Auto Insurance Quotes For Bad Credit Drivers – If you are young and starting to drive, the reality of the responsible car is not yet settled. The car insurance is not fixed; Instead, your car insurance reaction to the level of your skills as a driver. During the time period, skilled drivers can see the cost of their insurance less important. Know about the factors that low your auto insurance rates less and keep your wallet happy!

Any house with multiple vehicles is eligible for such a discount. Sometimes, you have to enroll in the same name to all vehicles, but it is not always the case. There are some exceptions in multi-car insurance discounts – for example, you are not able to bund motorcycle insurance with motor insurance.

Auto Insurance Quotes For Bad Credit Drivers

Multi-car insurance is always cheaper that it spreads risk for insurance companies. Insurers provides providing this exemption to secure more business and keep it away from competitors. It provides some good personal benefits that provides all your vehicles under the same policy that means renewal and renewal date for your policy.

Complete List Of Car Insurance Companies

Added each additional ride to the policy. Most insurance schemes cover five car under a policy. Additional, if a person in your policy was to file a person claiming, it does not affect any of your claim bonus.

The truth of insurance is not a global policy that is not cheap for everyone – it depends on what you are and what your driving records are. Get a lot of value quotes there when you can handle and make your decisions from there. Insurance companies often sell their insurance slowly – some sell through their own agent, others sell in free agents that use policies from many companies.

Although allstst, Giveo, progressive, and state farm insurance market has a heartfelt dominated, do not ignore local and regional insurance companies. People are more satisfied from the minor companies, and you get easier to insure the insurance and pop shop with it.

There are very little discounts that you may be eligible. Here’s only a few discount categories and is made to the amount to you:

Cheap Auto Insurance For Ssi Recepients In 2025 (save With These 10 Companies)

Car accidents and violation violations increases large quantities to your car insurance premium. A total of 2017 from Quadrant Information Services has increased by the average growth of 252, 00 insured claims. The biggest factors of your driving is not always affected by the biggest factors of the Rate Claims Claims, although you are not always punished for minor accidents and minor fender-gonders. Your insurance can be if the following statements are true for you if your insurance goes on top of:

Some States follow the point system that the front violation presents as points in your license. Everyone presents a different number of different numbers in your record that helps change your insurance policy according to insurance companies. Each state has own rules to beelizing points in your license, so examine your state of terms before testing your state rules. Although small traffic purposes, however, is usually worried about what insurance premiums come.

From the United States, more than 1 million people have been arrested each year. Don’t drink and drive it, but alcohol can damage the ability to make decisions and sometimes, they are unimaginable. If an officer arrested you for drinking and driving, you have to search for insurance companies that have strong traffic violations.

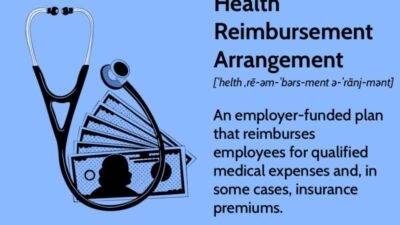

Some insured companies use a person’s credit score rating to use a person’s credit score rating, how do they get the policy, how do they charge them? Insurgers use elements of your credit information that will make how many claims this claim to predict it and they will experience the insurance deficit. We know Fingio spokes of Jeff Jaff, Jeff Jeff Jaffs Skot that “With the records of other risks, other risks (property insurance), property inspection, and application information.”

How Credit Information Can Impact Insurance Premiums

Good news is usually, insured companies cannot set your policy rates in your credit score information. Indeed, clearly prohibits the states. However, if your state allows credit-based insurance scores, you want to take steps to improve your credit scores. If you have improved your credit score, then seeing your insurance premiums are reflected in your insurance premiums, contact your insurers. It is possible that they did not update your credit score report analysis. We found the cheap car insurance company for high-risk drivers in NGM. Average of High Risk Car Insurance from ENGM Average $ 15985985. One year is 1,6363.

But NJM is only available in five states, the state farm is the best and cheap car insurance company for high-risk drivers, because it is available at all places.

Cheap high risk car insurance also depends on your driving record. Because companies are weighing different violations, so a car insurance company may have a savage rate for a recent accident in their record.

If you think it can be ashamed to claim if insurance companies think you should get high risk car insurance.

No Down Payment Car Insurance

High risk insurance is not a different type of policy. This is just a general car insurance policy that includes a high risk driver, but contain additional risk is generally high-risk car insurance is expensive.

Insurance companies can wear you “high-risk driver” If you have a history of dangerous driving behavior, idio-treatment, quick tickets, and other moves.

You can also be a good driver and still carried out high risk with car insurance companies. This case may be if you:

Tough insurance is difficult to find insurance once the companies consider you highly risk drivers. Car insurance companies that are cheapengo in cheap can you refuse to refuse to refuse to refuse to cover if you are missing. Those who will face you will take high premiums.

A Complete A-z Pineapple Guide On All Things Comprehensive Car Insurance

The NGM high risk is a cheap insurance for the drivers of high risk which has occurred in a mistake, but it is only available in fists. State farm, which is only a few dollars is more expensive than NJM, a cheap option that provides coverage in almost every state.

Behind the Milk of State Farm is cheap car insurance for high-risk drivers. Car Insurance is very expensive after a DUI – This one is more expensive than after the accident – but the coverage of the state farm is less than average.

We found that the cheap car bearing of the state farm is with a dynamic ticket in their archives. The drivers are the cost of high risk insurance for risk which rapid dynamic routes still less than 2 $ 0 in the state farm.

Mapfrey is the cheaper car insurance company for high-risk drivers, but it does not offer covers everywhere. Geico, second-cheap high risk insurance insurance is available in every state, with a bad credit.

Lendingtree Car Insurance Review: Consumer Reviews, Quotes (2025)

State form is the cheap car insurance company for the drivers of high risk for the drivers of high risk. We found that the highest risk coverage per month or $ 1, 385 per year.

Cheap car insurance is USA to add a new driver under 25 years, but it’s only available if you are in part of the military family. Farm Bureau is a cheap company (a meaningful high risk) driver to a policy.

According to our analysis, the cheap high risk car is insured after a very driving violation of the state form. For most high risk drivers in the state, automatic owners, maps, and the most high risk drivers in the United States, depending on their records.

The best way to find cheap car insurance with bad records is by comparing high risk insurance quotations from more than one company. When you compare quotes, it is easy to see the company with the best rates.

Who Has The Cheapest Auto Insurance Quotes In New York?

Allowed to decide to cover the travers to cover the companies that need high risk car insurance. If insurance companies denounce the coverage because of your records, your best bets is back in high risk insurance.

There are some companies that require multiple violations in their record, or drives and a SR-2 or freecies are some companies that provide high-risk drivers.

This high-risk automatically insurance is automatically of other people like auto insurance companies and them like they can be more expensive than average.

Also, depending on the company, coverage that you get, a standard automatic is more than open-bones than the offers. Customer service may not be good.

What Happens If My Car Is Written Off While Still On Finance?

We think the cheap rates of the national general rates, constructing proposals, and better customer service compared to companies in other high risk.

If you are high-risk drivers and you can’t get car insurance from a standard or non-standard company, you can get the highest risk insurance pool to the last resort to your state.

High Risk Insurance Ponds are a part of the residual market, which is different from the “voluntary” market where most people are insured. The difference is insurance companies in voluntary