Auto Insurance Quote Ontario Canada – 3 minutes can save you from hundreds. Insert your post code below and join the provision of a car insurance to the thousands of Canada.

With you, financial institutions serves as an intermediate mediator of your users. When you are interested in clarity, we also consider the many financial services without financial profit. The financial institution or broker is not working and to ensure accuracy, our content is discussed with licensed specialists. Our unique position is not repeated in your politics and again, improve our mission, making our mission to make better financial decisions to improve our mission (from discrimination.

Auto Insurance Quote Ontario Canada

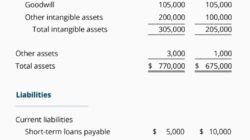

The last announcement that uses ontario Prime Doug Fordur’s province of insurance companies: Most of the inters of the introductions are hoping with this change. Reality – Multiple MPS also included in the calculations “Honor Codes” from the postal inspection, historical car insurance. Being logical, if you live with high demands and traffic, your claim risk of your claim. The results – Ontarianites pay by 40 percent from the Provincial Average.

Auto Insurance In Nova Scotia: Rates, Quotes, Expert Tips

Postcode discrimination can affect your car insurance premium and is very important for them for the best rate for them for the best rate for them, the best rate for them. Waiting for adjustment changes to reduce your insurance premium will give drivers!

There are several factors in the introduction of car insurance premiums, including the driving record and model in the model of the Mail code, plays a very important role in determining insurance worlds. In 2021, in 2021, the most valuable city for autonomous city for autonomy on Ontario (attached to the most valuable city on Ontario). Living in these cities should be your car insurance premiums higher than other cities in GTA.

How does this place take place in average 1, 598? Drivers in Voagan pay the average of 40 percent of the province for auto insurance. AJAX enters 38% in seconds, 38%, 30 percent and toronto to the top five (see more information).

If the postcode discrimination is over, and if this is large, this is where there are personal credit score data, alerta and new Brunswick. One thing is known that I wouldn’t increase my breath soon.

🚗💨 Ditch The Insurance Hassles

The last factor that affects your vehicle insurance premium is the insurance supplier you choose. Some automobile insurance companies can lead to rate a higher rate to the higher rate of young and driving record for a higher provider. n Given tailed and competitive automobile insuriture from the best providers. According to the team, computers require a large mental energy to communicate your voice with computers. One part of me for managing electronic devices – the same for important decisions while driving.

Collision auto insurance protects your vehicle with other vehicles or items with accidents. Know more about this additional coverage.

Bending the truth to the auto insurance attachments may be more likely to stay for a long time. The correct information and how to avoid the auto insurance.

Inaccurate vehicle covering you are in the accident with a consistent driver or attending the hit-running. Click to learn more ontario. This fact. However, do you know that only some types of car insurance are mandatory and some additional. In addition to me, in addition to the minimum compulsory covering, do you know what is required? In this article, we will interrupt the minimum law requirements, and you have any optional caprications, as well as the champs. We will also affect automobile insurance rates and discuss the correct amount of coverage. Not too little, not too much, not too much.

Cheap Car Insurance Quotes Toronto

Are you ready to cover the ideal car insurance? Use an industry industry income for a quick and private quote.

Mandatory Machine Insurance in Ontario should have a minimum legal standings in the Minimum Legal Ventor in Ontario you should go ontario:

Some misconceptions about compulsory car insurance are very expensive for older machines. However, most of this coverage is for bodily injury and yours. Remember: Machines may replace the cars, people can’t.

Additional car insurance on Ontario Addario Additional car insurance – Additional Aktau, you can buy for the Ontario auto insurance policy:

Car Insurance Claims Ontario: A Step-by-step Guide (2025)

To damage to a car: 10000 per cent of the guilt.

Machine a car for your car: $ 10000 $.

Ontario has an additional additional football petty for car insurance policy, but we have brightened the mains here. It is important for each of the additional coverage to be especially important for each of your needs and to assess how you can benefit from these decisions. Ask yourself; Do I need a rental car to get to work? Do I have a support on my way? Do I have a good driving record for protection? If I can’t get in an accident I can buy another car with insurance money or can I go without buy my car? This is also the questions that are often viewed along with the insurance broker to get and coverage. Make the next step? Get your personal quote in 30 seconds!

A: If the minimum covering meets legal requirements, it will not be enough to fully protect your assets in case of a serious accident. It is recommended to renew your responsibilities for at least $ 1 million because if he participated you in the trial of the court, it saves you from financial tension.

Best Home Insurance In Canada

A: The selection of DCPD may be kept with premiums, but this is a dangerous decision. If this is not coverage, you must continue to compensate from the insurance of another driver, when they are a guilty event, they may be allocated and materially unspecified.

A: All dangers combine the collision and complete coverage, including theft of people in your family. Covering non-comprehensive stealing, vandalism and fire as a fire, but no stealing with owners.

A: It depends on the value of your vehicle and repairs or replacing costs. Some drivers are choosing to spend this covering to save this coverage, but this is responsible for the full cost of repairs in the event of an accident or collision damage.

A: Yes, many insurancers offer discounts with discounts or fewer miles away. If you don’t walk or have a safe driving record asking potential discounts from your broker.

Car Insurance Broker Ontario

For the speedy visual-intimacy of the main points provided in this article, our below infographic. If you find it useful, don’t share it.

How will OPCF 49 affect ontario in your car insurance? Find out how to change in the OPCF 49 on Ontario, … Next in the province of Braifination average average medium-insurance value for a Canadian man? The volume of auto insurance pay average, will be different to the average province. For example, ontario and British Colombian drivers can expect to pay double-estevo and prince Eduard island.

So, what is your car insurance insurance value, and why? Here are a medium-time treating the moderate rates:

Legally, you should be on the way – need a structure on the road – to protect your own protection and others. We are paid a large amount to this protection to your province and other factors, according to the owner of your province and other factors (young, driving record, a car model, etc.).

Costco Car Insurance Review 2025

Unfortunately, automobile insurance rates are increasing rates, and it was never difficult for many that was never difficult for covering. Let’s see the change between the average car insurance rates in Canada, see where the rates grow, and is there hope for the trend.

Please note: IBC counts the province of general privincial premiums to the province of general privinces and counting the average in each province.

Let’s start with bad messages first. Western province drivers in Canada pays the highest insurance rates in Canada, with $ 1, $ 800 per year. This has more than $ 700 – 63% less than $ 1

Boat insurance ontario quote, auto insurance quote canada, online insurance quote ontario, auto insurance quote ontario, insurance quote ontario, car insurance quote ontario canada, auto insurance ontario canada, cheap auto insurance quote ontario, online auto insurance quote ontario, motorcycle insurance quote ontario, home insurance quote ontario, car insurance quote ontario