Auto Insurance Quote In California – The collision car insurance by 2025 (explained coverage) The automatic collision insurance covers damage to the vehicle after accidents, regardless of the fault. USAA has the lowest rate to $ 120 per month. You can add collision insurance to full coverage for $ 165 a month. The highest deductible can reduce the costs of collision automobile insurance, but older car coverage may be smarter.

Melanie Musson is the fourth generation of his family to work in the insurance industry. He grew up with the insurance conversation as part of his daily conversation and has studied to obtain an in -depth knowledge of the state’s specific insurance laws and dynamics, as well as a broad understanding of how the insurance in each person’s life is in line, from budgets to coverage levels. During his years working in …

Auto Insurance Quote In California

Brandon Frady has been an insurance agent and a licensed insurance manager since 2018. He has experience in companies from retail to finance, the job positions of cashier in management, but it was not until Brandon began working in the insurance industry that he really felt in his home in his career. In his daily interactions, he aims to live his business philosophy in the way he is treated …

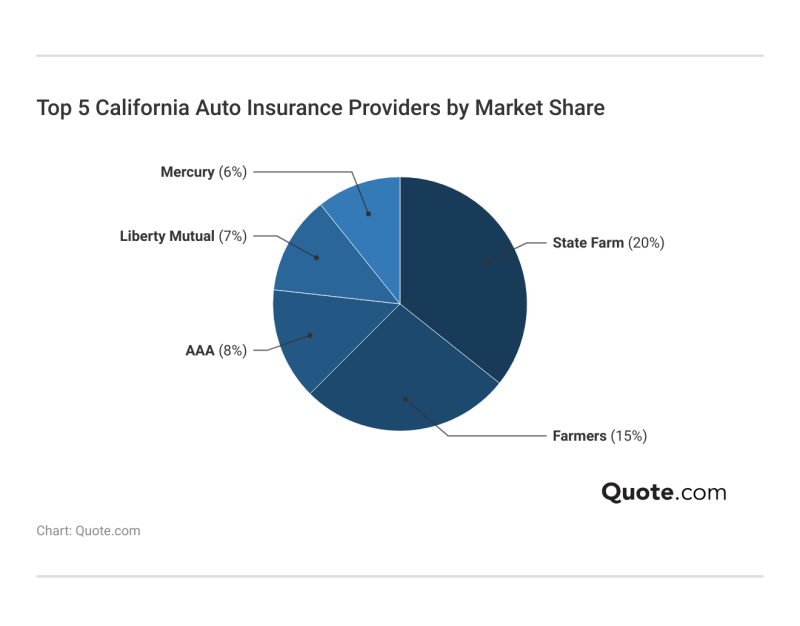

10 Best Auto Insurance Companies In California For 2025 (top Ca Providers)

We strive to help make insurance decisions and legally confident. Finding trust and reliable insurance should be easy. This does not influence our content. Our opinions are ours.

Editorial guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be a target and third party resource for everything related to insurance. We update our place regularly and all the content is reviewed by experts.

Browse the car insurance collision does not have to be complicated. This specialized coverage pays repairs to your vehicle after accidents with other cars or objects, regardless of the fault.

This guide breaks down the definition of collision insurance and details car insurance discounts that you can not miss. You will discover which vehicles benefit the most from the protection of collisions and when they are covered.

California Auto Insurance: Get A Quick, Reliable Quote Today

Learn to balance deductible, evaluate coverage limits, and determine if collision insurance has financial meaning to you. Do not pay for car insurance. Enter your zip code to find out if you can get a better offer.

What is collision car insurance? Collision car insurance covers damage to the vehicle caused by an accident, regardless of the failure. Pay repairs or replacement if you touch another car or object. If you have totalized your car without any collision insurance, you will need to cover the costs yourself.

If you are looking for a collision coverage, comprehensive insurance protects against theft, vandalism and when natural animals or disasters damage the vehicle.

Complete and collision insurance is often combined with minimum responsibility for full coverage car insurance. This coverage is useful for newer vehicles, but it may not be profitable for older cars. Knowing when to set aside collision insurance depends on the value of the car, if the repair costs exceed their value, it may not be necessary.

Full Coverage Car Insurance In California

When considered the advantages and cons of the collision car insurance, this coverage exclusively protects against vehicle accidents and accidents in a single vehicle, regardless of the fault. Collision’s main advantage is to protect your investment after accidents and complements full and liability insurance to provide full coverage.

Collision rates vary significantly when compared to automobile insurance companies. While USAA offers the best value for $ 120 per month, it is only available to military families. State farm and travelers are the upcoming affordable options for collision and complete coverage.

Before choosing to base it exclusively on the meaning and cost of collision automatic insurance, also remember to evaluate complete options. It will increase your rates, but comprehensive automatic insurance protects against non -collision incidents that collision insurance does not cover.

Always request this personalized factor in your specific eligibility to obtain discounts. A complete coverage policy with collision insurance can become more affordable if you are a safe driver or secure -you are several vehicles.

Cross The Border With Coverage That Keeps You Protected From Start To Finish. Visit Our Website To Request Your Free Mexican Auto Insurance Quote Today: Www.costulessdirect.com/insurance-solutions-california/mexican-car- Insurance

For example, although progressive collision coverage limits may seem expensive to $ 160 a month, the use (UBI) -based potential discount on 40% (UBI) could reduce the costs spectacularly compared to companies with lower basic rates, but less discounts.

Opt for a higher deductible collision if you have substantial savings. This can reduce the monthly premium without sacrificing the essential coverage.

If you do not welcome many discounts, increasing your deductible collision insurance is one of the best tips to pay less for car insurance. Just make sure you can pay off pocket costs in case you have to file a collision claim after an accident.

Collection car insurance is recommended for funded and rented vehicles, where lenders require protection for their investments. Luxury and new vehicle owners benefit more, just as high-risk drivers like adolescents who are most likely to join in inexperience accidents.

Best Car Insurance In California For August 2025

Dyk teenagers are more likely to have drivers over 20 years old in a fatal collision? http://t.co/2s1felfra23. #Summersafety pic.twitter.com/LHJPadppux – USAA (@usaa) July 9, 2015

Should you have collision insurance in a ten -year car? If the value of your vehicle exceeds your deductible, the falling coverage can help reduce car insurance rates.

While collision insurance can reduce premiums, consider if you can afford repairs in your pocket. For budget conscious drivers, comparing suppliers can help find the cheapest car insurance with proper coverage balance.

While USAA provides exceptional value to only $ 120 a month, you may find cheaper collision car insurance elsewhere. Enter your zip code to start comparing the local business collision insurance for free.

Cheapest Car Insurance In California For August 2025

Collision coverage pays repairs to your vehicle after accidents with other vehicles or objects, regardless of who is to blame. It covers accidents of a single vehicle such as rolls and collisions with stationary objects such as sticks or trees.

Both serve for different purposes. Collision insurance covers accident damage, while complete policies cover non -accident events such as theft, vandalism and natural disasters. Most financial experts recommend having the two newest vehicles.

Collection insurance does not cover damage to theft, vandalism, fire, floods, hail, falling objects, animal impacts or natural disasters. Comprehensive insurance covers these events.

Collection insurance is usually not worth it when the vehicle value drops below 10 times the annual premium. For older vehicles worth less than $ 3,000, you could consider collision coverage to save at premiums. Check the ways to lose money in your car for more savings strategies.

Give Us A Call For A Free Insurance Quote 2400 Wible Road Suite 5 Bakersfield Ca 93304 Office 661-412-4139

This depends on your financial situation. A deductible $ 1,000 amount reduces the premium but requires more out -of -pocket expenses during claims. A deductible $ 500 means higher premiums, but less financial tension in a claim.

You should pay the collision insurance If the car is more recent or of important value, you could not allow you to repair or replace it out of pocket, you have a loan or a lease that requires it, or drive in high risk areas with frequent accidents.

Nor directly. Injuries to pedestrians are covered by your liability insurance. Damage to the vehicle to prevent a pedestrian would be covered by collision insurance. Get more information on how to file an automatic insurance claim and win if you are ever in a collision.

It depends on the current value of your car. If a 10 -year -old car is worth less than $ 3,000, collision coverage may not be profitable. Find your cheaper automobile insurance by entering your postal code to our free comparison tool.

Car Insurance Quotes In California

Legally, no. However, it is still recommended if the paid vehicle has a significant value. Consider your ability to pay repairs or replacement out of pocket if you are in an accident.

The full coverage insurance of a 15 -year -old car is rarely profitable, unless it is a classic, luxury or otherwise valuable vehicle. Our guide for use -based car insurance can offer better alternatives for older vehicles.

Auto insurance quote arizona, california life insurance quote, virginia auto insurance quote, auto insurance quote nc, chicago auto insurance quote, insurance auto insurance quote, military auto insurance quote, auto insurance quote usaa, auto insurance quote orlando, louisville auto insurance quote, auto insurance quote in massachusetts, auto insurance in florida quote