sufficiently protected in the case of an accident. Here is a breakdown of the minimum coverage requirements that you should pay attention to:

Meeting the minimum coverage ensures legal compliance and basic protection, but higher limits offer better financial security in the event of serious accidents. Delaware works as an “AT-Fault” accident status, which means that if you are responsible for an accident, you are legally liable for personal injury or property damage claims arising from the incident.

Request Auto Id Card

Although Delaware is not obliged to consider uninsured/under -secured motorist coverage, it is a valuable option to consider. You and your passengers can protect this cover if you are involved in an accident with a driver who lacks sufficient insurance. Choosing this additional protection can help you protect against financial vulnerability in these situations, in particular by tackling how accidents change your car insurance percentage.

Insight into the most common types of claims can help drivers to anticipate potential costs and to make informed decisions about their coverage. These top five claims in the state include collision damage, extensive damage, physical injury, liability for material damage and uninsured motorists claims, each with different characteristics and financial effects.

Maintaining proof of financial responsibility is a legal requirement for all directors in Delaware. This regulation ensures that you are financially prepared to cover the average car insurance costs in connection with car accidents, which protects both yourself and others on the road. Acceptable financial responsibility includes valid liability, car insurance policy, ID card or insurance folder.

To meet the legal requirements of Delaware, it is essential to provide valid evidence of financial responsibility when requested by law enforcement or during the aftermath of an accident. This documentation proves that you have sufficient coverage to handle liabilities from a collision, so that you can prevent fines and being complied with with the state regulations.

Understanding Your Car Insurance Declarations Page

Although Delaware’s minimum liability insurance meets the legal requirements for basic insurance, exploring additional coverage options can offer improved protection and peace of mind. Here are some important options to consider:

Choosing extra liability coverage in Delaware can significantly improve your financial protection and offer more extensive support in different scenarios. By evaluating these options, you can adjust your insurance policy to better meet and protect your needs against higher risks and unexpected events.

Analyzing the accident of Delaware and claim data per city is evident from different levels of risk throughout the state. The high numbers of Wilmington indicate a need for possible higher coverage, while smaller cities such as Rehoboth Beach pose a lower risk. Insight into these statistics helps you to choose the right car insurance and planning possible claims, improving financial planning and coverage decisions.

In Delaware, the driving licenses of the row must be personally extended every eight years with a vision test and new residents must obtain a license within 60 days of relocation. Teenagers must follow the course of a director and have a permit from a student up to the age of 18. License aprons require the submission of an SR-22 for recovery and address changes must be reported to the DMV within 30 days.

Delaware Car Insurance Requirements In 2025 (everything De Drivers Should Know)| Us Insurance Agents

These regulations cover everything, from licensing to requirements for new residents, including whether you can get a car insurance without a license. Insight into the laws of Delaware’s vehicle license is crucial for maintaining driving rights and avoiding fines such as fines or suspension, making the license process more efficient.

By staying aware of changes in the law and fulfilling all necessary obligations, you can keep your rice status in good condition. Ultimately, this knowledge enables you to drive confidently and responsibly, while you adhere to the state guidelines.

The car insurance landscape of Delaware offers various discounts and premium options that influence the total costs and the coverage quality. For discounts, Delaware scores well with high reviews for safe driver discounts (up to 20%) and multi -length policy (up to 15%), available at top providers such as State Farm and Progressive.

However, anti-theft device discount and low mileage receive lower figures, as a result of smaller savings. With regard to premiums, Delaware maintains a solid performance with good affordability and coverage options, although customer satisfaction and claim processing can see improvements.

Do Auto Insurance Quotes Change Daily? (what You Should Know In 2025)

Although top discounts and affordable premiums make it easier to find savings, areas such as customer satisfaction and claim processing suggest opportunities for improvement. By understanding these figures and options, you can better navigate your insurance choices and optimize your coverage to meet your needs and budget.

Compliance with Delaware’s road rules is essential for maintaining safety and legal compliance while driving. Following these regulations and implementing driving tips for road safety can help prevent accidents, minimize traffic violations and promote a smoother traffic flow. Here are five crucial row rules to keep in mind:

Entering yourself with and following these essential traffic rules in Delaware not only helps you to stay within legal limits, but also promotes a safer driving environment for everyone. By adhering to these regulations, you contribute to road safety and avoid possible fines, ensuring a smoother and safer driving experience.

The article offers an extensive overview of the Top 10 companies that offer cheap car insurance in Delaware, starting with rates as low as $ 43/month. It emphasizes leading providers such as travelers, Progressive and Geico, known for their affordability and reliable coverage. It describes the advantages and disadvantages of each insurer and emphasizes factors such as customer service, discount and coverage options.

How To Save Money By Comparing Car Insurance Quotes

In addition, the article relates to the minimum coverage requirements of Delaware, legal compliance and the value of exploring different discounts to maximize savings. It advises readers to use their zip code for personalized rate comparisons to find the most cost -effective and extensive car insurance for their needs. Consult our in -depth report ‘Auto Insurance Buying Guide’ to deepen deeper.

Protect your vehicle at the best prices by entering your zip code in our free comparison tool for car insurance policies below.

The cheapest car insurance in Delaware is